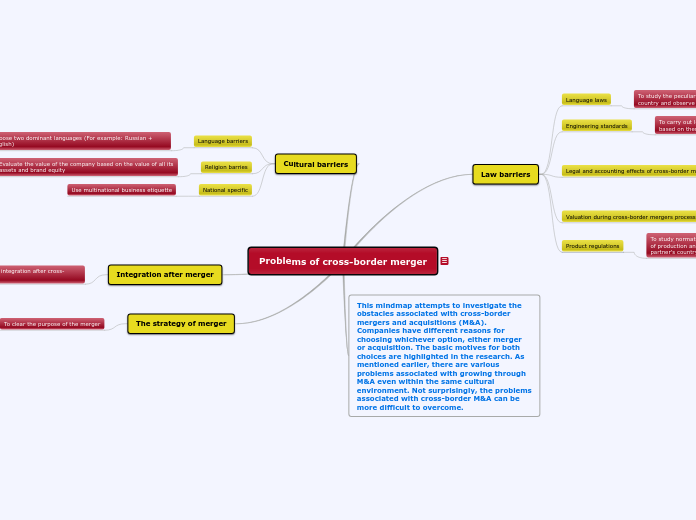

Problems of cross-border merger

Law barriers

Language laws

To study the peculiarities of the language law in the partner's country and observe them

Engineering standards

To carry out local engineering standards and produce goods based on them

Legal and accounting effects of cross-border mergers

During the merger process it is necessary to distinguish two

important dates. The Directive’s and all Member States laws

have to differentiate the validity of cross-border mergers

according to accounting and legal view. The date of legal

validity of cross-border merger is governed by the law of the

State where the successor company is established. For effective merger of two companies it's nessesary to choose qualified lawyer that will face with all problems of companies.

Valuation during cross-border mergers process

Evaluate the value of the company based on the value of all its assets and brand equity

Product regulations

To study normative acts concerning regulation of the process of production and sale of products in the territory of the partner's country and to observe them

This mindmap attempts to investigate the obstacles associated with cross-border mergers and acquisitions (M&A). Companies have different reasons for choosing whichever option, either merger or acquisition. The basic motives for both choices are highlighted in the research. As mentioned earlier, there are various problems associated with growing through M&A even within the same cultural environment. Not surprisingly, the problems associated with cross-border M&A can be more difficult to overcome.

Cultural barriers

Language barriers

Choose two dominant languages (For example: Russian + English)

Religion barries

Evaluate the value of the company based on the value of all its assets and brand equity

National specific

Use multinational business etiquette

Integration after merger

To attach great importance to the integration after cross-border merger

The strategy of merger

To clear the purpose of the merger