a Felipe Quintana 5 éve

617

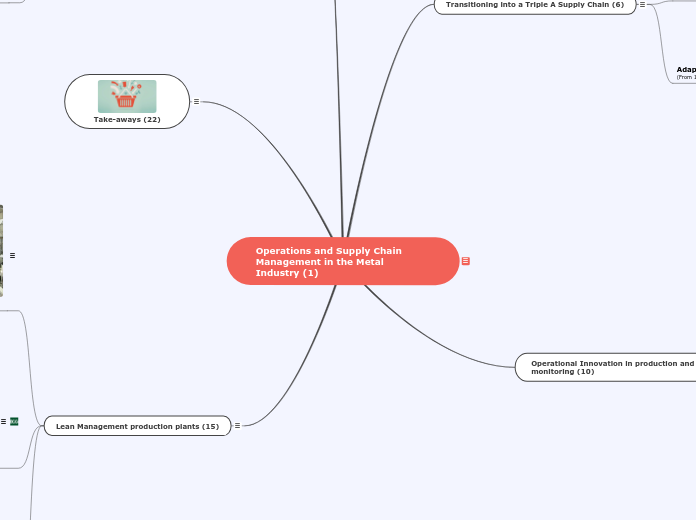

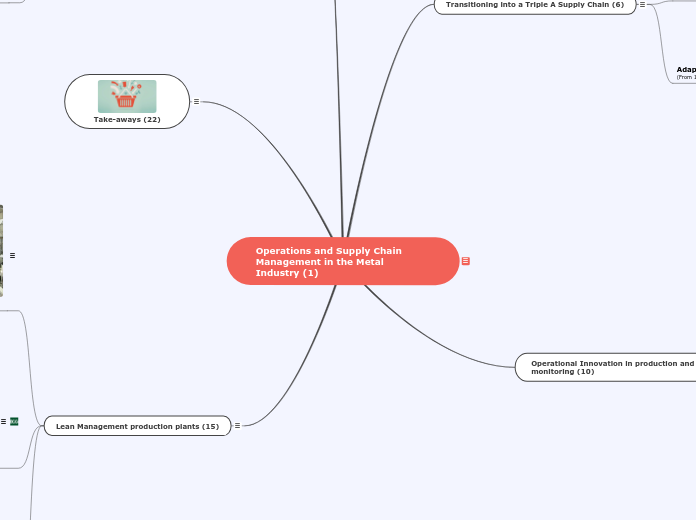

Operations and Supply Chain Management in the Metal Industry (1)

a Felipe Quintana 5 éve

617

Még több ilyen

IE Business School

MIM - S2

Course: Operations and Supply Chain Management

Prof. Felipe Quintana

Section 2

Maxime Corneille

Operations and Supply Chain Management in the Metal Industry

The metal sector is essential in the world of today, and its importance is often taken for granted in our everyday life. Very few people are familiar with this industry and many consider it unattractive and old. However, many companies of the metal world embraced innovation and are early adopters of revolutionary technologies. These technological disruptions had deep repercussions on the operations and supply chains of many of its companies, reason why I would like to further explore the extent of these advancements.

Arcelormittal : "We believe that a lean and effective organisation is essential to making sure the company is managed as efficiently as possible."

Metal companies need to comply not only with product technical specifications but also with logistic requirements regarding labelling, packaging, transportation, and most other downstream processes.

Tramways can be found in most metal production factories; they serve principally to transport hot metal and finished goods around the production building. Due to everyday use these tramways often got damaged, but they were very difficult to replace due to their complexity.

Most producers have now adopted a simplified tramway technology that is easily repairable, but also reduces the noise and vibrations that were usually associated with them.

Metal producers are usually situated at proximity of where their raw materials are extracted. Therefore, semi-finished and finished products have to be transported to their customer. Large pieces of metal are often transported by truck given their weight and size. This is also the case of lighter pieces of metal, however these can also be transported by sea and air.

As the cost of inbound and outbound transportation plays an important role in location, metals are packed in the most optimal way to reduce these costs.

(If you wish to learn more about this topic, you may find detailed information in the article attached).

A very common way to store steel before it is distributed is stocking it as a roil. This standardisation enables to save space by rolling the steel sheet around itself, but also facilitates storage, packaging, and transportation.

