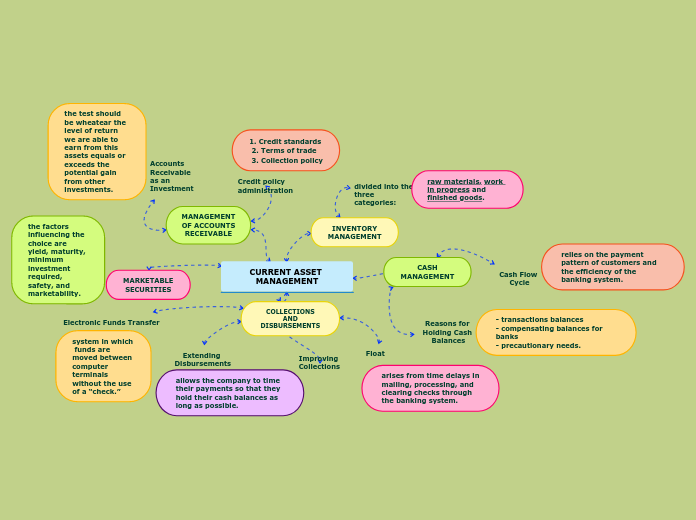

COLLECTIONS

AND

DISBURSEMENTS

allows the company to time their payments so that they hold their cash balances as long as possible.

MANAGEMENT

OF ACCOUNTS

RECEIVABLE

Reasons for Holding Cash Balances

relies on the payment pattern of customers and the efficiency of the banking system.

- transactions balances

- compensating balances for banks

- precautionary needs.

arises from time delays in mailing, processing, and clearing checks through the banking system.

Electronic Funds Transfer

system in which

funds are moved between computer terminals without the use of a “check.”

the factors influencing the choice are yield, maturity, minimum investment

required, safety, and marketability.

divided into the three categories:

raw materials, work in progress and finished goods.

Credit policy administration

Accounts Receivable as an Investment

1. Credit standards

2. Terms of trade

3. Collection policy

the test should be wheatear the level of return we are able to earn from this assets equals or exceeds the potential gain from other investments.