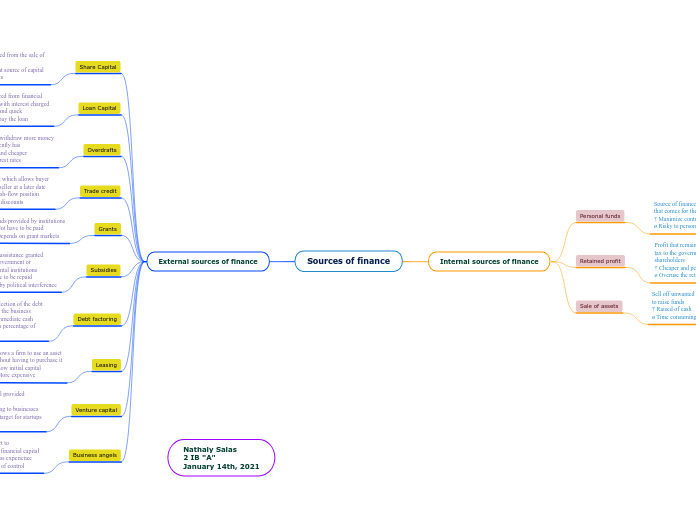

Sources of finance

Internal sources of finance

Personal funds

Source of finance for sole traders

that comes for their own personal savings

† Maximize control over the business

ø Risky to personal savings

Retained profit

Profit that remains after a business has paid

tax to the government and dividends to

shareholders

† Cheaper and permanent

ø Overuse the retained profit

Sale of assets

Sell off unwanted and unused assets

to raise funds

† Raised of cash

ø Time consuming to find a buyer

External sources of finance

Share Capital

Money raised from the sale of

shares

† Permanent source of capital

ø Pay profits

Loan Capital

Money sourced from financial

institutions, with interest charged

† Accesible and quick

ø Failure to pay the loan

Overdrafts

A firm can withdraw more money

thanit currently has

† Flexible and cheaper

ø High interest rates

Trade credit

Agreement which allows buyer

to pay the seller at a later date

† Better cash-flow position

ø Lose out discounts

Grants

Funds provided by institutions

† Not have to be paid

ø Depends on grant markets

Subsidies

Financial assistance granted

by both government or

governmental institutions

† Not have to be repaid

ø Marred by political interference

Debt factoring

The collection of the debt

owed to the business

† Get immediate cash

ø Lose a percentage of

profits

Leasing

Allows a firm to use an asset

without having to purchase it

† Low initial capital

ø More expensive

Venture capital

Financial capital provided

by investors

† Provide funding to businesses

ø Highly profit target for startups

businesses

Business angels

Provide and support to

entrepreneurs with financial capital

† Help with business experience

ø Assume a degree of control