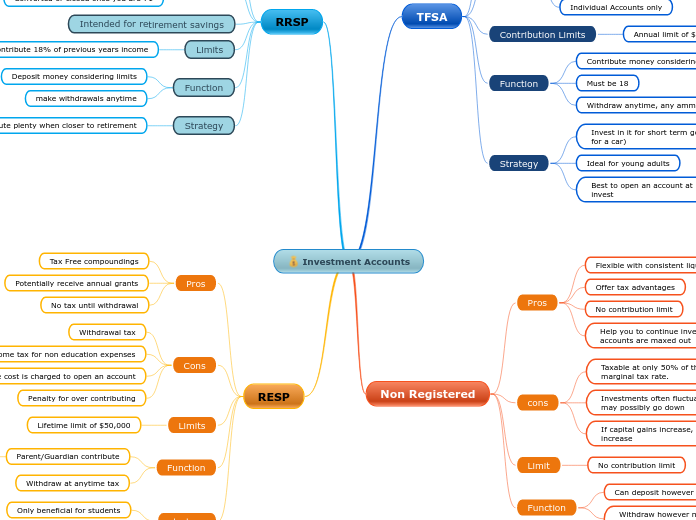

Investment Accounts

TFSA

Pros

Investment income is tax free

Withdrawal tax is free

Unused room is carried onto future years

Once retired the investments aren't classified as income

Cons

No tax refund

No spousal plan

Penalties for over contributions

Individual Accounts only

Contribution Limits

Annual limit of $6000

Function

Contribute money considering limits

Must be 18

Withdraw anytime, any ammount

Strategy

Invest in it for short term goals (ex. saving for a car)

Ideal for young adults

Best to open an account at 18, and begin to invest

Non Registered

Pros

Flexible with consistent liquidity

Offer tax advantages

No contribution limit

Help you to continue investing, if registered accounts are maxed out

cons

Taxable at only 50% of the account holder’s marginal tax rate.

Investments often fluctuate, meaning they may possibly go down

If capital gains increase, then taxes will also increase

Limit

No contribution limit

Function

Can deposit however muchyou want

Withdraw however much you want from contributions

RRSP

Pros

Tax-Relief by deducting contributions

Tax Sheltered (I.e. Investments grow tax free)

Cons

Pay tax upon withdrawal

Converted or closed once you are 71

Intended for retirement savings

Limits

Contribute 18% of previous years income

Or

Maximum contribution of $27,230

Function

Deposit money considering limits

make withdrawals anytime

Strategy

Contribute plenty when closer to retirement

RESP

Pros

Tax Free compoundings

Potentially receive annual grants

No tax until withdrawal

Cons

Withdrawal tax

Income tax for non education expenses

Service cost is charged to open an account

Penalty for over contributing

Limits

Lifetime limit of $50,000

Function

Parent/Guardian contribute

Government grants an additional 20% of contribution

Withdraw at anytime tax

strategy

Only beneficial for students

Maximize tax free compounding growth