door Tedla Tyndall 5 jaren geleden

227

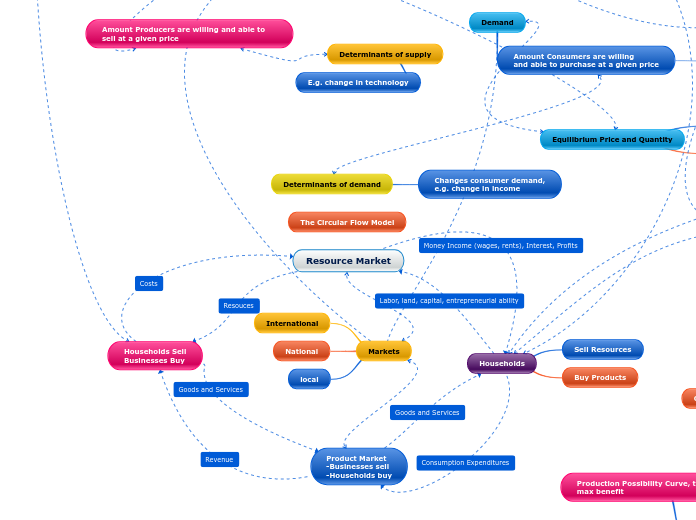

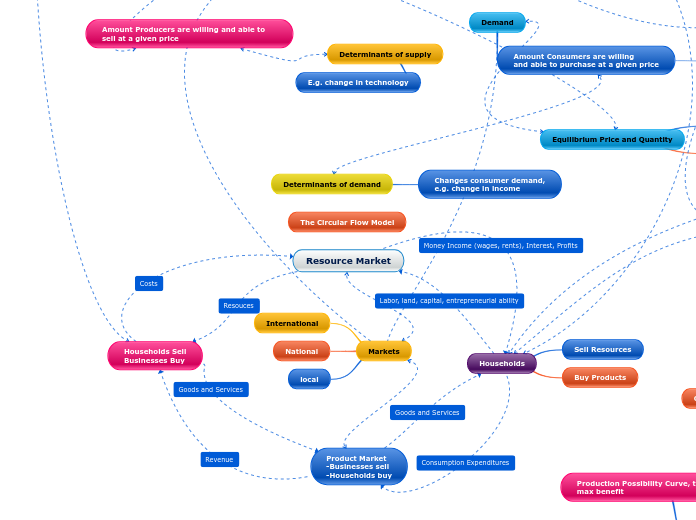

Resource Market

door Tedla Tyndall 5 jaren geleden

227

Meer zoals dit

Lowers with recession

Fed Gov't begins Fiscal SPending

As G decreases, AD decreases

As G increases, AD increase

Federal Reserve lowers interest rate

Multiplier effect

money supply shrinks and interest increases

investment spending decreases, AD decreases

Inflation decreases

this increases the money supply, interest rate falls

investment spending increases, AD increases, GDP increases

creates surplus

For demand-pull inflation

Creates deficit

for use in recessions