Cryptocurrency 101 - Day 2

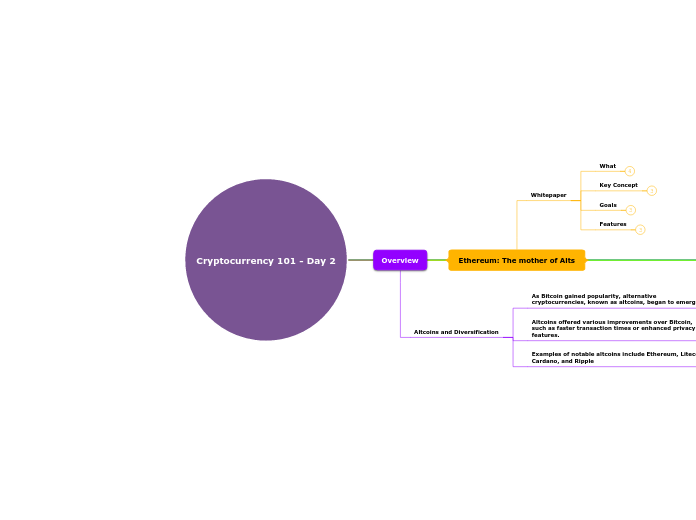

Overview

Altcoins and Diversification

As Bitcoin gained popularity, alternative cryptocurrencies, known as altcoins, began to emerge.

Altcoins offered various improvements over Bitcoin, such as faster transaction times or enhanced privacy features.

Examples of notable altcoins include Ethereum, Litecoin, Cardano, and Ripple

Ethereum: The mother of Alts

Whitepaper

What

Key Concept

Goals

Features

Ethereum: Smartcontract

How it works?

How to build

How to deploy

Limitations

How much does it cost

The cost of smart of contract determined by the work it performs (reading/writing data)

Ethereum: Evolution 2.0

ETH 2.0

What

Why

Transitioning from Ethereum 1.0 Mining to Ethereum 2.0 Staking: Implications for Miners

Ethereum 1.0 Mining

Transition to Ethereum 2.0 and PoS

Implications for Ethereum 1.0 Miners

Ethereum:EVM

Overview

What

The Ethereum Virtual Machine (EVM) is a crucial component of the Ethereum blockchain. It's a virtual machine, which means it's a software environment where smart contracts are executed. Smart contracts are self-executing agreements with predefined rules and conditions. The EVM enables the execution of these smart contracts on the Ethereum network.

What does it do?

How does EVM work?

Who utilize EVM?

Binance Smart Chain (BSC): BSC is a blockchain platform that supports smart contracts and decentralized applications. It incorporates the EVM, allowing developers to use Solidity and deploy existing Ethereum smart contracts on the BSC network.

Polygon (formerly Matic): Polygon is a scaling solution for Ethereum, aiming to improve its scalability and reduce transaction costs. It utilizes the EVM, enabling developers to deploy and run Ethereum-compatible smart contracts on the Polygon network.

Avalanche: Avalanche is a decentralized platform that supports the creation and execution of smart contracts. It utilizes the EVM, enabling developers to build and deploy Ethereum-compatible applications on the Avalanche blockchain.

These are just a few examples of blockchain platforms that have integrated the EVM to provide a familiar and compatible environment for developers who are already familiar with Ethereum and Solidity. The EVM's widespread adoption promotes interoperability among different blockchain networks, expanding the possibilities for decentralized applications and smart contract development.

Why many blockchain used EVM?

Several blockchains have adopted the EVM due to its wide-ranging benefits and established ecosystem. Here are a few reasons why many blockchains choose to utilize the EVM:

Interoperability: The EVM standardizes smart contract execution, allowing for seamless interaction and compatibility between different Ethereum-based blockchains.

Developer Community: Ethereum has a vibrant and experienced developer community, which contributes to the ongoing development and improvement of the EVM.

Security and Auditing: The EVM has undergone extensive testing and auditing, making it a trusted platform for secure and reliable smart contract execution.

Smart Contract Standards: Ethereum's established smart contract standards, such as ERC-20 and ERC-721, have gained widespread adoption, attracting developers to utilize the EVM.

Network Effect: Ethereum's extensive user base and network effect make it an attractive choice for blockchains that seek to leverage the existing infrastructure and user adoption.

Tooling and Documentation: The EVM offers a rich set of development tools, frameworks, and comprehensive documentation, making it easier for developers to build on top of the platform.

Layer 2

What

Layer 2 refers to a set of solutions designed to improve the scalability of the Ethereum network without compromising security or decentralization.

These solutions operate "on top" of the Ethereum mainnet and handle a significant portion of transactions, relieving the load on the main chain.

Goals

Enhanced scalability: Layer 2 solutions allow for a higher throughput of transactions, enabling businesses and users to process more transactions per second.

Lower transaction costs: By offloading transactions to Layer 2, businesses can potentially reduce gas fees, making transactions more affordable and efficient for their customers.

Improved user experience: Faster confirmation times and lower fees contribute to an enhanced user experience, attracting more users and driving adoption.

