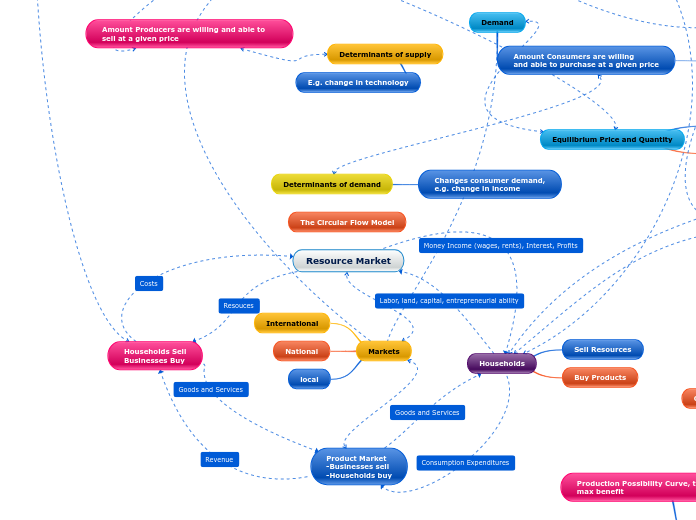

Resource Market

Opportunity Cost

Utility at the cost of other utility

Utility=Happiness

Marginal Analysis

How we Maximize Utility on the Margin

Marginal Benefit

Marginal Cost

Law of increasing opportunity costs

Households Sell

Businesses Buy

Households

Sell Resources

Buy Products

Product Market

-Businesses sell

-Households buy

The Circular Flow Model

Markets

International

National

local

Demand

Amount Consumers are willing

and able to purchase at a given price

Law of diminishing marginal utility

Supply

Determinants of demand

Changes consumer demand,

e.g. change in income

Amount Producers are willing and able to sell at a given price

Determinants of supply

E.g. change in technology

Equilibrium Price and Quantity

Price floors

Surplus=Qs-Qd

Price Ceilings

Shortage=Qd-Qs

The Government

Fiscal Policy

Changes in taxes

Changes in Government Spending

Designed for

encouraging growth in the economy

controlling inflation

encouraging full-employment

Expansionary policy

Decreases taxes, increases spending

for use in recessions

Creates deficit

Contractionary Policy

Increases taxes, decreases spending

For demand-pull inflation

creates surplus

Problems

Recognition Lag

Administrative Lag

Operational lag

political cylces/interests

Government Debt/Surplus

The Federal Reserve

Manages inflation

Prints Money

Sets Reserve Requirement

Lends money to banks

Manages interest rates

Scarcity

Economizing Problem= limited income, unlimted wants

Wants always exceed production

There is no Free Lunch

Choice must be made

Production Possibility Curve, to determine max benefit

PPC increase with international Trade

GDP

Nation's aggregate output

Expenditure Approach

GDP=C+Ig+G+Xn

Income Approach

GDP gap= Actual GDP-Potential GDP

Net Domestic Product

National Income

Personal Income

Disposable income

Household Spending

Inflation

=General rise in Price Level

Consumer Price Index

CPI goes down as inflation goes up

Cost-Push and Demand Pull Driven

Business Cycle

Prices "Sticky" Downwards

In Recessions, leads to unemployment

Peak

Recession

Unemployment

Unemployment rate

=unemployed/labor forcex100

three types

Structural

Frictional

Cyclical

Trough

Expansion

Monetary Policy

Open Market Operations

Buying and selling bonds

Influences money supply

When fed sells securities, commercial bank reserves are reduced

Repos and reverse repos

Reserve Ration

Multiplier

Discount Rate

Last case scenario

Interest on Reserves

Expansionary Monetary Policy

Feds Buy Bonds, lower the interest ratio, decrease the discount rate, etc.

increases excess in reserves, decreases the funds rate

this increases the money supply, interest rate falls

investment spending increases, AD increases, GDP increases

Restrictive Monetary Policy

Feds sell Bonds, increase the reserve ratio, increase the discount rate, etc.

excess funds rate increases, reserves decrease

money supply shrinks and interest increases

investment spending decreases, AD decreases

Inflation decreases

Federal reserve Banks

Commercial Banks

Thrift Institutions

The Public

Money

Functions of Money

Money is Liquid

Store of Value

Unit of Account

Used to buy and sell goods

M1

Currency

Checkable Deposits

M2

M1

near monies

MMDAs

MMMFs

Small denominated time deposits

Interest Rates

Demand for Money

Inversely related to bond prices

Trade

Comparative advantage

Terms of trade

Case for Trade

Prices for consumers go down

Standard of living increases

more products available for consumers

Resource Endowment

Labor-intensive

Land intensive

Capital intensive

Trade agreements

EU

WTO

NAFTA

GATT

Tariffs

Revenue tariff

protective tariff

Decreases consumption

Import Quotas

places a hard limit on incoming imports

World Price

WP>Domestic, Export

WP<Domestic, Import

Aggregate Supply (AS)

Total real output produced at each price level

changed via changes in production costs, productivity, etc.

Aggregate Demand (AD)

Real GDP desired at each price level

Determinants of aggregate Demand

Changes in C,I,G,Xn

Multiplier effect

Lowers with recession

Federal Reserve lowers interest rate

Fed Gov't begins Fiscal SPending

As G increases, AD increase

As G decreases, AD decreases