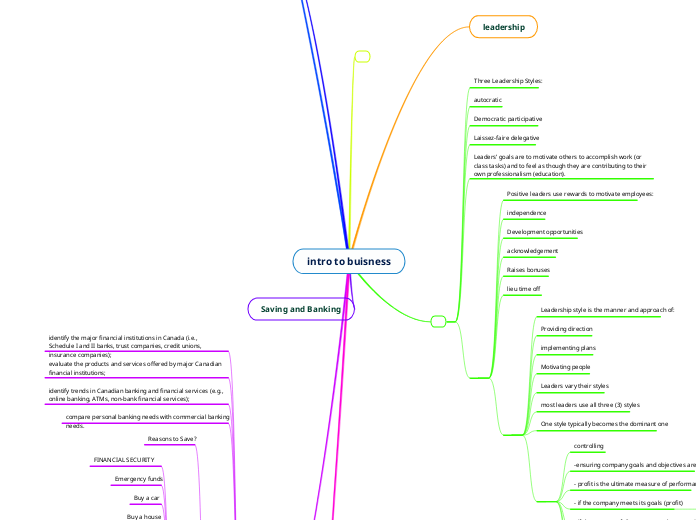

intro to buisness

leadership

Three Leadership Styles:

autocratic

Democratic participative

Laissez-faire delegative

Leaders’ goals are to motivate others to accomplish work (or class tasks) and to feel as though they are contributing to their own professionalism (education).

Positive leaders use rewards to motivate employees:

independence

Development opportunities

acknowledgement

Raises bonuses

lieu time off

Leadership style is the manner and approach of:

Providing direction

implementing plans

Motivating people

Leaders vary their styles

most leaders use all three (3) styles

One style typically becomes the dominant one

controlling

-ensuring company goals and objectives are met

- profit is the ultimate measure of performance

- if the company meets its goals (profit)

- Management’s role is to duplicate it

- if the company fails to meet goals

- Management’s role is to determine why?

This process is known as evaluation

makerting

goods or services to satisfy consumer needs and wants

Marketing is the process that connects suppliers with end users

brand name: a word, or group of words, to distinguish a

businesses product from its competitors)

logo / trademark: a business combines their name with a

special symbol

The Marketing Mix- 4 P’s

Product

Place

Price

Promotion

Retail stores provide value to the products they sell

Delivery

Installation

Extended warranties

Alterations

Advice

Carry outs

Gift wrapping

When establishing price, considerations

need to be given to the unit cost price, marketing costs and distribution expenses.

Increased Selection

Alternative Choices – i.e. bad service

Better prices

Increased productivity

Product improvements

Technology advancements

Saving and Banking

identify the major financial institutions in Canada (i.e., Schedule I and II banks, trust companies, credit unions, insurance companies);

evaluate the products and services offered by major Canadian financial institutions;

identify trends in Canadian banking and financial services (e.g., online banking, ATMs, non-bank financial services);

compare personal banking needs with commercial banking needs.

Reasons to Save?

FINANCIAL SECURITY

Emergency funds

Buy a car

Buy a house

Pay for your kids to go to school

Retirement

Where to Open an Account

You can open an account at any of these financial institutions. They provide the same kinds of banking services for chequing and savings accounts, but they are run differently:

Banks and trust companies – make money for the people who own their

shares.

Credit unions – owned and run by the members who bank there. They

may charge a refundable membership fee to join.

Each of the three has its own unique features and services but they all provide regular banking services including:

chequing and savings accounts,

Safety deposit box rental

Saving bonds

loans

Mortgages

Credit

Deciding on which financial institution and which type of account you need is based on the services you want to have available to you and the amount of money you are willing to pay in fees or interest in order to have those services.

Chequing and Savings

Savings and chequing accounts are safe places

to put money you plan to spend soon:

Saving accounts – allow you to set money aside

for emergencies, save for a large purchase or

build funds for your education – while keeping

your money readily accessible.

Chequing accounts – for money that you plan to use for a day to day spending or to pay bills