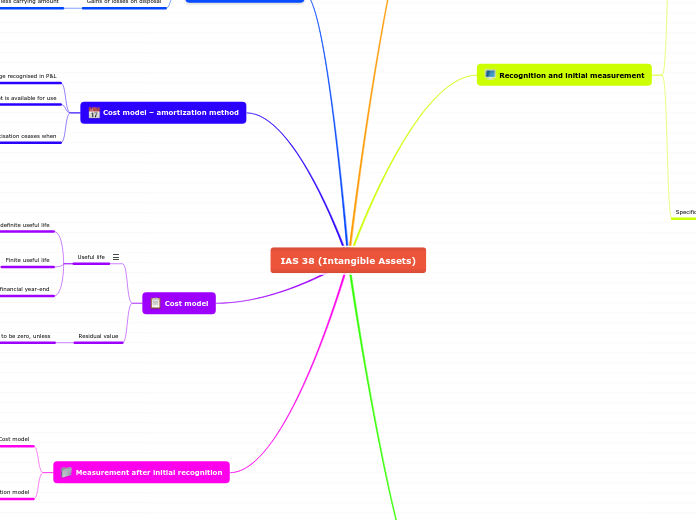

IAS 38 (Intangible Assets)

Definition

Examples : ➢ Computer software

➢ Patents

➢ Motion picture films

➢ Import quotas

Aller voir le slide 48 semaine 2

Recognition and initial measurement

An asset meeting the definition of an intangible asset should be recognised when

It is probable that future economic benefits associated with asset will flow to the enterprise and cost of asset can be measured reliably

Specific principles

Acquired in a separate acquisition

Recognition

Probability criterion => always satisfied

Reliable measurement => usually satisfied (particularly when payment is in monetary assets)

Measurement

At cost

Cost components when purchased

− Purchase price, import duties and purchase taxes, directly attributable expenditure of preparing the asset for its use

and less trade discounts & rebates

Expenditures that are not part of the cost of an intangible asset

− Costs of introducing a new product or service (incl. advertising and promotional activities)

− Costs of conducting business in a new location or with a new class of customers (including costs of staff training) and administration and other general overhead costs

Acquisition in a business combination

Recognition

Probability criterion => always satisfied

Reliable measurement => always considered to be satisfied

Measurement

At fair value based on

− Quoted market prices (active market)

− If no active market, use techniques to estimate fair value

• multiples/profitability

• discounted future cash flows...

Internally generated goodwill

Not recognised as an asset (expense to P&L)

Internally generated intangible assets

Expense to P&L

Research expenses

None of intangible asset arising form research (or research phase) should be recognised

All expenditure on research should be expensed when incurred

Examples of research activities :

• Gaining new knowledge

• Search for applications of research findings

• Search for alternatives to materials, products, processes, etc.

• Formulation, design, evaluation and selection of possible alternatives for new or improved materials, products, processes, etc.

Development expenses

Capitalisation of development costs if, and only if

−All these criteria are met :

− technical feasibility

− intention to complete

− ability to use or sell the asset

− probability of future economic benefits

− availability of resources (technical, financial)

− expenditure can be reliably measured

Some remarks

Intangibles acquired in

a business combination

In process R&D to be

recognised as well

The fact that the acquirer has no intention to further use these intangibles is not a reason not to recognize them at fair value

Intention not to use has no

impact on initial fair value

Development expenses

In pharma and life sciences industry it is very rare that development expenses are capitalized (technical feasibility criterion)

In some cases no material further development expenses are to be incurred from the moment all criteria to capitalise were met

IAS 38 requires to expense (passer en charge)

Training costs

Advertising costs

Relocation costs

Start-up costs

Retirements and disposals

Elimination from balance sheet when

Disposed of or no future economic benefits are expected from its use or disposal

Gains or losses on disposal

Proceeds less carrying amount

Cost model – amortization method

Amortisation charge recognised in P&L

Amortisation begins when the asset is available for use

Amortisation ceases when

The asset is classified as held for sale in accordance with IFRS 5 – Non-current Assets held for Sale and Discontinued Operations or the asset is derecognised

Cost model

Useful life

Indefinite useful life

No amortisation, but annual test of impairment according to IAS 36 (Impairment of Assets)

Finite useful life

Allocation of the depreciable amount (= cost – residual value) on a systematic basis over the useful life

Review at the end of each financial year-end

Change in accounting estimate accounted for prospectively

Residual value

Assumed to be zero, unless

Commitment by a third party to purchase or active market and

- Residual value can be determined by reference to that market

− It is probable that such a market will exist at the end of the useful life

Measurement after initial recognition

Cost model

Cost less accumulated amortisation and impairment losses

Revaluation model

Revalued amount less accumulated amortisation and impairment losses

Not further discussed as very rare and only possible for intangibles for which there exists an active market