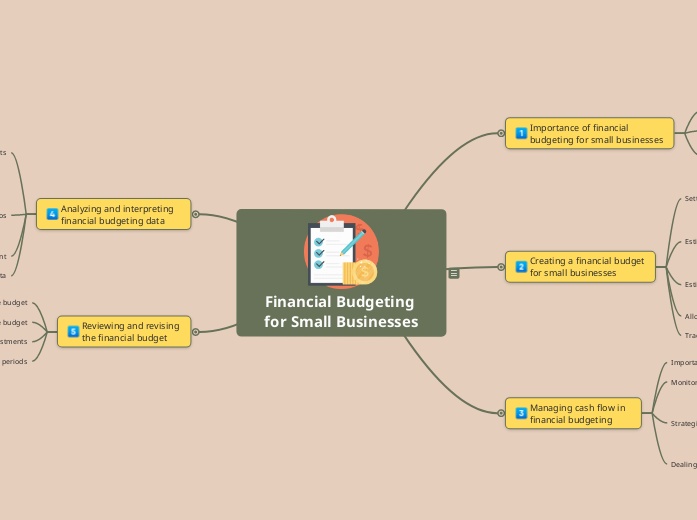

Financial Budgeting for Small Businesses

Importance of financial budgeting for small businesses

Overview of financial budgeting

Benefits of financial budgeting for small businesses

Challenges of financial budgeting for small businesses

Creating a financial budget for small businesses

Setting financial goals

Short-term goals

Long-term goals

Estimating revenues

Sales forecast

Other sources of revenue

Estimating expenses

Fixed expenses

Variable expenses

Allocating funds for contingencies

Tracking and adjusting the budget

Managing cash flow in financial budgeting

Importance of cash flow management

Monitoring cash inflows and outflows

Strategies for improving cash flow

Reducing expenses

Increasing sales

Negotiating better terms with suppliers

Dealing with cash flow gaps

Analyzing and interpreting financial budgeting data

Understanding financial statements

Income statement

Balance sheet

Cash flow statement

Key financial ratios

Profit margin

Return on investment

Current ratio

Identifying areas of improvement

Making informed financial decisions based on data

Reviewing and revising the financial budget

Regularly reviewing the budget

Identifying deviations from the budget

Making necessary adjustments

Revising the budget for future periods