KAMIEN & SCHWARTZ 1982

Empirical testing of those 2 theories

Conclusion

Neither perfect competition or perfect monopoly appear to be most conducive to technological advance

Hard to say because

How to measure monopoly power?

How to measure firm size?

How to define the outputs in the process?

use number of workers assigned to R&D or Spendings in total

Hard to define innovation

Use patents stats

Are those theories correct?

Galbraith theory

Large firms are more than proportionnately more innovative than small firms

Demand-push

Edge for large scale firms with better facilities to respond the opportunity

New marketing opportunity and demand / innovation in response

Technology-push

Requires R&D investment / edge for large scale firms

Firm innovates and push the idea on a non-existing market

The edges of large size company for innovation

Better exploitation of the outputs from R&D

Bigger pool of ideas

Researchers get more productive with more colleagues

Innovation is increasingly expensive

Schumpeter theory

Positive relation between innovation and monopoly power

Situation 2: Possession of Monopoly Power

Slower to replace with superior products

Lack of motivation for new innovations

Additional leisure

Ability of Hiring top innovative people

Possible self-financement because borrowing leads to information disclosure

Ensure the profitability

Discrourage imitation

Extend Monopoly to new products

Situation 1: Anticipation of Monopoly Power

Erection of barriers

Ability to prevent or retard imitation by patents, trademarks or copyrights

Potential problems of innovation

Failure from the inventor

Solution 2: Accept departures from the conditions for perfect competiton = Enter a market oriented system

Solution 1: Collective financing to spread the risk

Moral hazard consists in forcing the inventor to carry more risks in the project to be more involved in its success

Uncertainty: about profitability / success which makes it more expensive to invest in innovative activities

Monopoly power and large size firms can reduce uncertainty by targetting profitable opportunities

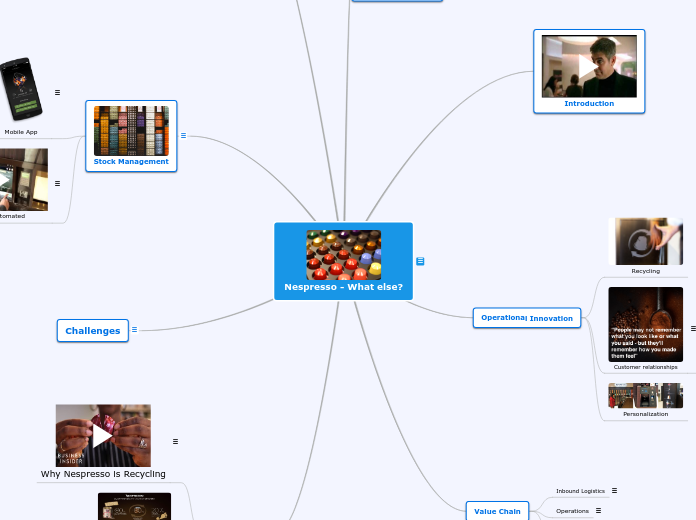

BOWER & CHRISTENSEN 1995

Disruptive technologies create disadvantages for established companies

How to spot them and compete them?

Keep it independant to avoid the established companies' mistakes of only focusing on ASSURED markets

Create your own disruptive and independant organization

Identify the disruptive technology's starting market and customers

Define the market strategy

Disruptive or sustaining technology?

Example of the Hard-disk-drive industry

SEAGATE TECHNOLOGY and the 5.25 inch

Seagate = Leader in 5,25 inch drives

Former Seagate employees create their company CONNER PERIPHERALS

Become direct competitor to 5,25 drives with advantages

Improve the 3,5 inch drives capacity

Emerging Market

Specialized in 3,5 inch drives ("Inferior technology")

Decide not to invest in 3,5 inch drive as their clients (IBM mostly) are not interested

Managers keep doing what has worked in the past / where the market is assured

Disruptive technologies can look financially unattractive to established companies

Why investing in something less elaborated than what we already offer?

Technologies initially inferior (disruptive) become more adapted to customers' needs

How to stay to stay at the top of your industry?

