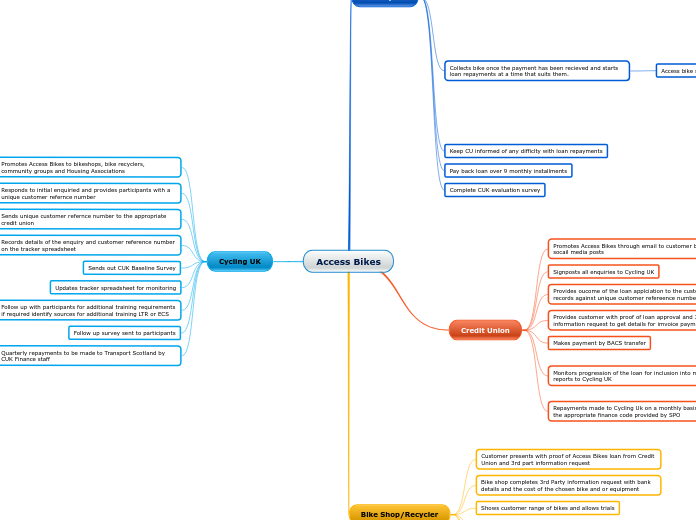

Access Bikes

Participant

Responds to advert or is signposted to CUK Web site

Participant decides to particpate in the scheme

Participant downloads smartphone app and makes CU application. Identyification can be verified using the app. Customer provides CU with their unique Reference number

If no smart phone they can apply to jointhe CU by phone, online, in person or using a paperbased application

Participant makes loan application

Loan application is approved customer attends bike shop with proof of loan and gets them to complete a 3rd party informatio request form

Selects bike and obtains invoice for bike and equipment from bike shop to return to CU for payment

If the loan is refused SPO can suggest community bike hubs for free or very cheap bikes and make referrals/link people in

Participant completes CUK baseline survey

Attends Bike shop and selects the best bike for their needs. Is given an invoice to send or take to the credit union to initiaite payment. Invoice can be emailed or physical

Bike not is stock? CU loan in place for 3 months

if bike is still not avaialble within that timefram a fresh applciation will need to be made

Sends or takes email to CU

Collects bike once the payment has been recieved and starts loan repayments at a time that suits them.

Access bike support as required

Online resources

Community Cycle Hubs

Learn to Ride training

Essentila Cycle Skills Training

Community Cycle Club

CUK Member Group

Basic Maintenance Training

Keep CU informed of any difficlty with loan repayments

Pay back loan over 9 monthly installments

Complete CUK evaluation survey

Credit Union

Promotes Access Bikes through email to customer base and socail media posts

Signposts all enquiries to Cycling UK

Provides oucome of the loan applciation to the customer and records against unique customer refereence number

Provides customer with proof of loan approval and 3rd party information request to get details for imvoice payment

Makes payment by BACS transfer

Monitors progression of the loan for inclusion into monthly reports to Cycling UK

Lona applications made

Loan Applications in progress

Loan applications rejected

Loans in repayment

Loans in default

Repayments made to Cycling Uk on a monthly basis including the appropriate finance code provided by SPO

Bike Shop/Recycler

Customer presents with proof of Access Bikes loan from Credit Union and 3rd part information request

Bike shop completes 3rd Party information request with bank details and the cost of the chosen bike and or equipment

Shows customer range of bikes and allows trials

Once the payment has arrived contact the customer to arrange collection of the bike

Arrange follow up apppointment for bike check up

Signposts potential Access Bikes customers to Cycling UK

Cycling UK

Promotes Access Bikes to bikeshops, bike recyclers, community groups and Housing Associations

Have contacts for Housing associations from Cycling Scotland

Responds to initial enquiried and provides participants with a unique customer refernce number

Sends unique customer refernce number to the appropriate credit union

Records details of the enquiry and customer reference number on the tracker spreadsheet

Contacts local bike shops for each enquiry

Time permitting will be fine at the start buut will have to see how this one works out

Sends out CUK Baseline Survey

Updates tracker spreadsheet for monitoring

Follow up with participants for additional training requirements if required identify sources for additional training LTR or ECS

Follow up survey sent to participants

Quarterly repayments to be made to Transport Scotland by CUK Finance staff