This article stresses the relevance of inventory management to avoid production bottlenecks, inefficiencies, and other types of operational issues.

BCG comes with some recommendations for "best practices" in handling inventory, which is of outmost importance in the production of any kind of metal:

Relating this back to "The Triple A Supply Chain" of Hau L. Lee, we could add to these points that, as important as it is to "keep it down", it could be recommendable for firms to maintain inventory buffers of inexpensive but key components in the production of metals.

Not all metals have the same properties or are destined for the same usage. Therefore, there are different ways to store stocks to save space, adapted to the product in question.

While storing metal tubes, producers strap them into standardised hexagonal packages to pile them and move them more easily around the plant.

In this picture, the red plastic circles at the extremities of the tubes are there to ensure that nothing goes inside the pipes while there are stored or transported. This is done to avoid contact with external elements that could intrude with the interior quality of the pipe or contaminate it; this is relevant since the pipes could be used for potable water systems were the liquid inside the tubes must absolutely not be contaminated.

Raw materials, principally iron ore, are stored at bulk in large containers close to the foundry. This containers can usually be placed into tracks to facilitate the transport of these materials into the furnaces. This process saves a lot of time to firms that enables them not to have to charge and uncharge the large quantity of raw materials several times.

By optimising equipment setups and throughput times, it is estimated that steel companies improved their capacity utilisation by up to 25% in the last decade.

Since the metal industry is very resource intensive, it is important that space is used as efficiently as possible. This is fostered by flawless communication between departments to correctly evaluate space requirements at a given point in time (it could be that some parts of a factory floor are only needed at certain periods during the year due to seasonality for example).

The operations and supply chain management of the metal industry are a good example of the innovation and efficiency standards in the sector.

Metal companies are becoming more customer centric and agile through digitally enabled technology such as sensors and machine learning softwares.

By embracing these disruptive tools, while adopting a lean mindset, the metal industry is aiming to better anticipate change and become more sustainable.

In the future, I believe that the supply chain of metal companies will become even more integrated, digitally connecting companies of more upstream sectors such as mining. Also, the adoption of technologies disrupting the supply chain has mostly been visible in European and North American markets; I believe that with time most developing countries and smaller companies will have access and will adopt these technologies and a lean mindset.

Metal production consists principally of iron, steel, aluminium, and copper. These can look very similar in appearance, but each one of them has different material properties.

ArcelorMittal is one of the leading producers of steel worldwide. In its promotional video, the company shows the importance steel had during human history and has in our modern world. Given metals' versatility, manufacturers need to constantly develop and adapt their products for the needs of their clients, while staying cost competitive. For example, steel producers are often demanded by the automotive industry to come with lighter and more resistant alloys. Given the range of applications the product could have, it needs to count with a reliable and efficient supply chain to address the different deadlines, regulations, and other kind of specificities related to each final customer. Given its widespread use, quality standards are essential to maintain since the use of metals produced could have serious safety implications, as in the construction sector.

The video briefly shows some elements of the supply chain of metal production, such as the standardised storage and the way that plants use magnetic arms to move scrap steel around the factory.

This illustration simplifies steel's life cycle, which is essentially the same for most other metals.

The metal industry does not focus on the initial "raw material extraction" phase, which is carried out by the mining industry.

The many steps in the supply chain of the metal industry require logistic excellency to coordinate all the different players.

Many ignore the majority of metals, such as most types of aluminium and steel, are fully and infinitely recyclable without losing on their quality. However, the industry remains one of the world's most polluting. According to the World Steel Association, steel alone represents around 8% of all direct emissions from fossil fuels.

Many producers have set sustainability goals regarding their emissions. This is the case of Liberty House, a leading industrial conglomerate, that is aiming to become the first carbon neutral producer by 2030, notably by trying to replace coal by hydrogen powered plants.

Energy is consumed in consequential quantities during the production process. Electricity costs alone could reach 25% of total costs for steel producers, and more than 45% for aluminium producers. This is why many metal manufacturers are optimising their water and electricity consumption. Online monitoring allows to properly analyse energy flows and combustion processes. Predictive modelling is used in order to improve energy efficiency and environmental sustainability.

Adding to the previous illustration, we see in this image that on top of the various steps to produce metals and the difficulty in coordinating them, each different stage is already very complex by itself.

