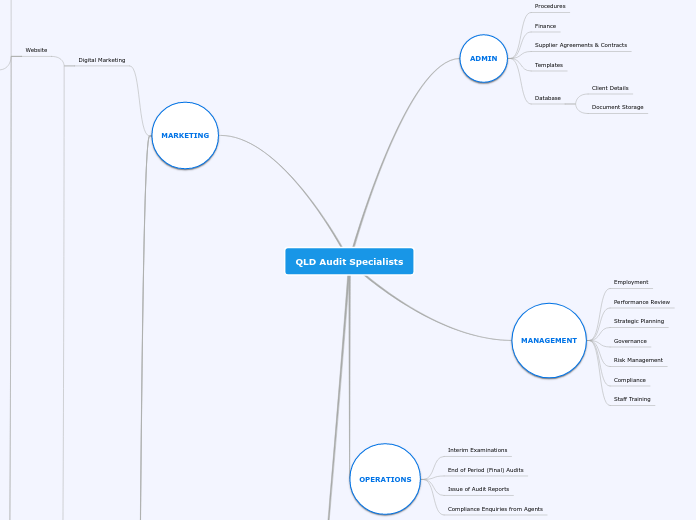

QLD Audit Specialists

SALES

Cold Calling

Pipeline

Web Quote Forms (MARKETING)

Engagement Preparation

Schedule of Audit Dates

End of Period (Final) Audit

2nd Interirm

1st Interim Review

Letter of Engagement

Initial Follow-up Email

Agents Respond and supply info

Phone Call Contact

MARKETING

Broadcast media

Print Media

Subtopic

Social Media

Google Plus

Linked In

Facebook

Seminar/Conferece Sponsorship

REIQ

Regional Workshops

National Conference

Digital Marketing

Google Adwords

Website

Contact Details

Exposure

Landing Pages

Licensee Resources

Regulations Checklists Summary

Agents Fact Sheets

Dealing with Trust Money

in the simplest of terms, or to put simply, trust money is money that you hold, that belongs to someone else. So for real estate agents, trust money are most commonly: deposits to purchase property, and rents received from tenants.

What am I required to do with trust money?

What is trust money?

Where trust money has been received by an agent who is licensed under the Property Occupations Act 2014, then the money must be deposited into a trust account in compliance with the requirements of the Agents Financial Administration Act 2014

" Trust Money" is defined in the legislation (Schedule 1) as "...an amount that was, or ought, under this Act, to have been, deposited in a trust account by an agent". In simple terms it means money that has been received by an agent which belongs to someone else. This includes money that has been paid a person (group of persons or a corporation etc.) that is to be dealt with in some way or form, for or on behalf of someone other than the agent, or the person from whom the money was received.

Operating a Trust Account

Withdrawing moneys held in trust (Payments)

Receiving Trust Money (Receipts)

Reg12

Reg11

Reg10

Reg9

Reg8

Reg7

Trust Money

Computerised Accounting System

Manual Accounting Records

Audit Requirements

Closing a Trust Account

Opening a Trust Account

Regulation Videos

Regulations

Reg 31

Reg 30

Reg 29

Reg 28

Reg 27

Reg 26

Reg 25

Reg 24

Reg 23

Reg 22

Reg 21

Reg 20

Reg 19

Reg 18

Reg 17

Reg 16

Reg 15

Reg 14

Reg 13

Payments/Withdrawals made from the trust account by Cheque

Reg 12

If money is deposited into the trust account by means of:-

(b) all other means - the agent must ensure a copy of the deposit form is kept in the trust account records

(a) electronic transfer - then the agent must obtain at least weekly a report from the bank showing the transactions into the trust account and ensure the transaction report statement is retained in the trust account records

Reg 11

Trust Deposit Forms must be completed which contain

(d) if trust money received is by way of a cheque, the name of the drawer and the name and branch of the financial institution the cheque is from

(c) signature of the person who made the deposit

(b) amount

(a) name and account number of the trust account

Reg 10

When dealing with trust account receipt forms, agents must ensure:-

(e) if a trust receipt form is cancelled, the cancelled receipt must be kept in the agents records and a note or brief description

(d) a duplicate trust account receipt form is kept in the agents records

(c) the trust receipt form is given to the person who paid the trust money - if requested

(b) receipts are only used for receipt of trust money (or an amount of money that includes both trust money and non-trust money)

(a) the receipt forms contain all the items listed regulation 9

Reg 9

Trust Receipt Forms must include

(j) if for rent, the address of the rented premises and the date or period the rent payment relates to

(i) a description of how the money was received - e.g. cash, EFT, cheque etc

(h) amount of money - expressed in numbers

(g) brief description of the matter or reason the trust money has been received (i.e. what it is for or what it relates to)

(f) a name (or identifying code) of the person on whose behalf the money is received

(e) name of the person the receipt is completed for

(d) the name of the person completing the trust account receipt form and if the receipt is in hard (printed) copy the persons signature

(c) the date the trust money was received and the date the trust account receipt was completed

(b) licence number of the agent

(a) name of the agent

Reg 8

Requirement to complete trust account receipt form

8(b) or immediately when receiving trust money

8(a) as soon as an agent becomes aware that money has been paid (received into the trust bank account

Reg 7

Trust Account Receipt heading requirements

7(2) duplicate trust account receipt forms must contain the words "Office Copy" or "Duplicate Copy"

7(1)(b) must be consecutively numbered

7(1)(a) must state "Agents Financial Administration Act 2014 Trust Account Receipt"

Reg 6

Must maintain a register of trust account receipt forms, and update changes to receipt forms held within 2 days

Reg 5

Entries in Books and accounts must only be in relation to carrying on a business as an agent

Reg 4

Using Software to maintain Books, Accounts and Records

4(5) Retain hard copies of account ledgers prior to deletion from the accounting system

4(4) Hard copies must be made within 5 business days after the end of each month

(c) reconciliation reports (to the trust creditor balances)

(b) reconciliation reports (to the trust bank statement balances)

(a) trust ledger balances

4(3) must keep details in chronological sequence

(d) trust account and BSB numbers

(c) amount

(b) transaction description details

(a) name and address detiails

4(2) must ensure that ledgers cannot be deleted unless they have a zero balance and a copy of the ledger is maintained

4(1) applies for computer accounting systems

Reg 3

Books and Records to be maintained

weblink

3(2) Must be maintained in a way than can be properly audited

3(1) Books, accounts & records that must be kept

(g) accurate accounts of amounts paid and received

(f) journal book - with pages and entries consecutively numbered

(e) ledger book

(d) cash book

(c) deposit forms in duplicate

(b) consecutively numbered receipts in duplicate

(a) register of trust receipt forms

Online Quote Form

Submitted Quote Forms

Auto-Response

Converions

Performance Tracking

OPERATIONS

Compliance Enquiries from Agents

Issue of Audit Reports

End of Period (Final) Audits

Interim Examinations

MANAGEMENT

Staff Training

Compliance

Risk Management

Governance

Strategic Planning

Performance Review

Employment

ADMIN

Database

Document Storage

Client Details

Templates

Supplier Agreements & Contracts

Finance

Procedures