Type

State channels: State channels enable off-chain transactions between participants, only settling the final outcome on the Ethereum mainnet. Examples include the Lightning Network and Raiden Network.

Sidechains: Sidechains are separate chains connected to the Ethereum mainnet, allowing for increased transaction capacity. Examples include Polygon (previously Matic) and xDai Chain.

Rollups: Rollups aggregate multiple transactions into a single transaction on the Ethereum mainnet, improving scalability. There are two types: Optimistic Rollups and ZK-Rollups.

Use Cases

Decentralized Finance (DeFi): Layer 2 solutions can significantly enhance the scalability and cost efficiency of DeFi protocols, making them more accessible to a wider audience.

Non-Fungible Tokens (NFTs): Layer 2 can facilitate the seamless trading and interaction with NFTs, allowing for a more user-friendly and affordable experience.

Gaming and Virtual Worlds: Layer 2 solutions enable high-performance gaming experiences, supporting real-time interactions and reducing latency.

other

Token vs Coins

Marketcap

Differences

Coin has its own blockchain, while token uses other's blockchain

Examples

Platform Tokens

Security Tokens

Transactional Tokens

Utility Tokens

Governance Tokens

Fun fact

Shitcoins: Exploring the World of Alternative Cryptocurrencies

Introduction

What

How

Impact of Shitcoins on the Market

Fun fact

Summary

Stablecoins

Overview

Volatility has been a significant concern in the cryptocurrency market.

Stablecoins, pegged to fiat currencies like the US Dollar, were introduced to address this issue.

Stablecoins provide stability and act as a bridge between traditional financial systems and cryptocurrencies.

Examples

Fun fact

Initial Coin Offering (ICO): Revolutionizing Fundraising in the Crypto Market

Overview

The rise of Ethereum also led to the emergence of Initial Coin Offerings (ICOs).

ICOs allowed startups to raise funds by selling their own tokens in exchange for cryptocurrencies like Ethereum or Bitcoin.

ICOs provided an alternative to traditional funding methods and facilitated the rapid growth of the cryptocurrency market.

An Initial Coin Offering (ICO) is a fundraising method used by blockchain-based projects to issue and sell their native tokens or coins to investors.

ICOs typically occur in the early stages of a project's development and aim to secure capital to fund further development, marketing, and operations.

Investors participate in ICOs by purchasing the project's tokens, often in exchange for established cryptocurrencies like Bitcoin or Ethereum.

Success Story

ICOs have given rise to several success stories, with some projects achieving remarkable growth and success. Here are five notable examples:

Ethereum (ETH): Ethereum's ICO in 2014 raised funds to develop a decentralized smart contract platform, becoming one of the most successful ICOs and paving the way for a multitude of projects.

Binance Coin (BNB): Binance's ICO in 2017 helped fund the development of the Binance cryptocurrency exchange, which has since become one of the largest and most influential in the industry.

Chainlink (LINK): Chainlink's ICO in 2017 enabled the development of its decentralized oracle network, which has become a crucial infrastructure for connecting smart contracts with real-world data.

EOS (EOS): EOS's ICO in 2017 raised substantial funds for building a scalable and decentralized blockchain platform, attracting attention for its ambitious goals.

Tezos (XTZ): Tezos's ICO in 2017 gathered significant funding for its self-amending blockchain platform, emphasizing governance and flexibility.

DApp

DeFi

Overview

What

Why

How

NFT

Web3

Overview

What

The Origin of NFTs

History of Cryptokitties and Success Stories in the NFT Space (Early to 2023)

NFTs in the Art World

Digital Art: NFTs have revolutionized the art world by enabling artists to sell and monetize digital artworks directly to collectors.

Authenticity and Scarcity: NFTs provide a way to verify the authenticity and scarcity of digital art, giving artists more control and ensuring value for collectors.

Marketplaces: Platforms like OpenSea, SuperRare, and Rarible have emerged as popular NFT marketplaces.

NFTs in Gaming

In-Game Assets: NFTs allow gamers to own and trade in-game items and assets securely.

Play-to-Earn: Blockchain-based games leverage NFTs to enable players to earn real-world value by participating in the game's ecosystem.

Virtual Real Estate: NFTs extend to virtual worlds, where players can buy, sell, and develop virtual properties.

NFTs in Music and Entertainment

Royalties and Licensing: NFTs provide a new way for musicians and content creators to earn royalties and maintain control over their intellectual property.

Ticketing and Events: NFTs are used for ticketing and event access, enhancing security and reducing fraud.

Celebrity Engagement: NFTs have attracted celebrities who release exclusive content or merchandise in the form of NFTs, engaging directly with fans.

Future Implications of NFTs

Tokenization of Real-World Assets: NFTs have the potential to tokenize real estate, collectibles, and other physical assets, enabling fractional ownership and liquidity.

Supply Chain Transparency: NFTs can be used to track the provenance and authenticity of physical goods, ensuring transparency and trust.

Cross-Industry Adoption: NFTs are extending beyond art and gaming, with applications emerging in fashion, sports, and even virtual identities.

NFT:Market History

NFT: New-meta Soulbound token

Overview

Usecases

Benefits