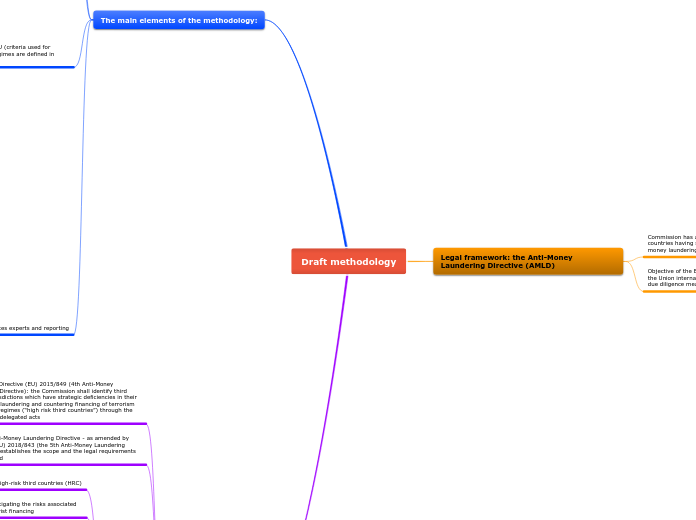

Draft methodology

Legal framework: the Anti-Money Laundering Directive (AMLD)

Commission has a legal obligation to identify high-risk third countries having strategic deficiencies in their regime on anti-money laundering and countering terrorist financing

Objective of the EU list of high-risk third countries: to protect the Union internal market, through application of enhanced due diligence measures by obliged entities

The main elements of the methodology:

(i) The interaction between the EU and the Financial Action Task Force (FATF)

Third countries listed by the FATF will, in principle, also be listed by the EU.

For countries de-listed by the FATF, the Commission services will assess whether the FATF Action Plans for a delisting are sufficiently comprehensive also in view of an EU delisting

Where necessary, specific EU requirements will “top up” the existing FATF Action Plan, by referring to additional EU specific criteria

Third countries that may present a risk and are not (yet) subject to the FATF procedure should be flagged by the Commission/Member States in the FATF before considering an autonomous listing by the EU

(ii) Autonomous assessment by the EU (criteria used for assessing third countries’ AML-CFT regimes are defined in Article 9 of AMLD)

The AML/CFT regime of a third country will be assessed according to the following eight building blocks:

1) criminalisation of money laundering and terrorist financing

2) measures relating to customer due diligence, record keeping and reporting of suspicious transactions in the financial sector

3) the same measures in the non-financial sector

4) the powers and procedures of competent authorities

5) the existence of dissuasive, proportionate and effective sanctions

6) the practice of competent authorities in international cooperation

7) the availability and exchange of information on beneficial ownership of legal persons and legal arrangements

8) implementation of targeted financial sanctions

Staged approach:

1) consulting the countries on preliminary findings of the Commission

2) drafting country-specific “EU benchmarks” to address each country’s concerns in relation to the criteria set by AMLD

3) seeking third countries’ commitment to implementing those country-specific “EU benchmarks”

A deadline of 12 months would be given to third countries to address concerns

A listing would occur:

if the country does not implement in full the benchmarks / commitments

in case countries are not cooperative or countries fail to implement the agreed benchmarks

in case there is “an overriding level of risk” that needs to be mitigated while there is no ability for the country to implement EU benchmarks

An emergency procedure is provided in case the Commission needs to urgently take mitigating measures in exceptional circumstances

(iii) Consultation of Member States experts and reporting

Member State experts will be consulted at every stage of the process ((law enforcement, intelligence services, Financial Intelligence Units)

The Commission will keep the European Parliament and the Council informed on the progress in applying the present methodology and the preparation of delegated acts

Objectives and Scope

Article 9 of Directive (EU) 2015/849 (4th Anti-Money Laundering Directive): the Commission shall identify third country jurisdictions which have strategic deficiencies in their anti-money laundering and countering financing of terrorism (AML/CFT) regimes (“high risk third countries”) through the adoption of delegated acts

The 4th Anti-Money Laundering Directive - as amended by Directive (EU) 2018/843 (the 5th Anti-Money Laundering Directive) - establishes the scope and the legal requirements to be fulfilled

Objectives:

identifying high-risk third countries (HRC)

understanding, managing and mitigating the risks associated with money laundering and terrorist financing

protecting the proper functioning of the Union's financial system and of the internal market

complement and reinforce international efforts

put further pressure on HRC to correct their strategic deficiencies

establishing a mechanism based on evidence and facts

the Commission is committed to assisting third countries and to exploring the provision of technical assistance to support implementation of:

EU requirements

Financial Action Task Force (FATF) recommendations

relevant United Nations Security Council Resolutions.

Scope

This methodology is applicable to any third-country jurisdiction

overseas countries and territories listed in Annex II to the Treaty of the Functioning of the EU, which have their own legal system and jurisprudence which is separate from the legal order in force in a Member State

This methodology does not apply to

EU Member States

countries which are subject to the requirements of Directive (EU) 2015/849 through the agreement on the European Economic Area countries of 3 January 1994