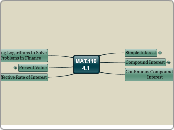

MAT.116

4.1

Simple Interest

Linear Function

Simple Interest Formula

Accumulated Amount Formula

Compound Interest

Exponential Function

Nominal Interest Rates

Conversion Periods

Compound Interest Formula (Accumulated Amount)

Continuous Compounding of Interest

Infinite Interest?

Continuous Compound Interest Formula (Accumulated Amount)

Uses

Using Logarithms to Solve Problems in Finance

Guidelines

Present Value

Terminology

Present Value Formula for Compound Interest

Present Value Formula for Continuous Compound Interest

Effective Rate of Interest

Synonyms

Effective Rate of Interest Formula