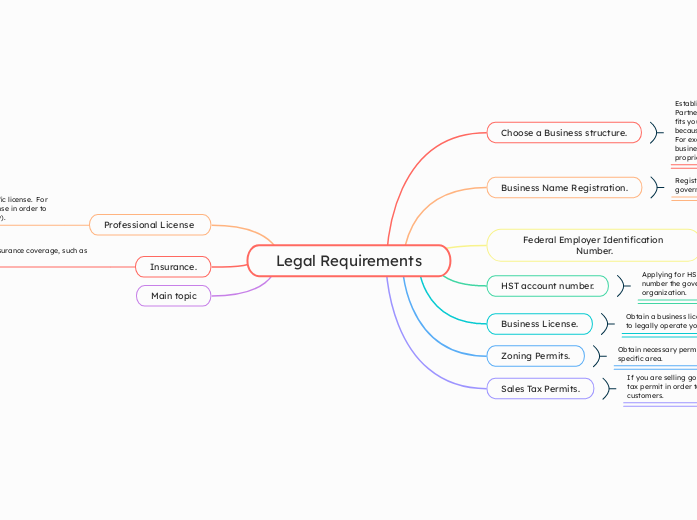

Legal Requirements

Choose a Business structure.

Business Name Registration.

Federal Employer Identification Number.

HST account number.

Business License.

Zoning Permits.

Sales Tax Permits.

Professional License

Certain professions require specific license. For example, you need a doctors license in order to practice and take patients (legally).

Shows you have met the requirements and standards in your profession. It also assures customers that u are a reputable and established business.

Insurance.

Obtain necessary insurance coverage, such as general liability.

Protects you and your businesses properties, operations, etc.

Main topic

Obtain a business license from your city or country to legally operate your business.

They ensure the health and safety of customers and consumers, as well as make sure revenue is generate for the government.

Obtain necessary permit if you are operating in a specific area.

Zoning permits ensure that your business project meets the zoning requirement's.

Zoning requirments include setbacks from property lines, building height restrictions, and land use restrictions.

If you plan on hiring employees, becoming a corporation, or a sole-proprietorship, you need to obtain an EIN from the IRS.

Having an EIN ensures that your business lines up with the federal tax laws.

Having an EIN helps with many different aspects of a business. For example, Having an EIN is essential for filling tax returns, and employment tax returns.

Register your businesses name with the government to ensure that it is not already in use.

It protects brand identity and confusion among customers.

This is important because it provides legal protection, ensuring that no one else can use the same name in your region.

If you are selling goods, make sure to get a sales tax permit in order to collect sales tax from customers.

Allows businesses to collect and remit sales tax from customers.

Applying for HST/GST account number is a unique number the government assigns to a business or organization.

If your business sells goods or services and collects sales tax from customers, you need an HST/GST account number to collect and hand over the tax to the government.

Establish if your business is a sole proprietorship, Partnership, Corporation, etc. Choose one the best fits your businesses needs. This is important because different structures offer different liability. For example a corporation may protect you from business lawsuits and debt, whereas sole proprietorship's dont.