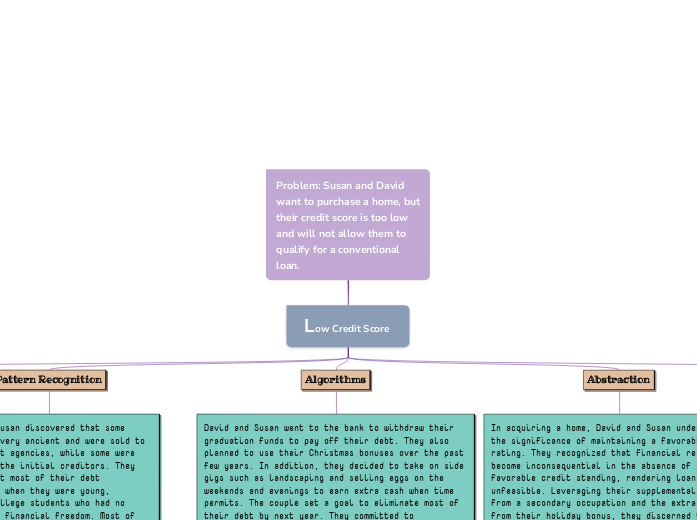

Problem: Susan and David want to purchase a home, but their credit score is too low and will not allow them to qualify for a conventional loan.

Low Credit Score

Decomposition

After hearing the bad news and being informed of some of the items that appeared on their credit report, David and Susan head home and decide to go through old, unopened bills. They locate numerous unpaid medical, credit card, and delinquent bills on their utility company account. While reviewing their mail, they saw that some of their bills had been turned over to collection agencies. When wedecomposea complex problem, we often find patterns among the smaller problems we create. (What is pattern recognition? - pattern recognition - KS3 computer science revision - BBC Bitesize 2023). At this point, they saw that it was best to set up a payment arrangement with their debtors so that they could wipe away their debt and increase their credit scores.

Rationale: Since their main problem is debt and debt-to-rate ratio, David and Susan ordered their credit reports from the three credit bureaus: Transunion, Equifax, and Experian. With these reports, they plan to identify the companies they owe, the accounts' age, and the amounts owed. With this information, they will align their monthly finances to ensure money is set aside and available to clear their debt.

Pattern Recognition

David and Susan discovered that some bills were very ancient and were sold to other credit agencies, while some were still with the initial creditors. They noticed that most of their debt accumulated when they were young, immature college students who had no concern for financial freedom. Most of their debt came from entertainment, shopping, dining, living, and medical expenses. However, now that the couple wants to purchase a house, they decided to settle their debt once and for all and agreed that funds to cover their debt would have to come from a source the two avoided touching. The two thought long and hard but decided to use the graduation funds they had been saving since college to cover their debt.

Rationale: After assessing their debt and future goals, David and Susan realized there are better decisions than carelessly spending money. They also acknowledged the significance of maintaining a good credit score when seeking a loan. Consequently, they opted to use their savings from graduation to pay off their debt. This decision would help them purchase their dream home without encountering credit issues.

Algorithms

David and Susan went to the bank to withdraw their graduation funds to pay off their debt. They also planned to use their Christmas bonuses over the past few years. In addition, they decided to take on side gigs such as landscaping and selling eggs on the weekends and evenings to earn extra cash when time permits. The couple set a goal to eliminate most of their debt by next year. They committed to reevaluating their credit scores after six months to stay on track. This time frame allowed them to prioritize their spending and eliminate unnecessary expenses.

Rationale:Once David and Susan prioritized their spending, they saw that their credit scores could have been higher much sooner, only if they had been more responsible with their finances. Abstraction, or the reduction of information to focus on relevant details, is a central problem-solving approach that computer scientists use. (Gretter & Yadav, 2016).

Abstraction

In acquiring a home, David and Susan understood the significance of maintaining a favorable credit rating. They recognized that financial resources become inconsequential in the absence of a favorable credit standing, rendering loans unfeasible. Leveraging their supplemental income from a secondary occupation and the extra income from their holiday bonus, they discerned the value of possessing skills and assets for generating funds to address difficulties. Abstraction is the process of filtering out – ignoring - the characteristics of patterns that we don't need in order to concentrate on those that we do.(What is abstraction? - abstraction - KS3 computer science revision - BBC Bitesize 2023). These resources facilitated their debt liquidation and gave them hope amid their financial adversity.

Rationale:With access to credit reports, prospective homeowners were able to manage their credit and debt effectively. This enabled them to attain their desired credit score, qualifying them for a conventional loan.

When wedecomposea complex problem we often find patterns among the smaller problems we create. (What is pattern recognition? - pattern recognition - KS3 computer science revision - BBC Bitesize 2023).

Refrences

BBC. (2023a, March 9). What is abstraction? - abstraction - KS3 computer science revision - BBC Bitesize. BBC News. https://www.bbc.co.uk/bitesize/guides/zttrcdm/revision/1

BBC. (2023b, March 9). What is pattern recognition? - pattern recognition - KS3 computer science revision - BBC Bitesize. BBC News. https://www.bbc.co.uk/bitesize/guides/zxxbgk7/revision/1

Yadav, A. (2016, June 15). (PDF) Computational Thinking and Media & Information Literacy: An Integrated Approach to teaching twenty-first century skills. https://www.researchgate.net/publication/304001335_Computational_Thinking_and_Media_Information_Literacy_An_Integrated_Approach_to_Teaching_Twenty-First_Century_Skills