Ch 3 - Mktg Mix for Fin Serv

Characteristics of Services

HETEROGENEITY

-Service quality depends on who provides it, when, where & how

-Services are not standardized. The sources of variability was due to:-

i) Customers are different from each other

ii) Customers have different needs

INTANGIBILITY

-Services cannot be touched or seen

-A service may have some tangible representations like: cheque book covers, bank statements, plastic cards.

-Different services also present a different level of risk to the customer.

PERISHABILITY

-Services cannot be stored. (e.g. time when sales persons are not serving customers cannot be utilized to expand service at peak periods.)

-Demand for services fluctuates from day to day, week to week, month to month, especially for branches in tourist areas.

INSEPARABILITY

-Consumption & production of service take place at the same time

-Services are frequently created at the time they are used, unlike the tangible products, which must be produced before they can be sold to customers.

-

Distinctive Characteristics of Services

1.Service are performances

2.Customers are involved in the production process of services

3.4.People as part of the service product

Quality of service is difficult

5.Harder for customers to evaluate service quality before hand (suggestion box)

6.No inventory for services

7.Time factor is important since value of service depends on possibility to match customer’s time & service offers

8.Non-traditional distribution channel: Distribution of service implies distribution of production facilities (branches/ATM)

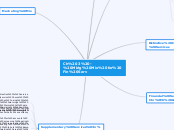

Financial Services Satisfy

6 Generic Needs

Need for money

“Loans”

Need to earn a return on money

“Saving & Investments”

Need to manage risk

“Insurance”

Need for advice or expertise

“Comment on Appropriate

Strategy”

Need for information

“Appraisal of

Market Situation”

Need to move money

“Money Transmission”

Influences on distribution strategy

CUSTOMERS’ PREFERENCES: Customers are now increasingly seeking greater control & greater convenience in receiving fin. Services. Services transactions need to be more transparent to meet the control requirement of customers & a huge number of new distribution methods.

Eg:Long-hours banking & telebanking have been develop to give more convenience to customers.

TECHNOLOGY: the application of technology in fin. Service delivery allows improvement of the bank distribution system’s productivity, enlarge the geographical & timing availability of services offered & generates more convenience for the service user.

Eg: Today, many insurance companies, credit card companies & banks provide customer service around the clock thanks to the development of computer & telecommunications technology.

COMPETITION: The way fin. Services is distributed by competition usually contributes to the change in the buying behavior of customers.

Eg: When certain insurance companies started providing their services at home beyond normal office hours, other companies were forced to follow suit.

Marketing Mix

Product:main aspects of the environment that particularly influence “PRODUCT STRATEGY”:

I) CONSUMERS

II) COMPETITORS

III) GOVN,LEGISLATION & POLITICAL CHANGES

Price:basic influences as follows:

i) COSTS

ii) CUSTOMERS SETS

iii) COMPETITORS

iv) CONSTRAINTS

Place:

-Was done primarily through establishment of “full service bank branches”.

-However not always feasible nowdays because of their high “cost of operation”.

-banks have employed advanced technology in delivery of banking services such as ATMs, & EFTPOS.

Promotion:Promotion involves efforts by an organisation to communicate with its customers to build image & reputation, differentiate it from competition, attract customers & educate them about its service products”.

-PROMOTION MIX inclusive several elements such as:

i) Advertising (TV, radio, movies, newspapers)

ii) Personal selling (sales presentations, telemarketing,

meetings)

iii)Sales Promotion (contests, coupons, rebates, gifts)

iv) Public relations (speeches,reports,media publication)

Process:

-Most financial services tend to be intangible in nature.

-Important in providing customers “PHYSICAL EVIDENCE” about the quality of a distributions systems.

-They provide tangible cues to let customers evaluate the services of the provider.

People:

-A critical component on providing financial services.

-Customer’s evaluation of the financial services organisation depends upon his/her interactions with the customer-contact people

Physical Evidence:form of facilities & equipment & other tangible cues become important determinants of quality perceived by customers.

-Customers attempt to evaluate intangible services by examining tangible evidence. (in the form of modern & appealing)

Supplementary Services

"ICOHSEBP"

I=INFORMATION: Direction to service site, schedules/service hours, prices, instructions on using the service, reminders, warnings, conditions & terms of sale, notifications of change, summaries of account activity, receipts, etc.

C=CONSULTATION: Advising, auditing, personal counseling, training, management or technical consultancy

O=ORDER-TAKING: Applications for accounts, loans, etc., screening applications, appointments, reservations, etc.

H=HOSPITALITY: Greeting, food & beverages, toilets & washrooms, waiting area, security & transportation

S=SAFEKEEPING: Caring for customers’ possessions, parking facilities, safe deposits, etc

E=EXCEPTIONS: Special requests (deviations from standard operating procedures), complaints, compliments, suggestions, problem solving, guarantees, restitution, etc.

B=BILLING: Periodic statements of account activity, invoices, verbal statements of amount due, etc.

P=PAYMENT FOR SERVICE: Self-service, check handling, automatic deduction from financial deposits, etc