af Andrew Graves 4 år siden

286

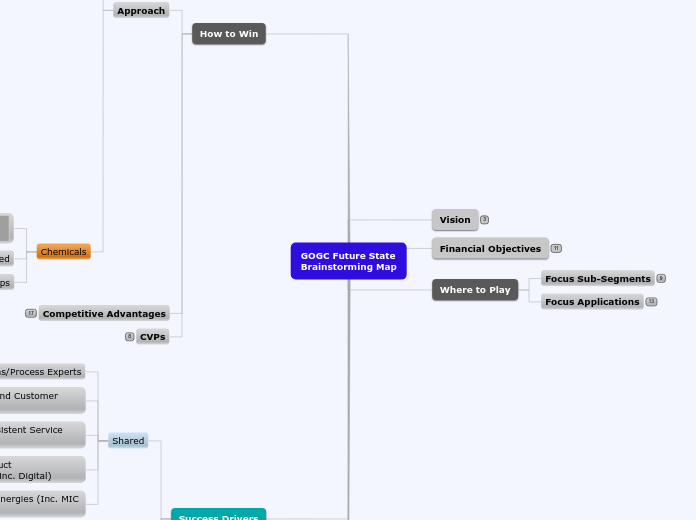

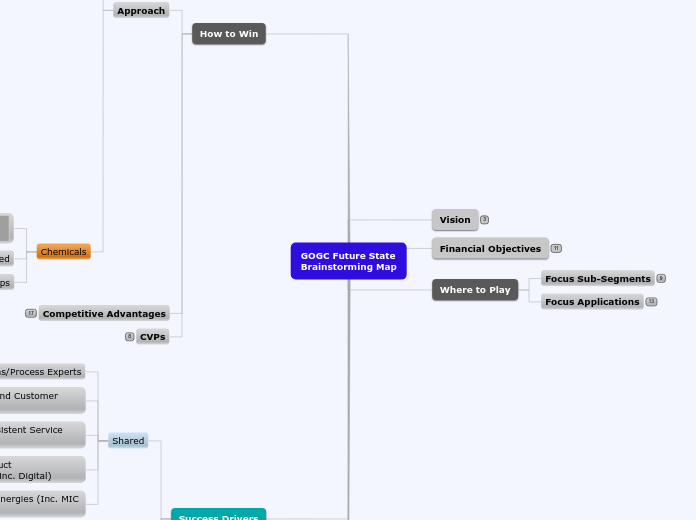

COPY 250221: Strategies as Maps - TEMPLATE

af Andrew Graves 4 år siden

286

Mere som dette

Process gap - to fill knowledge gaps and specific enquiries.

Low level of knowledge/experience present (and risks to existing)

Steam Generation

Storage Tanks / Farms

Turbines

Condensate Usage / Recovery

Steam Distribution

Heat Exchangers

Tracing

Consumer

Specialty / Performance

Basic / Commodity

Alternative Fuels

Gas Processing

Petrochemical Manufacture

Petroleum Refining

ML: Chemicals sales more ot process (higher GM)

ML: Easier for Gestra to increase GM in this market.

ML: Gestra margin expected to be lower in O&G; seen as high price in this market

Sales Excellence process - how to leverage? How to build around the key accounts

Mix of KAMs and SMEs

Not just about the existing knowledge - how do we get fast knowledge transfer

As above

Evolution from product to process solutions?

Alignment with Sakis's service strategy

Gap analysis? Existing, but spread across functions?

Line between consultative and governance

Solutions/proposals governance

End user - "feet on the ground"

Project governance

Central/regional etc

See above

Process Productivity

Energy & Sustainability

Expand & Refurbish

Maintain & Repair

Strong/aligned supply chain

Products/solutions

Interfaces/processes

Standards/association

drive from centre

Output from the above +relationships

Systems for the link GOGC to rest of org

Combination of local/central

Need the types of knowledge "delivery system" to match the customer need

Diamond approach (2x Cheese wedges)

Consider People, processes and sytems

As above (under approach)

ML: Alliances/partnerships

ML: Projects needed

Approach notes:

Aftermarket ONGOING - service capability with end user.

Product, system and process knowledge

Aftermarket INITIAL - EPC Contractor (for early site access/commissioning - leads to end user maintaining that relationship with contracts).

Product knowledge

First fit - partnership - problem solving throughout project, knowledge recognition and ability/trusted to take work (value add) [meet schedule and minimise risk

At EPC stage: more product/steam systems

In FEED: steam system and process

First Fit - project execute

First Fit - Opportunity management; inc. relationships with specific project teams in EPCs (EPC level 2 relationships)

First fit - key account management (EPC level 1 relationships)

First Fit Customers = EPC Contractors, Feed Contractors (Process Licensors)

End users - knowledge partnerships - value add problem solving and expertise (4 drivers)

Service capability

Processes

Steam system

End users - key account management