Investor Relations

Combined Code

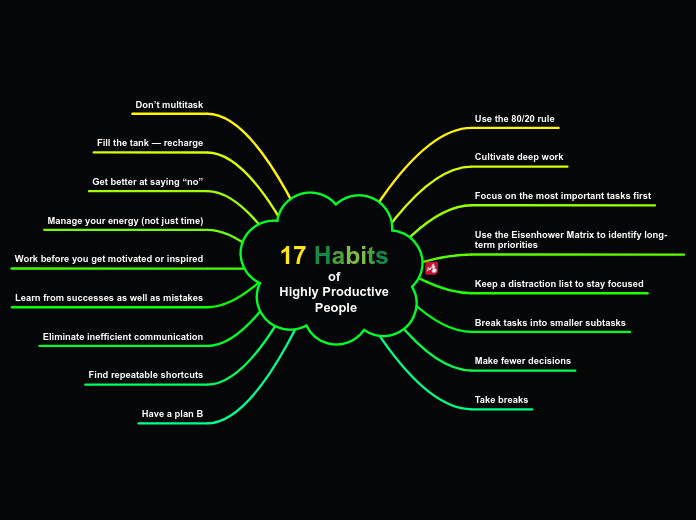

Institional Investors

Shareholder voting

Institutional investors should be able to give clients information on proportion of resolutions castes

Major SH should attend as much as possible

Translate Voting intentions translate into practice

Dialogue with Company

Evaluate Corp Governance disclosure

Avoid Box ticking approach

Explain non-acceptance with reasons in written form

Careful consideration on non-compliance

Company

Maintain dialogue with institutional investors

Senior Independent D should attend enough meeting to understand SH view

SH can request NED to meet

NED should attend meeting with SH to know more about their concerns

Chairman should discuss strategy and governance with Major SH

Chairman should ensure views of SH are communicated to the board

Make Constructive use of AGM

Let SH vote with openess

Count proxy votes

No issue bundling

Let SH ask questions

Singapore: External Auditor

Chairman of NC, AC, RC should be there

All directors to attend

Encourage attendance at AGM

Good Timing

Nice Location

> 20 days notice

Best Practice

Effective investor relations department

Functions of the investor relations officer

Well versed in finance and investment

Clear on management's Strategies and vision

Uniformity since it is one person

Written investor relation guidelines

If accidentally disclose, make sure the public knows soon

Do not disclose more than required

Investor Relations Programme

Provide facility for SH to vote by proxy

Arrange site meetings for major SH

Presentations to analysts

Planned presentation to bother existing and potential investors

Senior Management involvement and support

Invlove CEO, CFO, Co Sec, IR manager and consultant

Signal that investor relation is of high priority

Frequent updates and communication with investors

Quarterly Reporting

Analyst Briefing

Updates on company website

Emails

Even when there are no extraordinary events

Instill a sense of confidence

High quality, timely, and accessible info

AGM

Webcasting of AGM

Investors can question and have concerns addressed

Investor can gather information

Periodic reports

Information Technology

Allow Shareholder to appoint Proxy through electronic means

Share Price update

Media Release Articles

Industry specific information

Event Calendars

Email notification

Archive information for the last five years

AV of meeting, speeches

Press Release

Digital format of AR

Shareholders

Activism

Subtopic

Rights

S303 CA- Remove director from office

Voting Rights

Approval on issue new shares

S89 CA - Subcribe to new share in proportion of current SH

S459 CA - 5% share can put resolution in AGM

S368 CA - Call EGM with at least 10% share

S459 CA - Prevent predjudicial treatment

S35(2) CA - Prevent Ultra Vires

Responsibilities (Esp institutional investors)

Voting

Engagement with board and management

Require the compliance with the Code

Performance Monitoring

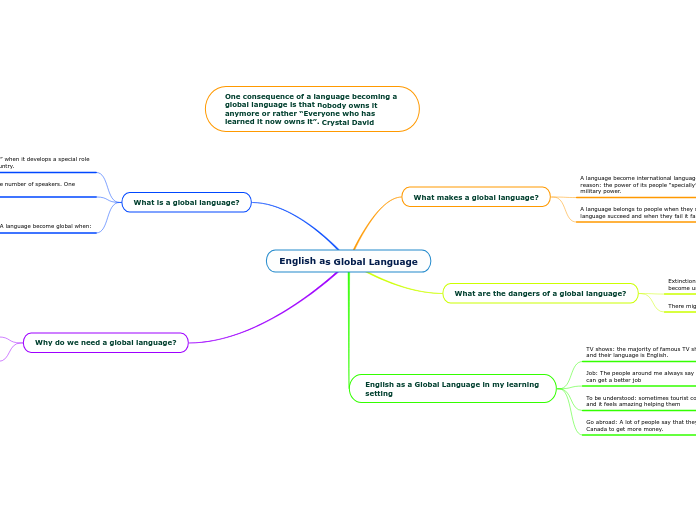

SCG on board/co Action

SCG #10: Provide Balanced and Understandable assessment

Other price sensitive public reports and reports to regulators

Performance, position and prospect

SCG #15: Notes and minutes

Made available upon request

Include substantial comments and queries from SH and the responses from Board

SCG #15 Seperate Resolutions - Avoid Bundling unless issues are interdependent

Explaination when bundled

SCG #14: Gather views or inputs and participation at AGM

SCG # 15: Vote through proxy or absent vote counts if there is SH consent via mail, email, fax etc

SCG # 15: AA should have no limit on the number of proxies

Give SH the opportunity to participate effectively and vote at AGM

SCG #14 Address shareholders' concerns

SCG #15: External Auditors should also be present to explain the audit and audit report

SCG# 15: The AC, NC, RC should be present to address shareholder concerns in AGM

SCG #14: Convey pertinent information regularly

Openess: disclosure should not be just a selected group, should convey to public ASAP via internet

Timeliness

Disclosure should be descriptive and detailed and not boilerplate