af Jasmeen Plaha - Turner Fenton SS (2572) 6 år siden

416

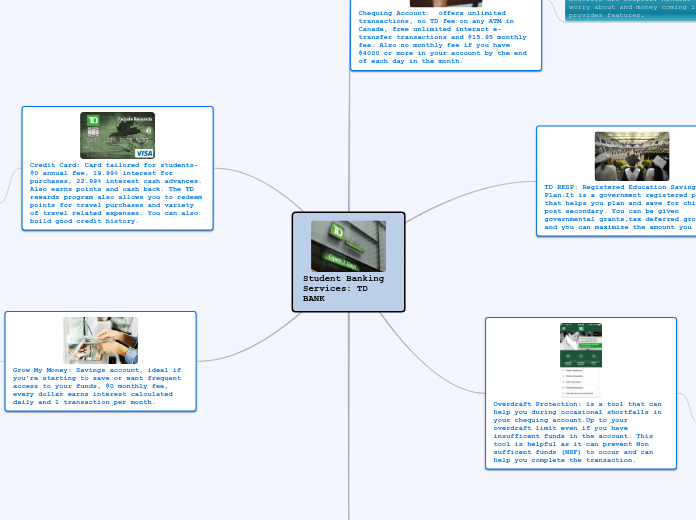

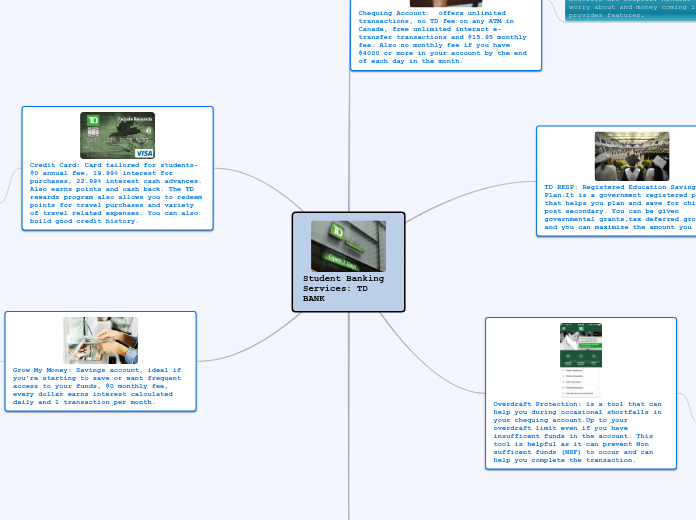

Student Banking Services

af Jasmeen Plaha - Turner Fenton SS (2572) 6 år siden

416

Mere som dette