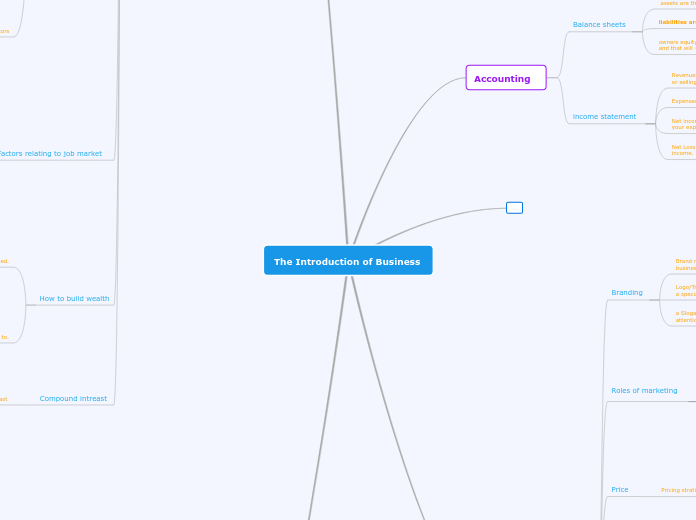

The Introduction of Business

Accounting

Balance sheets

assets are things that you own with a dollar value.

liabilities are things that you owe like a bill.

owners equity is your net worth after you do assets-liabilities and that will = your net worth which is Owners equity.

income statement

Revenue, Revenue is money earned from preforming a service or selling goods.

Expenses, Expenses is money that is spent.

Net income, Net income mean you have a profit greater than your expenses.

Net Loss, Net loss is when you expenses are greater than your income.

Markiting

Branding

Brand name is a word, or a group of words. to distinguish a businesses product from it's competitors

Logo/Trademark is when a business combines there name with a special symbol i.e.

a Slogan is a short catchy phrase that will catch peoples attention very easily.

Sales

Reaserch

Distribution

Advertising

Promotion

Price

Pricing stratiges involve the following decisions

Reflecting on what a customer is willing to pay for the produce

What the competitors are selling their product for.

What image to project to the customers

Place

place stratiges involve the following decisions.

Where a product is to be distibuted locations stores.

How a product is being distibuted, Online, storefront or both

Direct competition

Very similar products addresing the same need.

Indirect competition

The options are not directly related to eachother

Benifits of compitition

Increased selection

Altreative choices

Better prices

Increased productivity

Product improvments

Technology advansments

The product-service mix

Installation

Delivery

Extended warrenties

Alterations

Advice

Carry outs

Gift wrapping

Lablling

Part of packaging info for the customer to see

Product ingredians

The Marketing Mix

The time and money spent on the Marketing activities reqiured to move a particular product or service from the producer to the consumer.

Product

Place

Promotion

price

The compitition

The consumer

Personal finances

Ways we us are money

Spend

On goods and services

Save

For future use

Invest

To increase value over time

Doante

To help assist others in need

Gamble

Bet on luck for a gain

Big expensive purchases require some big dicision making. For instance, buying a house or car isn't something you rush into.

Money avaliable

Pre-approval from the bank

Bank looks into your finalcial position ( salary, credit rating, assest, cash, work, history, .ect) to see what type of risk you'd be.

Used to determaine how much of a loan you qualify for.

costs (expenses)

Question: What are your monthly cost.

In other words: How much desposable income (take home pay) is left to play your monthly bills such as: food, clothing, taxes, utilitse, ect.

Buyer behaviour

Indaviduals have different wants and needs that influance their buying decisions

For example:

So people might view a home purchase as a burdun, rather then a benifit.

Might prefer to pay rent to avoid having to cut the grass, paying property taxes directly, ect.

Others might prefer to spend their money on the purchase of a home, knowing that at the end of the term, they would have something to show for their efforts and will own versus rent what they have been paying for.

Comparison shopping and product info.

How do you compare big items?

Make a list detalling important "must haves" for you.

Compare your different choices (pros vs cons) in order to decide which choice suits you best.

Service

Somehing that you pay someone else to do for you because you don't have those particular skills or knowlage

I.e real estate agent, mechanic, stock broker, ect

Quality

Question: should you pay more and get high quality. Or should you pay less and get mediocre quality

Warranties and gaurantees

Warranty:provides after sales service on a product for a specified period of time.

Gaurantee: a formal promise or assurance that goods/services are of a sepcific quality.