There are many different ways to elaborate a metal, in this case steel, as there are thousands of possibilities in the dosage of raw materials and heating peculiarities during the production process.

The versatility of the final product is the reason why steel, as other metals, can be applied in so many sectors.

(If you wish to learn more about this topic, you may find detailed information from pages 4 to 8 of the article attached).

With such complex supply chains, metal companies have to develop new and innovative ways of production to add value and smoothen the process.

McKinsey identifies different ways in which the digitalisation will change the metal players' entire supply chain.

Firms will be able to leverage on the additional data extracted through different type of sensors to optimise feedstock costs and production, and eventually through advanced analytics to have predictive maintenance indicators. Predictive maintenance assesses machine usage and failure patterns that can help reduce expensive downtime.

Robotic arms have been widely adopted in metals' assembly and packaging. Self-organising production has compounded the benefits of this technology by automatically coordinated machines, leading to an improved utilisation and output. Predictive maintenance allows to repair equipment prior to breakdown.

In the extract of this video we can see how metal production does not only refer to products with monumental sizes. Metal production also takes into account things such as hangers that have a highly automatised production given a cost competitive environment with little possible product differentiation.

Robotics do not only help improve the efficiency of more downstream processes. They are widely used in the production of recycled steel and aluminium, picking up scrap metal with powerful magnets to transport them to the furnaces where they are melted.

Quality controls that were previously performed manually have been greatly optimised by metal producers. Celsa, a leading producer of steel products, now uses a system based on electromagnets and lasers to measure the straightness of laminated steel bars.

Machine learning based analytics were also adopted to reduce the crack and scratch defects on steel products at an earlier stage in the supply chain.

Tata Steel states: "We strengthened the quality assurance mechanism through our Mastercraft Application Lifecycle Management (...) the comprehensive test reports were digitised and yielded real-time traceability"

ArcelorMittal is considered to be one of the most innovative firms in its industry, and this is clearly testified in this video.

Digitalisation, drones, virtual reality to control production, data analytics, applications to check progress and scan items, sensors, mixed reality for maintenance work, automated stocks, driverless cranes... All these are operational innovations that ArcelorMittal integrated to its admirable supply chain.

Being at the forefront of innovation and adopting these technologies is extremely important as they improve the speed and efficiency of the supply chain at times when the "fast are eating the slow".

In complicated macroeconomic times that directly affect the metal sector, in a context of trade tensions and metal oversupply, it is important for producers to be Agile, Adaptable, and Aligned to improve the functioning of their operations.

To cause change, instead of reacting to it, this video shows the benefits of first committing to a meaningful and clear identity. Among other things, this identity facilitates alignment with suppliers and customers that get a more clear idea on the principles and procedures of the focal company.

To then be able to quickly embrace upcoming changes, firms should be customer centric, masters of their supply chain, and cost leaders. This adaptability feature is enhanced by the adoption of several possible processes such as standardisation and flexible factory utilisation that through a resilient supply chain prepare firms to withstand disruptions and better respond to demand fluctuations.

Digital technology is giving Severstal, a major steel company, more opportunities to understand its customers through their behaviour and communicate with them through personalised experiences and online portals. This enables the firm to manage the supply chain in order to best meet customer timelines and changing demand. The firm provides customers with information on the production and on the ways to best use and handle the product.

As a result of this communication, customers can adjust their own production plans. They can also use quality data to change the welding power or decrease the heat level to save energy. Furthermore, the customer can plan more precisely because the expected arrival date is more reliable.

The study showcased in this video demonstrates how the correct utilisation of data through sensors, and the ongoing communication with the firm's final customer, enables steel and aluminium producers to improve their performance.

The correct utilisation of data are key for an agile supply chain that in turn guarantees a sustainable growth, to manage price fluctuations effectively, and to adapt to policy shifts.

A combination of vertical and horizontal integration seem to improve the agility of metal producers' supply chain. Vertical integration enhances organisation and provides "real-time" monitoring. Horizontal integration enables companies to integrate customers into their supply chain, making it more agile and flexible. This resilient supply chain brings the end customer base closer to the production by sharing data powered updates and analysis on the fabrication process.

This efficient supply chain is what allows European metal firms, that usually have high production costs, with companies in the developing world, as in China and Brazil, where a very large part of the metal production takes place nowadays.