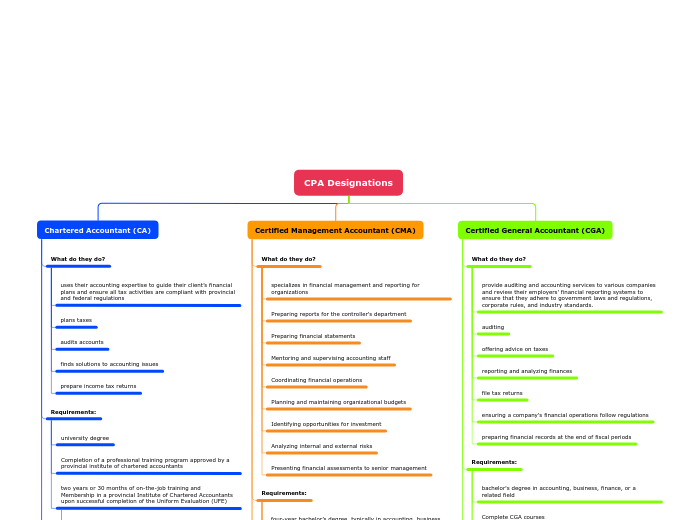

CPA Designations

Chartered Accountant (CA)

What do they do?

uses their accounting expertise to guide their client’s financial plans and ensure all tax activities are compliant with provincial and federal regulations

plans taxes

audits accounts

finds solutions to accounting issues

prepare income tax returns

Requirements:

university degree

Completion of a professional training program approved by a provincial institute of chartered accountants

two years or 30 months of on-the-job training and Membership in a provincial Institute of Chartered Accountants upon successful completion of the Uniform Evaluation (UFE)

length depends on what province you reside in

Where do they work?

accounting firms

public sector banks

What do they make? (annual salary)

starting salary: $55,000

average salary: $62,500

top salary: $88,313

Certified Management Accountant (CMA)

What do they do?

specializes in financial management and reporting for organizations

Preparing reports for the controller's department

Preparing financial statements

Mentoring and supervising accounting staff

Coordinating financial operations

Planning and maintaining organizational budgets

Identifying opportunities for investment

Analyzing internal and external risks

Presenting financial assessments to senior management

Requirements:

four-year bachelor’s degree, typically in accounting, business or finance.

Successful completion of the CPA Professional Training Program,

work for two years in a professional capacity

have to pass a two-part exam called the Common Final Examination (CFE) . One part is on financial planning, performance and control. The second test covers financial decision making.

Where do they work?

in for public companies, private businesses, and government agencies in business and leadership positions

What do they make? (annual salary)

starting salary: $57,481

average salary: $64,000

top salary:$105,788

Certified General Accountant (CGA)

What do they do?

provide auditing and accounting services to various companies and review their employers' financial reporting systems to ensure that they adhere to government laws and regulations, corporate rules, and industry standards.

auditing

offering advice on taxes

reporting and analyzing finances

file tax returns

ensuring a company's financial operations follow regulations

preparing financial records at the end of fiscal periods

Requirements:

bachelor's degree in accounting, business, finance, or a related field

Complete CGA courses

Pass the CGA exam

two years of professional experience in accounting

Where do they work?

a number of different industries, including finance, government, commerce or government

most work in accounting firms and organizations

What do they make? (annual salary)

starting salary: $48,263

average salary: $60,000

top salary:$80,500