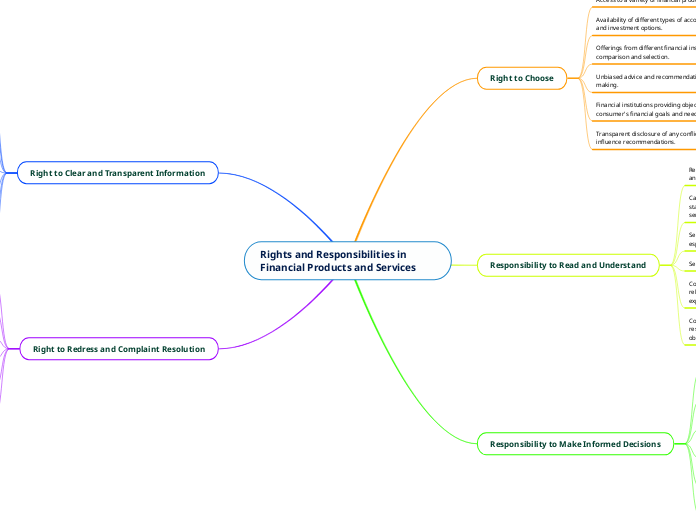

Rights and Responsibilities in Financial Products and Services

Right to Choose

Access to a variety of financial products and services.

Availability of different types of accounts, loans, credit cards, and investment options.

Offerings from different financial institutions, allowing for comparison and selection.

Unbiased advice and recommendations to assist in decision making.

Financial institutions providing objective guidance based on the consumer's financial goals and needs.

Transparent disclosure of any conflicts of interest that may influence recommendations.

Responsibility to Read and Understand

Read and comprehend the terms and conditions, contracts, and documents.

Carefully review agreements, contracts, and disclosure statements before entering into any financial product or service.

Seek professional advice or clarification when necessary, especially for complex products or unfamiliar terms.

Seek clarification and ask questions when necessary.

Contact the financial institution's customer service or relationship manager to obtain further information or explanations.

Consult the financial institution's website or educational resources to better understand product features and obligations.

Responsibility to Make Informed Decisions

Consider personal financial situation, goals, and risk tolerance.

Assess individual income, expenses, and savings goals to determine suitability for a particular product or service.

Evaluate risk appetite and willingness to invest in higher-risk products

Evaluate benefits, risks, and costs associated with the product or service.

Compare interest rates, fees, and features of different products to assess their potential benefits and drawbacks

Understand the impact of costs, such as management fees or transaction fees, on investment returns.

Right to Clear and Transparent Information

Clear and accurate information about fees, interest rates, and terms and conditions.

Itemized breakdown of fees and charges.

Disclosure of interest rates, including any variable rates or promotional rates.

Detailed explanation of terms and conditions, including any potential penalties or limitations.

Understandable explanations of risks associated with the financial product or service.

Description of potential risks, such as market fluctuations or credit risks.

Information on how risks may affect the consumer's financial situation.

Right to Redress and Complaint Resolution

Access to a complaint resolution process in case of issues.

Contact information for filing complaints with the financial institution or relevant regulatory bodies.

Clear explanation of the steps involved in the complaint resolution process.

Availability of dispute resolution mechanisms.

Access to external bodies or ombudsman services for impartial resolution of disputes.

Mediation or arbitration options to address conflicts and seek fair outcomes.