Technological changes that revolutionize the market are usually

Improving the performance attributes valued by customers

Different package of performance attributes

Not difficult from a technological point of view

Not radically new

Implement processes to identify customers needs and forecast technolgical Trends

DISRUPTIVE TECHNOLOGIES = Less advanced but more competitive and adapted to customers' value

Example:IBM and minicomputers

Blind the comanies to important NEW EMERGING MARKETS

CURRENT markets and customers

Well-managed companies = ahead of their industry

Address the customers' needs

Imcremental improvements OR breakthroughs

Developing and commercializing new technologies

Leading companies stay close to the customers

Anticipation of the customers' demand

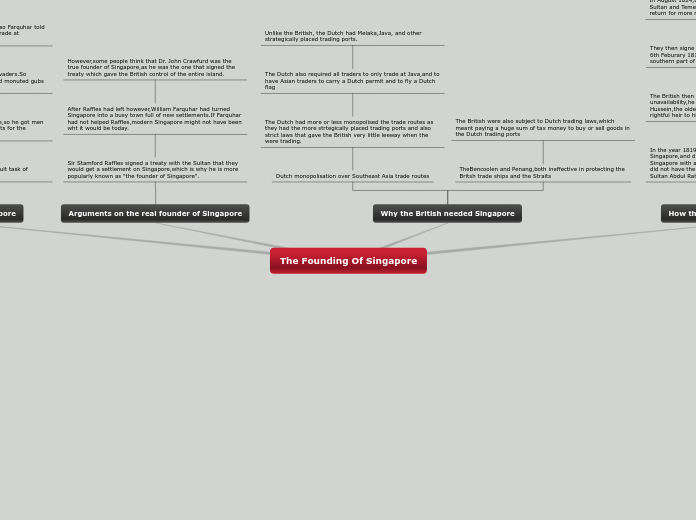

ABORNATHY & UTERBACK (1982)

Product Lifecycle over the time

Both tend to meet

Process Innovations

Rate of Major Innovations

How does a company innovation evolve when it grows?

Standardized Product

Incremental innovations

Changes are costly

Production technology efficient

Low unit profit margins

Products well understood

Well defined market

High volumes

Large Unit Production

Major New Product

Market needs ill defined

Quick changes in th process

Dominant design not reached

Flexible Technical Approach

Process yet to be upgraded

Vague performance criteria

BAUMOL (2004)

Public Sector

30% of R&D Spendings in the US

Universities

Patent a lot to boost their image

Bring fresh and intuitive Point of View

Collaborate with Governments and Private Sector

Government

Active contribution

Research on domains that are not attractive enough for the Private Sector

R&D on long term projects (Ex military research)

Support the basic research (Ex Internet)

Passive contribution

Avoid the interferences

Protection for intellectual property

Provide legal infrastructures

Private Sector

70% of R&D Spendings in the US

High risks of imitation and reverse engineering

Why?

Position of oligarchy

Secure to enter a market that already exists

High risks of failure

High costs of R&D

Small Companies

Entrepreneurship

Innovation in all different kind of domains

Look for revolutionnary breakthroughs

Few patents / high rate of top patents

Innovate to create new market opportunities

Explore unexisting markets

Big Companies

Patent a lot, but a short rate of top patents

Unspeculative

Innovate to Survive their competitors

Product Improvement

Avoid the unknown markets

Oligopoly

BLUE OCEAN STRATEGY by KIM & MAUBORGNE

How to create a Blue Ocean?

No need to focus on technological innovation

Create Added Value for the customer

Thinking about opportunities instead of beating existing competitors

Creation of a "New Market"

Cost Reduction

Omit the costly elements

Blue Ocean = Uncontested Market Place

Irrelevant Competition

Represents 14% of new ventures

Examples

Nickelodeon

Apple personal computer

CTR's Tabulating Machine

CompaQ

Chrysler Minivan

Ford Model T

Cirque du Soleil

Brand Equity

Growth

Unknown Market Spaces

High Profits

Red Ocean = Overcrowded Industry (No opportunities)

Represents 86% of new ventures

Fighting for Market Share

Though Competition

Known Market Space