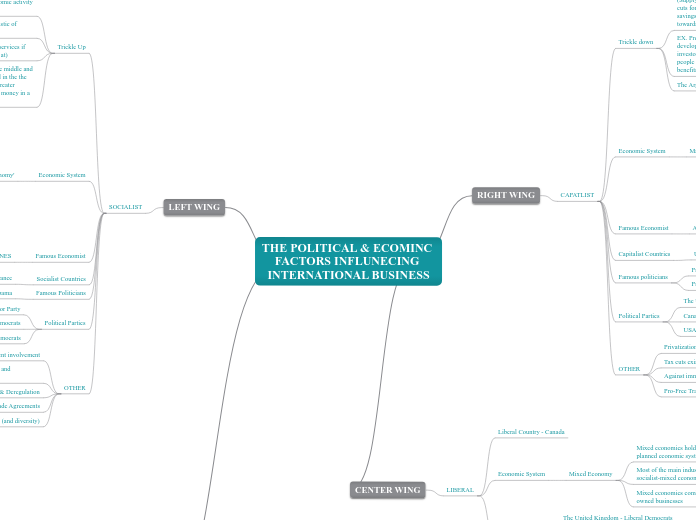

THE POLITICAL & ECOMINC FACTORS INFLUNECING INTERNATIONAL BUSINESS

RIGHT WING

CAPATLIST

Trickle down

(Supply side economics) - an economic theory that conjecture tax cuts for those with wealth and power, for resulting in an increased savings and investment capacity for them, that 'trickle down' towards the whole economy

EX. President Regan and his contemporaries who were republican, developed and favored the idea of: The greater tax cuts for wealthy investors and businessmen (CEO's and Chairmen), provides these people with incentives to invest, save, an produce economic benefits that trickle down in the whole economy.

The Argument: That the supply create its own demands

Economic System

Market Economy

The Law of supply and demand determine the prices of all productions and products

Governments do not show any strong forms of involvement in with businesses

It encourages businesses to keep introducing new(/foreign) and improved products and productions to the markets

It encourages to have ownership of private properties(ex. small and large businesses) for gain

It encourages foreign investments, however self-sufficiency is not recommended nor seen as an economic goal

Famous Economist

ARTHUR LAFFER

An American economist who was a member of President's Reagan's "Economic Policy Advisory Board" and as well as serving as an economic advisor to President Trump's Presidential Electoral Campaign in 2016

Capitalist Countries

USA

Famous politicians

Presdient Reagan

President Donald Trump

Political Parties

The United Kingdom - Conservatives

Canada - Conservatives

USA - Republicans

OTHER

Privatization & Deregulation

Tax cuts exists do wealth individual and organizations

Against immigration

Pro-Free Trade except for Far Right

CENTER WING

LIBERAL

Liberal Country - Canada

Economic System

Mixed Economy

Mixed economies hold aspects of both markets and centrally planned economic systems

Most of the main industries are controlled by the government in socialist-mixed economies

Mixed economies combine government involvement privately owned businesses

Political Parties

The United Kingdom - Liberal Democrats

Canada- Liberals

France - Modern Liberal

LEFT WING

SOCIALIST

Trickle Up

(Demand Side Economics) - Based off of a Keynesian Economic Belief; that demand for goods and services drive economic activity in the society

Aggregate Demand; an extremely important characteristic of demand side economics

Governments can generate the demand for goods and services if indivisual and organizations are unable (to carry it out at)

(Taxing corporations and the wealthy, alternative to the middle and lower classes of society) - Having money being placed in the the pockets of the middle and lower social classes, has a greater benefit to the economy than savings or stockpiling the money in a wealthy individual's account.

Economic System

'Command Economy'

The state or nation makes the decisions to regulate prices and wages, production quotas, and the distribution of raw materials to export partners

Profit motive is not the strongest or overriding goal of the business seeing as government control is more sturdy

The government restricts as well as controlling the ownership of private properties

The government(s) regulate(s) the amount of goods and services presented, as well as the distribution and prices of these goods and services as well

"The needs of the entire society are more important than the individual needs"

Famous Economist

JOHN KEYNES

An English Economist who has significant and influential ideas that altered the practice of 'macroeconomics' as wells as the economic polices of the governments

Socialist Countries

France

Famous Politicians

President Barack Obama

Political Parties

The United Kingdom - Labor Party

Canada - New Democrats

USA - Democrats

Subtopic

OTHER

Has more frequent government involvement

Taxes are implemented more to wealthy individuals and organizations

Is against Privatization & Deregulation

Is mostly Against Free-Trade Agreements

Is for Immigration (and diversity)

Additional

SOCIAL SECURITY CONTRIBUTIONS LEVIED ON EMPLOYERS

EMPLOYER

Family Allowances

Health (accidents) Insurance

Professional Training Tax

Medical Insurance

Unemployment insurance benefits as well as supplements

Employer + Employee

Day Care and Disability Allowance

Pensions for old-age, disability, and survivors (accidents)