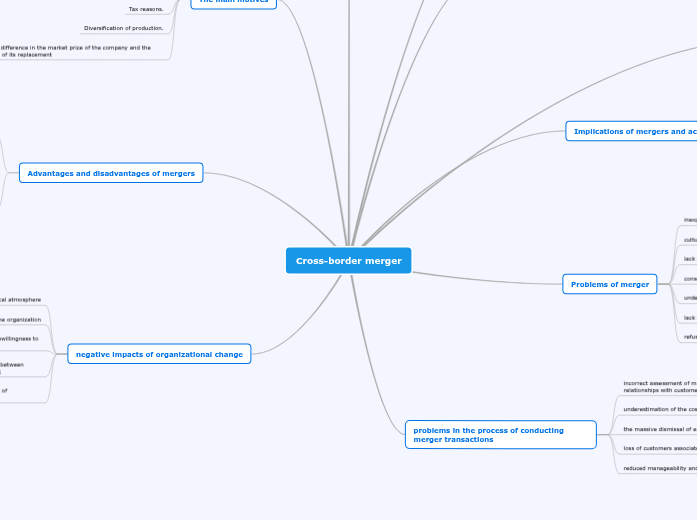

Cross-border merger

types of cross-border merger

Merger by absorption

Merger by Absorption of a Wholly-Owned Subsidiary

Merger by Formation of a New Company

How does an Cross-Border Merger Work?

Pre-Merger Acts

Court Approval

Registration and Strike-Off

Motives of transactions

desire for growth

improving the quality of management

the desire to build a monopoly

Implications of mergers and acquisitions

an incorrect assessment by a takeover company of the attractiveness of the market or the competitive position of the absorbed (target) company

underestimation of the size of the investment required to complete a merger or acquisition transaction

mistakes made in the process of a merger transaction

Problems of merger

inexperience of managers

cultural barriers

lack of proper control

consciously biased assessment

underestimation of costs

lack of strategy

refusal of employees to cooperate in an integrated company

problems in the process of conducting merger transactions

incorrect assessment of market potential for development; relationships with customers, competitors and suppliers

underestimation of the costs of the integration process

the massive dismissal of employees on their own

loss of customers associated with the departure of employees

reduced manageability and transparency

Depending on the attitude of the company's management personnel to a merger or acquisition transaction of a company

friendly mergers

hostile mergers

corporate alliances

corporations

The main motives

Getting a synergistic effect.

economies of scale

combining complementary resources;

financial savings by reducing transaction costs;

increased market power due to reduced competition (motive of monopoly);

Improved management quality.

Tax reasons.

Diversification of production.

The difference in the market price of the company and the cost of its replacement

Advantages and disadvantages of mergers

advantages of merger

The ability to quickly achieve the best results

Such a strategy weakens competition

Instant purchase of market share

Disadvantages of mergers

Big risk with an incorrect assessment of the company

The integration process becomes complicated if companies operate in different areas

After the end of the transaction there may be problems with the staff of the company that you bought

negative impacts of organizational change

tense psychological atmosphere

reducing the loyalty of employees towards the organization

reduction of innovation activity of employees, unwillingness to “take” even reasonable risks

the increase in the number of conflict situations between workers and management, within the workforce;

change of employees' requirements for the level of remuneration