War’s Influence on Wall Street

Capitulation

In War: "surrender"

In Peace: In the stock market, capitulation refers to the surrendering of any previous gains in stock price by selling equities in an effort to get out of the market and into less risky investments.

War Chest and War Bonds

In War: war chest refers to the funds a company uses to initiate or defend itself against takeovers.War bonds are government-issued debt, and the proceeds from the bonds are used to finance military operations.

In Peace: War chest refers to the funds a company uses to initiate or defend itself against takeovers.

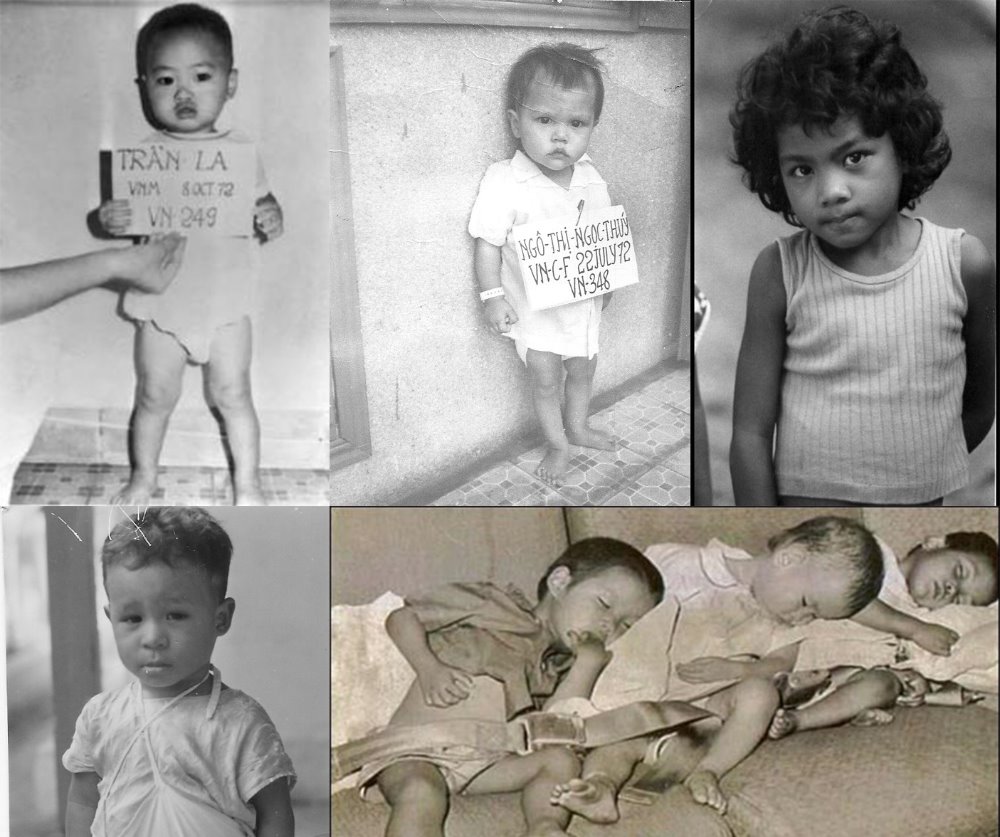

War Babies

In War: Children are classified as war babies if they satisfy one or both of the following:

1. They were born or raised during an invasion of their country.

2. They were fathered by foreign soldiers.

In Peace: the war babies of the investing world are the companies that enjoy a jump in stock prices during or before a war (traditionally a time of decline for the market).

Scorched Earth

In War: Russian army retreated, they burned every shelter, animal and plant that would catch fire, effectively leaving the French army without any “found” supplies to sustain them through a Russian winter.

In Peace: In order to scare off a hostile firm, the target firm will liquidate all its desirable assets and acquire liabilities.

Blitzkrieg Tender Offer

In War: In the first two years of the World War II, Nazi Germany crushed its opponents all over Europe by means of the Blitzkrieg or “lightning war” strategy, a set of tightly focused military maneuvers of overwhelming force.

In Peace: A Blitzkrieg tender offer is an overwhelmingly attractive offer a takeover firm makes to a target firm. The offer is designed to be so attractive that objections are few or non-existent, allowing an extremely quick completion of the takeover.

Dawn Raid

In War: Attack at any time – including dawn, when sleep is still thick in the enemy’s eyes. Because at day break the level of preparedness is lower, the dawn raid maximized enemy casualties.

In Peace: A dawn raid in the investing world occurs when a firm (or investor) purchases a large portion of shares in a target firm at the opening of the market.