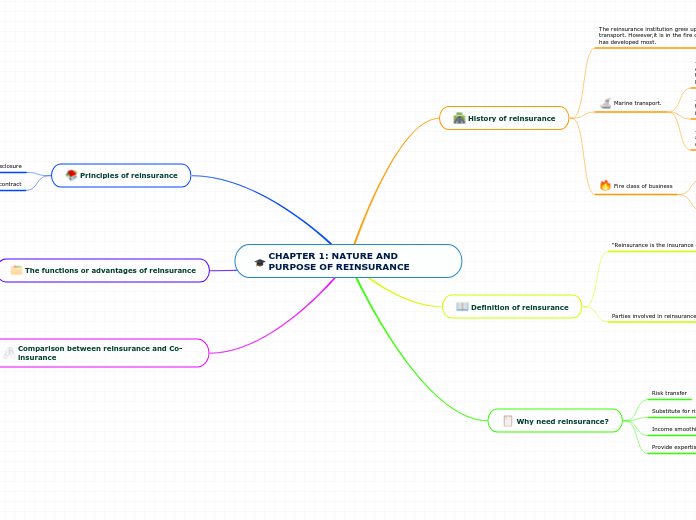

CHAPTER 1: NATURE AND PURPOSE OF REINSURANCE

History of reinsurance

The reinsurance institution grew up mainly in marine transport. However,it is in the fire class of business where it has developed most.

Marine transport.

-The first known reinsurance contract, written in Latin, was effected in Genoa in July 1370. It concerned a cargo that was to be carried by sea from Cadiz (in Spain) to Sluis (in Flanders) and was insured.

-Because of the dangerous nature of voyage, the insurer transferred most of the risk to a second insurer, who accepted it.

-It is shows a true reinsurance practise between the insurer and reinsurer, without the owner of the cargo having any contractual relationship with the reinsurer.

Fire class of business

-The development of the fire reinsurance in the 2nd of the 19th century.

-Rapid development of reinsurance was also due to major fires in New York (1835), Germany (Memel,1854), Switzerland (Glarus,1862) and England (Tooley Sreete Fire, 1861).

Definition of reinsurance

“Reinsurance is the insurance of the risk borne by the insurer"

Parties involved in reinsurance:

Direct insurers

Lloyd's

Administration

Retrocessionaires

Reinsurance broker

Why need reinsurance?

Risk transfer

Substitute for risk capital

Income smoothing

Provide expertise to cedents

Principles of reinsurance

Duty of disclosure

Privity of contract

The functions or advantages of reinsurance

Capacity

Financing

Stabilization of loss experience

Catastrophe protection

Underwriting assistance

Ease of entry or exit from a territory or a class of business

Comparison between reinsurance and Co-insurance

Reinsurance

Co-insurance