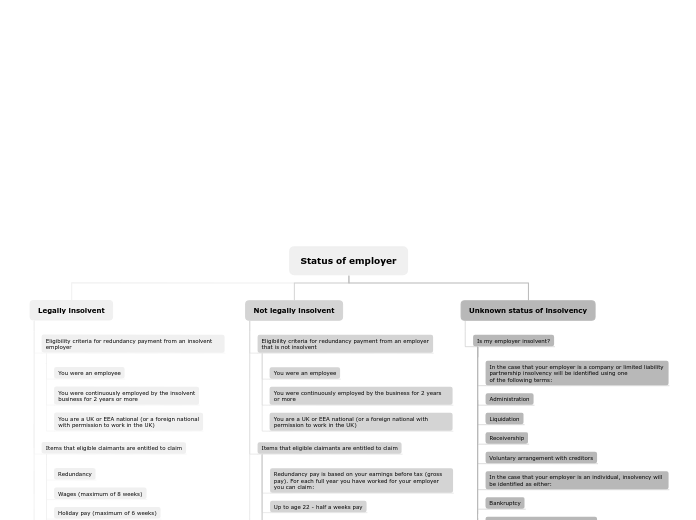

Status of employer

Legally insolvent

Eligibility criteria for redundancy payment from an insolvent employer

You were an employee

You were continuously employed by the insolvent

business for 2 years or more

You are a UK or EEA national (or a foreign national

with permission to work in the UK)

Items that eligible claimants are entitled to claim

Redundancy

Wages (maximum of 8 weeks)

Holiday pay (maximum of 6 weeks)

Compensatory notice pay (1 week after one calendar months service rising to 1 week per year of service up to a maximum of 12 weeks (new earnings will be taken into account))

Basic award for unfair dismissal

Protective award

Unpaid pension contributions

Making a claim

Debt must be registered with the employer's insolvency practitioner

Must apply for redundancy pay within 6 months of being dismissed

You are able to apply as soon as you have been made redundant

The insolvency practitioner (alternatively 'official receiver') will give you a 'CN' (case reference) number, you cannot claim without the CN number

The insolvency practitioner will provide you with the RP1 form to complete and return to them or they will request you to send it to the Redundancy Payments service to be done as soon as possible

Following a successful claim

If your claim is successful you should receive payment within 6 weeks however it can take longer

The information you provide will be checked against the employer's records. Payment will only be made if the employer's records reflect the information you provide

Benefits you are entitled to claim will be deducted from your statutory notice payment regardless of whether you claim them

Following an unsuccessful claim

Contact the Redundancy Payments Service who will provide details as to why the claim was rejected

You can make a claim to the Employment Tribunal if you disagree with the decision. You'll be claiming against the Secretary of State of Business and Energy and Industrial Strategy and your former employer

For help and assistance contact the Redundancy Payments Service. You will need to provide your case reference number or National Insurance Number

Not legally insolvent

Eligibility criteria for redundancy payment from an employer

that is not insolvent

You were an employee

You were continuously employed by the business for 2 years or more

You are a UK or EEA national (or a foreign national with permission to work in the UK)

Items that eligible claimants are entitled to claim

Redundancy pay is based on your earnings before tax (gross pay). For each full year you have worked for your employer you can claim:

Up to age 22 - half a weeks pay

Age 22 to 40 - 1 weeks

Age 41 and older - 1.5 weeks pay

If you turned 22 or 41 while working for your employer the higher rates apply for the full years you were over 22 or 41

You are only entitled to money included in your employment contract, other payments such as holiday pay, notice pay or arrears of pay cannot be made

Redundancy payments are capped at £544 a week (£538 if you were made redundant before April 6th 2021

Making a claim

Must apply within 6 months of being dismissed

You can apply as soon as you have been made redundant

Proceedings must be taken through the Office of Industrial Tribunal and Fair Employment Tribunal, this requires use of the ET1 form which can be accessed via the Legal Docs service (Form ET1: Make a claim to an employment tribunal)

Unknown status of insolvency

Is my employer insolvent?

In the case that your employer is a company or limited liability partnership insolvency will be identified using one

of the following terms:

Administration

Liquidation

Receivership

Voluntary arrangement with creditors

In the case that your employer is an individual, insolvency will be identified as either:

Bankruptcy

Voluntary arrangement with creditors

Your employer will not be regarded as insolvent if they simply stop trading or they are removed from the register of companies (dissolved)

In most cases an individual will be appointed to deal with the insolvency and will be identified as an 'Insolvency Practitioner' or 'Official Receiver'. They will be responsible for the progress of the case and act in one of the following capacities:

Administrator

Liquidator

Receiver

Supervisor (of a voluntary arrangement)

Trustee (in bankruptcy)

A closed business does not mean an insolvent business. You must identify insolvency status in order to make your redundancy claim. If you have yet to identify insolvency status you can use Companies House who hold trading details on its register of companies. Information on individuals who are declared bankrupt from the Insolvency Service