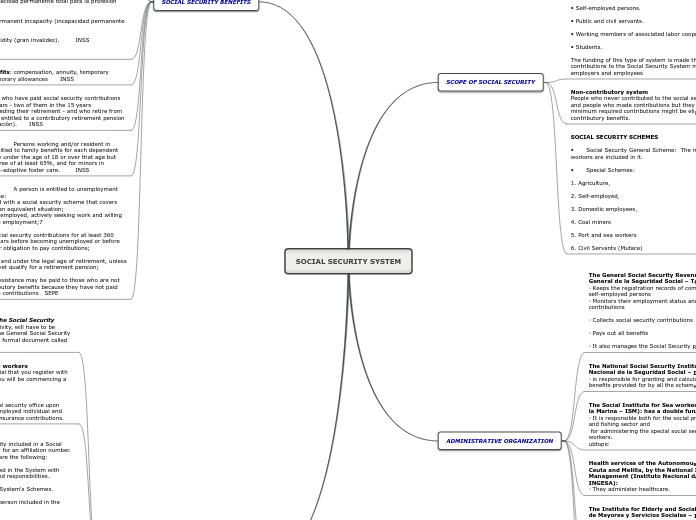

SOCIAL SECURITY SYSTEM

SCOPE OF SOCIAL SECURITY

Contributory system

In most of the cases, to receive benefits from the social security system there is a need to pay contributions for a minimum period.

The protection under the Social Security System covers everyone who develops a professional activity and their relatives.

We include under the contributory system all Spanish and foreign people that are under a legal situation in Spain and do any of the following activities:

• Employed persons.

• Self-employed persons.

• Public and civil servants.

• Working members of associated labor cooperatives.

• Students.

The funding of this type of system is made through the contributions to the Social Security System made by employers and employees

Non-contributory system

People who never contributed to the social security system and people who made contributions but they didn´t reach the minimum required contributions might be eligible for non-contributory benefits.

SOCIAL SECURITY SCHEMES

• Social Security General Scheme: The majority of the workers are included in it.

• Special Schemes:

1. Agriculture,

2. Self-employed,

3. Domestic employees,

4. Coal miners

5. Port and sea workers

6. Civil Servants (Muface)

ADMINISTRATIVE ORGANIZATION

The General Social Security Revenue Office (Tesorería General de la Seguridad Social – TGSS):

◦ Keeps the registration records of companies, employees and self-employed persons

◦ Monitors their employment status and social security contributions

◦ Collects social security contributions

◦ Pays out all benefits

◦ It also manages the Social Security Reserve Fund.

The National Social Security Institute (Instituto Nacional de la Seguridad Social – INSS):

◦ is responsible for granting and calculating all the cash benefits provided for by all the schemes.

The Social Institute for Sea workers (Instituto Social de la Marina – ISM): has a double function,

◦ It is responsible both for the social problems of the maritime and fishing sector and

for administering the special social security scheme for sea workers.

ubtopic

Health services of the Autonomous Communities and, in Ceuta and Melilla, by the National Institute for Health Management (Instituto Nacional de Gestion Sanitaria – INGESA):

◦ They administer healthcare.

The Institute for Elderly and Social Services (Instituto de Mayores y Servicios Sociales – IMSERSO): administers, with the Autonomous Communities,

◦ Pensions paid under the non-contributory system

◦ Benefits for the elderly and the disabled and related social services

◦ It also administers long-term care schemes.

The State Public Employment Service (Servicio Público de Empleo Estatal – SPEE):

◦ Administers and checks unemployment benefits

◦ It is also responsible for developing employment policies, in co-operation with the Autonomous Communities, through the employment offices (Oficinas de Empleo).

SOCIAL SECURITY BENEFITS

Temporary incapacity, Sickness and accident Healthcare (Asistencia sanitaria)

• Temporary incapacity

You may be entitled to sickness cash benefit if contributions for a total of 180 days within the five preceding years have been paid.

