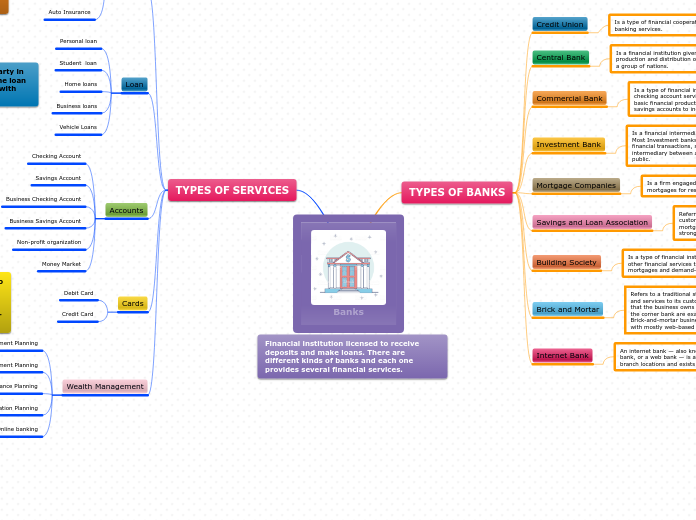

Banks

TYPES OF BANKS

Credit Union

Is a type of financial cooperative that provides traditional banking services.

Central Bank

Is a financial institution given privileged control over the production and distribution of money and credit for a nation or a group of nations.

Commercial Bank

Is a type of financial institution that accepts deposits, offers checking account services, makes various loans, and offers basic financial products like certificates of deposit (CDs) and savings accounts to individuals and small businesses.

Investment Bank

Is a financial intermediary that performs a variety of services. Most Investment banks specialize in large and complex financial transactions, such as underwriting, acting as an intermediary between a securities issuer and the investing public.

Mortgage Companies

Is a firm engaged in the business of originating and/or funding mortgages for residential or commercial property.

Savings and Loan Association

Referred to as S&Ls, provide many of the same services to customers as commercial banks, including deposits, loans, mortgages, checks, and debit cards.However, S&Ls place a stronger emphasis on residential mortgages.

Building Society

Is a type of financial institution that provides banking and other financial services to its members. These societies offer mortgages and demand-deposit accounts.

Brick and Mortar

Refers to a traditional street-side business that offers products and services to its customers face-to-face in an office or store that the business owns or rents. The local grocery store and the corner bank are examples of brick-and-mortar companies. Brick-and-mortar businesses have found it difficult to compete with mostly web-based businesses

Internet Bank

An internet bank — also known as a virtual bank, an online bank, or a web bank — is a bank that lacks any physical branch locations and exists only on the internet.

TYPES OF SERVICES

Insure

Life Insurance

Homeowners Insurance

AD&D Insurance

Auto Insurance

Loan

Personal loan

Student loan

Home loans

Business loans

Vehicle Loans

Accounts

Checking Account

Savings Account

Business Checking Account

Business Savings Account

Non-profit organization

Money Market

Cards

Debit Card

Credit Card

Wealth Management

Retirement Planning

Investment Planning

Insurance Planning

Education Planning

Online banking