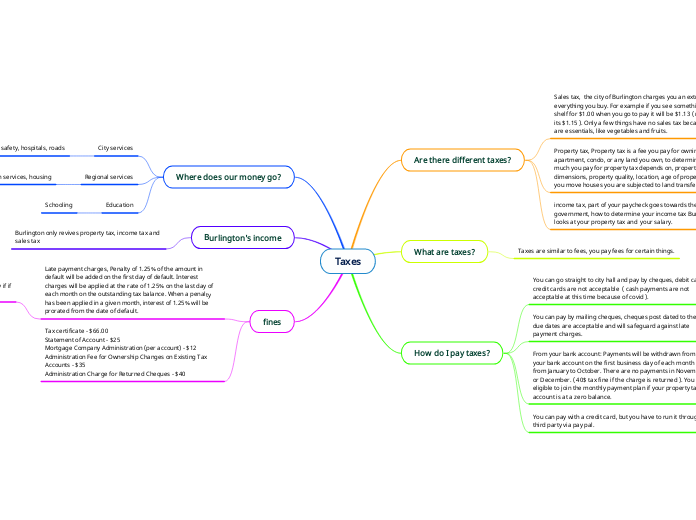

Taxes

Are there different taxes?

Sales tax, the city of Burlington charges you an extra 13% for everything you buy. For example if you see something on the shelf for $1.00 when you go to pay it will be $1.13 ( rounded up its $1.15 ). Only a few things have no sales tax because they are essentials, like vegetables and fruits.

Property tax, Property tax is a fee you pay for owning a house, apartment, condo, or any land you own, to determine how much you pay for property tax depends on, property dimensions, property quality, location, age of property. When you move houses you are subjected to land transfer tax.

income tax, part of your paycheck goes towards the municipal government, how to determine your income tax Burlington looks at your property tax and your salary.

What are taxes?

Taxes are similar to fees, you pay fees for certain things.

How do I pay taxes?

You can go straight to city hall and pay by cheques, debit card, credit cards are not acceptable ( cash payments are not acceptable at this time because of covid ).

You can pay by mailing cheques, cheques post dated to the due dates are acceptable and will safeguard against late payment charges.

From your bank account: Payments will be withdrawn from your bank account on the first business day of each month from January to October. There are no payments in November or December. ( 40$ tax fine if the charge is returned ). You are eligible to join the monthly payment plan if your property tax account is at a zero balance.

You can pay with a credit card, but you have to run it through a third party via pay pal.

Where does our money go?

City services

public safety, hospitals, roads

Regional services

police, children services, housing

Burlington should put more money towards transit,

the population is only gonna grow, everything in general needs to improve.

Education

Schooling

Burlington's income

Burlington only revives property tax, income tax and

sales tax

fines

Late payment charges, Penalty of 1.25% of the amount in default will be added on the first day of default. Interest charges will be applied at the rate of 1.25% on the last day of each month on the outstanding tax balance. When a penalty has been applied in a given month, interest of 1.25% will be prorated from the date of default.

late charges are reasonable, burlington needs their money if if you dont pay you get a punsihment

Tax certificate - $66.00

Statement of Account - $25

Mortgage Company Administration (per account) - $12

Administration Fee for Ownership Changes on Existing Tax Accounts - $35

Administration Charge for Returned Cheques - $40