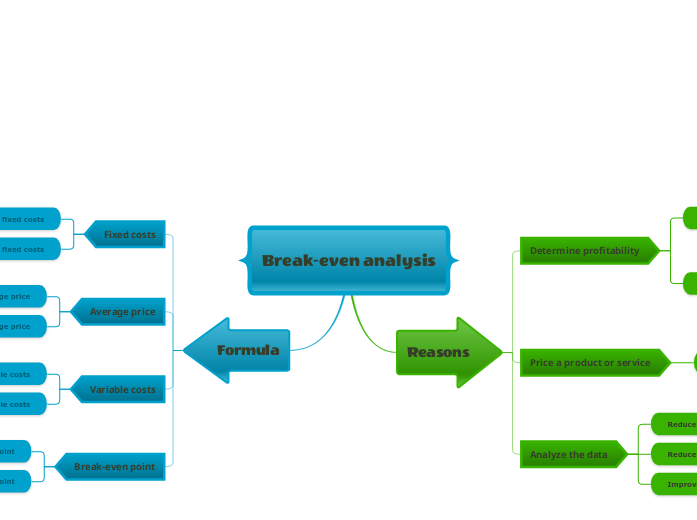

Break-even analysis

Starting any business has a price. Be prepared to cover those costs.

Formula

Use this formula to find the break-even point.

Fixed Costs / (Average Price – Variable Costs) = Break-Even Point

Break-even point

Determine break-even point

What is the break-even point?

The break-even point is the level of production at which the costs of production equal the revenues for a product.

Fixed Costs / (Average Price – Variable Costs) = Break-Even Point

Variable costs

Type variable costs

What are the variable costs?

Variable costs are costs that change as the quantity of the good or service that a business produces changes. Variable costs are the sum of marginal costs over all units produced.

Average price

Type average price

What is the average price?

To calculate the average purchase price of your shares you have to divide the total amount invested by the total number of shares bought.

Fixed costs

Fixed expenses or costs are those that do not fluctuate with changes in production level or sales volume.

They include such expenses as rent, insurance, dues and subscriptions, equipment leases, payments on loans, depreciation, management salaries, and advertising.

Type fixed costs

What are the fixed costs?

Fixed expenses or costs are those that do not fluctuate with changes in production level or sales volume.

They include such expenses as rent, insurance, dues and subscriptions, equipment leases, payments on loans, depreciation, management salaries, and advertising.

Reasons

Analyze the data

The Break-even analysis helps you analyze the data.

Improve sales

To improve the sales in your business, focus on the customers, and shift to increasing sales performance.

How can you improve sales?

Choose from the ideas below or add others.

Focus on the existing customersLearn about competitorsInnovation and unique productsCultivate valueBuild a customer service approachCustomer relationsPromotionMarketingProvide credible products

Reduce the variable costs per unit

How can you reduce the variable costs per unit?

Variable cost per unit is the production cost for each unit produced that is affected by changes in a firm's output or activity level.

Unlike fixed costs, these costs vary when production levels increase or decrease.

Reduce overall fixed costs

How can you reduce your overall fixed costs?

The success of a business rests on its ability to adjust and adapt to improve earnings.

Examples of fixed costs:

- Rent or mortgage

- Labor cost

- Insurance

- Property taxes

- Interest

- Advertising

- Standing orders

- License or membership fees

Price a product or service

The Break-even analysis helps you price a product or service.

Competitor name

Do some research and find competitor's prices.

Then try to establish your prices.

Price

What are the competitor's prices?

Determine profitability

The Break-even analysis helps you determine profitability.

Profit vs. loss

The profit and loss (P&L) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a fiscal quarter or year.

Which products or services turn a profit and which ones are sold at a loss?

Generated revenue

Type idea

Revenue generation is one of the most important activities any business can engage in.

It is defined as a process by which a company plans how to market and sell its products or services, in order to generate income.

How much revenue do you need to generate to cover all your expenses?