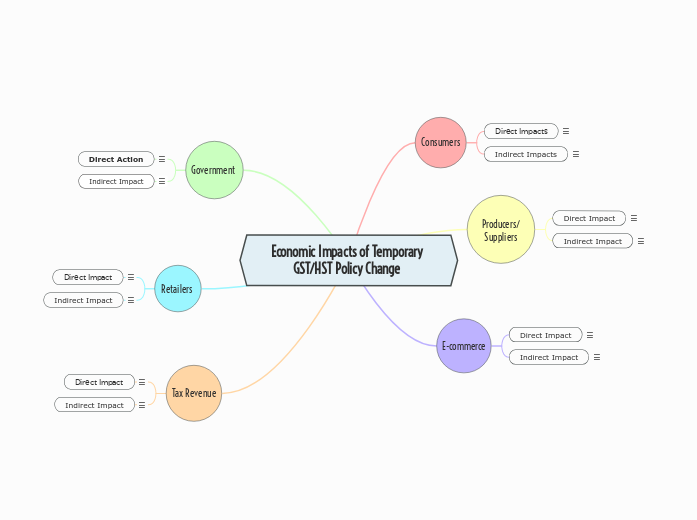

Economic Impacts of Temporary GST/HST Policy Change

Consumers

Direct Impacts

Indirect Impacts

Producers/Suppliers

Direct Impact

Indirect Impact

E-commerce

Direct Impact

Indirect Impact

Government

Direct Action

Indirect Impact

Retailers

Direct Impact

Indirect Impact

Tax Revenue

Direct Impact

Indirect Impact