Examples of

source documents

Kept on file for proof that a

transaction occured

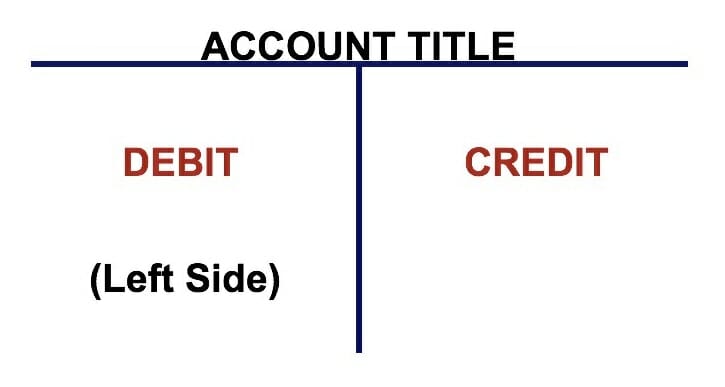

Always on the

RIGHT

Always on the

LEFT

For complete satisfaction,

balance all of your transactions!

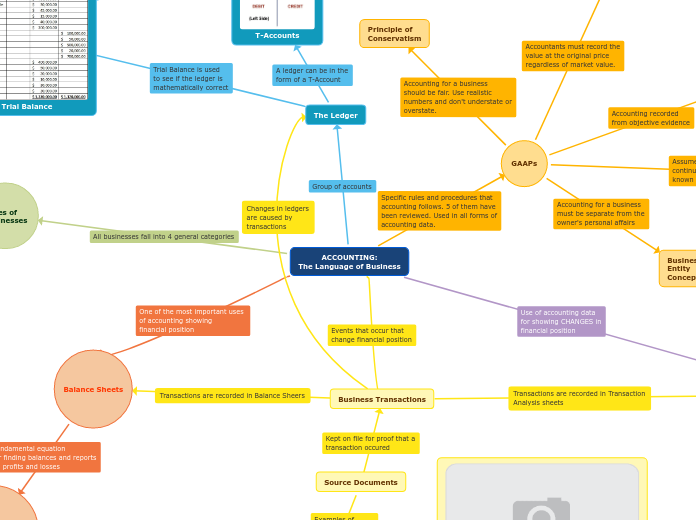

Trial Balance is used

to see if the ledger is

mathematically correct

A ledger can be in the

form of a T-Account

Accounting for a business

should be fair. Use realistic

numbers and don't understate or

overstate.

Accounting recorded

from objective evidence

Accountants must record the

value at the original price

regardless of market value.

Assumes a business will

continue to operate unless

known it will not.

Accounting for a business

must be separate from the

owner's personal affairs

Things that directly

affect OE

Examples of Liabilities

Examples of Assets

The "OE" of the equation.

What the ownership claims on total assets.

What remains after all liabilities are paid off

The "L" of the equation.

Debts and obligations that

the business owes.

The "A" of the equation.

Resources owned by a business.

Things of value used in carrying out

activities.

Fundamental equation

for finding balances and reports

on profits and losses

Business which is an individual in the eyes of the law

Unincorporated business owned by more than one individual

Unincorporated business owned by a single person

Holds activities for social benefit, not profit

Buys manufacturers items and resells them at a higher price

Combines effort + material to make a new product

Sells effort not resulting in material items

Events that occur that

change financial position

Group of accounts

Use of accounting data

for showing CHANGES in

financial position

Specific rules and procedures that

accounting follows. 5 of them have

been reviewed. Used in all forms of

accounting data.

One of the most important uses

of accounting showing

financial position

All businesses fall into 4 general categories

Total debits must

equal total credits

Transactions are recorded in Transaction

Analysis sheets

Transactions are recorded in Balance Sheers

Equation is vital when completing a

Transaction Analysis sheet

Changes in ledgers

are caused by

transactions