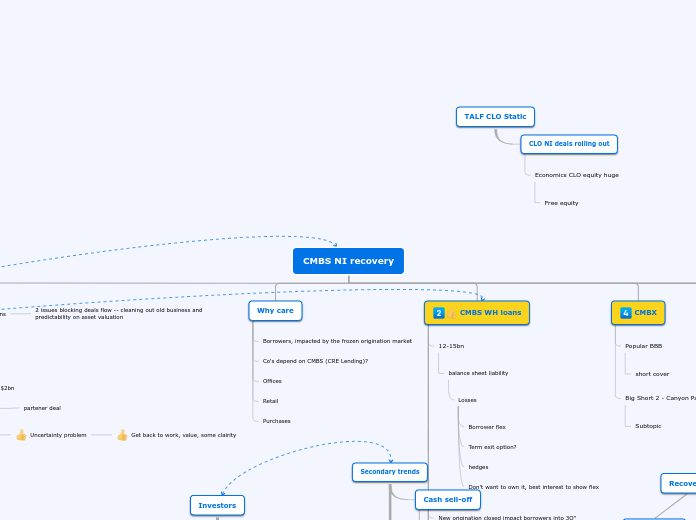

CMBS NI recovery

CMBS Conduit NI

NEW-New issue hiatus 5-6mth BoA

3Q lull, until origination returns

2 issues blocking deals flow -- cleaning out old business and predictability on asset valuation

Workouts

Borrower stress severe

Cover-Clean Portfolio

Transitional loans not for b/s

GS, DB Oversubscribed deals

4-5 more pipeline 700mm

Sized reduce from $2bn

WFCMT 2020-56

partener deal

Need to improve deals to grab investors

Not an investor problem like 2008

Uncertainty problem

Get back to work, value, some clairity

Why care

Borrowers, impacted by the frozen origination market

Co's depend on CMBS (CRE Lending)?

Offices

Retail

Purchases

CMBS WH loans

12-15bn

balance sheet liability

Losses

Borrower flex

Term exit option?

hedges

Don't want to own it, best interest to show flex

New origination closed impact borrowers into 3Q''

Investors benefit stronger deals, harder to sell

Huge bargains at the high risk level of subs

Ratings, not wait until vaccine, Dec. turnaround, 1Q

Overtime harder to play nice forbearance runsout

Rating pressure, fixed costs, losses expand

Subtopic

CMBX

Popular BBB

short cover

Big Short 2 - Canyon Partners 3/2019

Subtopic

TALF

Jawbone

SASB - liability

30% enhancement

NI TALF 1 not popular

SFR Progressive

Single Family Rental, AAA 10x oversold

Questions

Profit

Risk

Subtopic

Secondary trends

Cash sell-off

YoY

de-risk

impairment--

ratings

Empirasign data, orderly flow

2-types seller--

forced sellers

raising cash-- recovery

Buyers waiting

Opportunity funds

TALF CLO Static

CLO NI deals rolling out

Economics CLO equity huge

Free equity

Investors

mutual fund

Alliance Bernsteil

Insurance

Goldilox deals

Recovery

Ratings risk

Duration

Patience wanes

Agressive -Post collateral, liquidate,