Payroll - vocabulary

Gross pay

Gross means "big" total pay before deductions

Net pay

"take home" pay actual amount on your paycheque after deductions

Deductions

Mandatory gov't and any voluntary amounts taken off of your gross pay

Salary

Get paid the same amount every pay- not paid for any O/T

Discretionary income

Money left over after all necessities ( I.e food, rent, mortgage, utilities, ect) have been paid.

Hourly rate

Get paid a set amount per hour. if any O/T. you will get paid extra. 1.5 double.

Commission

Get paid a percent amount depending on your sales (how much you sell)

Piecework

Get paid for every item you make. The more you make the more money you get.

Payroll- Government deductions.

Income tax

Anyone who earns income has to pay federal and provincel income tax.

The money goes towards federal expenses such as defense, social programs ( EI, CPP) Canadian debt and to provicial expenses such as health, education, welfare and provicial debt.

CPP: Canadian pension plan

Anyone who works and is over 18 years old contributies to CPP.

Employees (workers) and employers bosses both contribute to CPP.

Pay into it from every paycheque.

When you reitire, become disabled or should your spouse pass away, you can recive CPP.

EI: employment insurance

Pay into it from every paycheque even if you are not yet 18.

If you get laid off, not fired and have worked 420 hours you can collect on EI cheques for awhile.

Types of expenses

How does the government recive the money?

Everytime you get paid, mandetory deductions are subtracted from your paycheque the employer then remits these taxes to the government.

At the end of the year, the government wants to make sure that you have paid the correct amount of taxes from your income bracket, thus, every year, you are expected to file an income tax return by april 30th.

The amount of income tax that you have already paid from your pay will be compared to the amount of tax that would be payable for your situation.

Paycheque formula

Non government deductions

Company pension plan

Take off money to put into a retirment plan (over 65) collect a work pension ( plus government pension- CPP)

Health plan

Take off money to pay for benifits such as, glasses, dental, drug plan, ect

Savings plan

Take off money to put into a savings account (forces you to save)

RRSP

Registered retierment savings plan is a government savings plan.

Life insurance

Deduct money in order for you/your family to recive money when you pass away.

Charitable doanations

Take off moey for charities, I.e, united way, M.A.D.D, ect.

Union dues

Take off money to pay to pay for union dues automatically

Income level factors

Why do some jobs pay more than others?

Education: the more education you have, the greater chances you will earn more money.

Expierence: the more experiance you have, the more valuable you are because you won't take as long to be trained (which is costly time and money)

Personal preformance: Employers don't want to lose good hard working employee's. Competent staff become valuable assets. The better you are, the greater possiablity of reciveing a higher salary.

Uniqueness of abilities: I.e being bilinugal, have a rare skill set or training.

Factors relating to job market

Type of business

some types of businesses pay more then others.

success of the business

How successful a business is will determaine what saleries they can afford to pay.

Economic conditions

If the economy is booming, "money is being made and jobs are plentiful.

A slowdown (recession) in the economy results in layoffs, pay cuts/freezes.

How to bulid wealth

In order to build good wealth you will need.

Good info

Good planning

Need to make good choices

You will also need to learn how to.

Earn money

Budget and save

Save and invest

Control debt

Compound intreast

Is the intreast earned on intreast

Leadership

Role of management

Planing

Forecasting the future

Begins with reaserch

Trends and changes in the business environmet

Organizing

Structure of the organization

Employees positions and responsabilities

Systems and procedures

Controling

Ensuring company goals and objectoves are met.

Profit is the ultimate measure of preformance

If the company meets it's goals (profit)

Management's role is to duplicate it.

If company fails to meet goals

Management's role is to determine why

Positive leaders

Positive leaders use rewards to motivate employees

Independance

Development oppratunities

Acknowledgment

Raises bounses

Lieu time off

Negative leaders

Negative leaders use peilties with there employees

These leaders act domineering and superior with people

Negative penalties Include

Days off without pay

Reprimanding infront of others

Assining unplesent job tasks

Leadership goals

Leadership style is the manner and approch of...

Providing direction

Implementing plans

Motivating People

Most leader us all three styles

One style typically becomes the domanaite one

Managers versus leaders

Managers are people who do things right, while leaders are the ones who do the right thing.

Three different styles of leadership

Autocratic

Tells others what to do

Not open to new ideas

"It's my way or the highway"!

Democratic

All members are involved

Asks before tells

Leader has final say

Supports teamwork

Lassiez-faire

Gives little or no direction nor, motivation to teamwork or members

Advice is offered only if asked

No one seems to be in charge