Occupational disease and accident: No minimum contribution period required INGESA

MUTUAS AT

COMPANIES

Maternity and paternity benefits Healthcare (Asistencia sanitaria)

• Maternity benefits are paid to all registered workers who are entitled to the maternity leave prescribed by labour legislation for the birth, adoption or fostering of a child. To be eligible for contributory Maternity Allowance (subsidio por maternidad de naturaleza contributiva) or Paternity Allowance (subsidio por paternidad), an insured person has to have collected at least

• 180 contribution days in the seven years immediately preceding the birth of the child (or, in case of adoption or foster care placement, immediately preceding the date of the administrative/judicial decision); or

• 360 contribution days during the entire working life.

Special provisions govern the situation of workers under 26 years of age, only in case of maternity. INGESA

Permanent incapacity: In case of partial permanent incapacity to perform your normal occupation, the benefit is a lump-sum compensation , it depends on depends on the level of incapacity:

• partial permanent incapacity to perform your normal occupation (incapacidad permanente parcial para la profesión habitual)

• total permanent incapacity to perform your normal occupation (incapacidad permanente total para la profesión habitual).

• absolute permanent incapacity (incapacidad permanente absoluta).

• severe invalidity (gran invalidez). INSS

MUTUAS

Survivors’ benefits: compensation, annuity, temporary pension and temporary allowances INSS

Old-age:Persons who have paid social security contributions for at least 15 years - two of them in the 15 years immediately preceding their retirement - and who retire from employment, are entitled to a contributory retirement pension (pensión de jubilación). INSS

Family benefits Persons working and/or resident in Spain may be entitled to family benefits for each dependent child of the family under the age of 18 or over that age but disabled to a degree of at least 65%, and for minors in permanent or pre-adoptive foster care. INSS

Unemployment A person is entitled to unemployment benefit if he or she:

• is registered with a social security scheme that covers this risk, or is in an equivalent situation;

• is legally unemployed, actively seeking work and willing to accept suitable employment;7

• has paid social security contributions for at least 360 days in the six years before becoming unemployed or before the end of his/her obligation to pay contributions;

• is above 16 and under the legal age of retirement, unless he/she does not yet qualify for a retirement pension;

Unemployment assistance may be paid to those who are not entitled to contributory benefits because they have not paid enough insurance contributions SEPE

COMPANY’S SOCIAL SECURITY OBLIGATIONS

Registration of the company in the Social Security

The company, before starting its activity, will have to be registered into Provincial Office of the General Social Security Revenue Office. It is done through a formal document called TA.6.

Registration OF SELF-EMPLOYED workers

Before you start trading, it is essential that you register with the tax office to inform them that you will be commencing a business activity.

You must also register with the social security office upon commencement of trade as a self-employed individual and start paying your monthly national insurance contributions.

Affiliation of workers

Any person who begins a work activity included in a Social Security System scheme must apply for an affiliation number.

The characteristics of the affiliation are the following:

• It is required for people included in the System with regard to contributory type rights and responsibilities.

• It is unique and covers all the System's Schemes.

• It covers the entire life of the person included in the System.

• It is exclusive.

Concept of affiliation, termination of affiliation, and data change

Affiliations are administrative acts that constitute the Social Security legal relationship.

Termination is an administrative act that ends the Social Security legal relationship.

Variations are administrative acts by which modifications to identification, address or employment data on the affiliated workers are communicated to the Social Security System.

Registration, deregistration and changes in data must be reported to Social Security to let them know when an employee begins working, when they cease to work and when there are any changes to the personal and employment data of workers affiliated to Social Security.

The employer is required to request registration or deregistration and to report any changes to their employees' data.

Social security contribution

It is the action whereby responsible individuals contribute financial resources to the Social Security System by virtue of being included in said System because of exercising a labour activity.

The Social Security System also receives contributions that are used to finance the system.

Thus, contributions are the payments to the Social Security to provide economic resources to the system.

RED SYSTEM

RED System (ON-LINE Automatic Data Transfer System), a service whereby it is possible to complete official procedures and exchange information and documents related to contribution, affiliation and submission of registration and de-registration forms on temporary disability benefits.