a Ihsan Rafiansyah 4 éve

1202

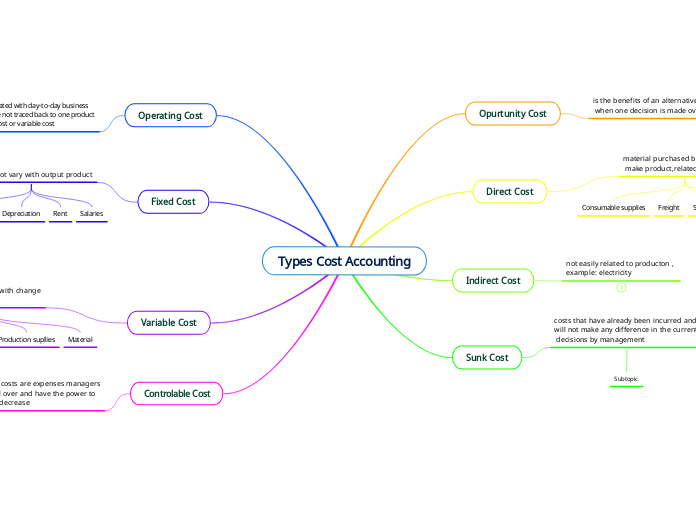

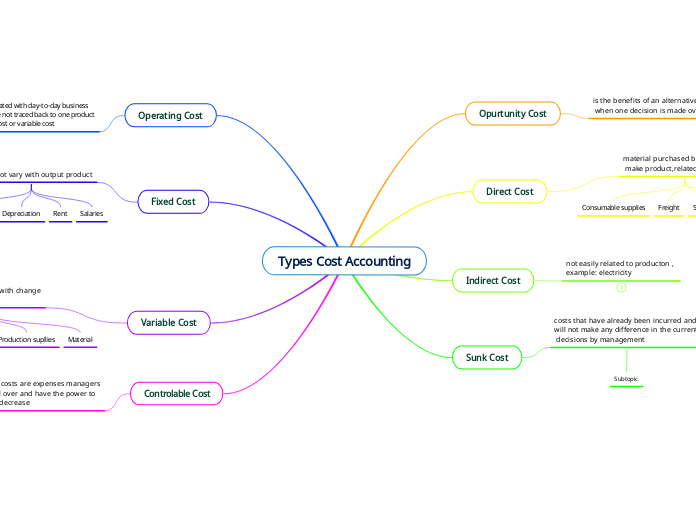

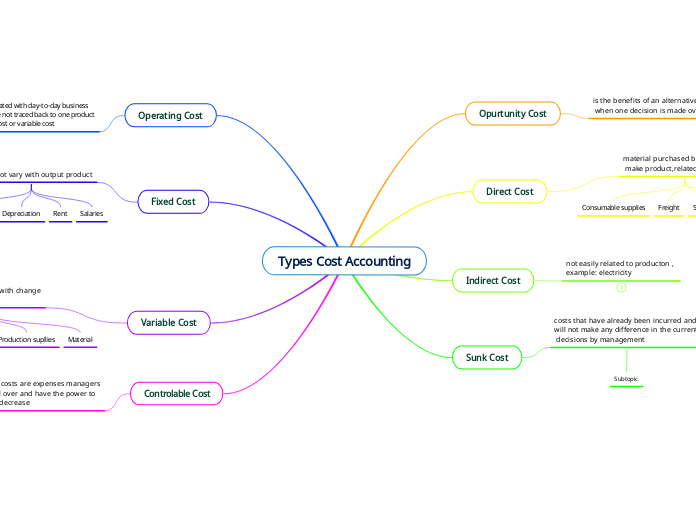

Types Cost Accounting

Types Cost Accounting

Controlable Cost

Controllable costs are expenses managers

have control over and have the power to

increase or decrease

Variable Cost

cost will fluctuate with change

of output product

Material

Production supllies

Credit card fees

Commisision

Fixed Cost

cost do not vary with output product

Salaries

Depreciation

Insurance

Operating Cost

expenses associated with day-to-day business

activities but are not traced back to one product

,it can be fixed cost or variable cost

Sunk Cost

costs that have already been incurred and

will not make any difference in the current

decisions by management

Subtopic

Indirect Cost

not easily related to producton ,

example: electricity

Office expenses

Rent

Security expense

Direct Cost

material purchased by company to

make product,related to production

Direct cost

Sales commision

Freight

Consumable supplies

Opurtunity Cost

is the benefits of an alternative given up

when one decision is made over another.