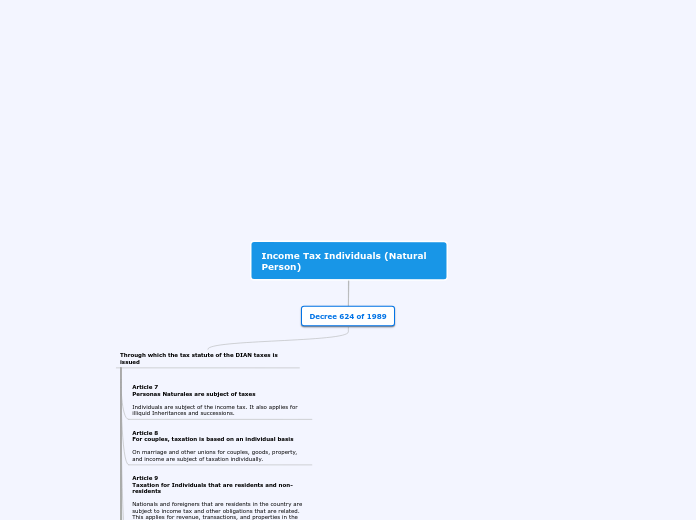

Income Tax Individuals (Natural Person)

Decree 624 of 1989

Through which the tax statute of the DIAN taxes is issued

Article 7

Personas Naturales are subject of taxes

Individuals are subject of the income tax. It also applies for illiquid Inheritances and successions.

Article 8

For couples, taxation is based on an individual basis

On marriage and other unions for couples, goods, property, and income are subject of taxation individually.

Article 9

Taxation for Individuals that are residents and non-residents

Nationals and foreigners that are residents in the country are subject to income tax and other obligations that are related. This applies for revenue, transactions, and properties in the country and in other countries.

Individuals that are not residents in the country, will only have to declare income and other obligations in Colombia, only they will be taxed for the income and ocassional income in the country.

The article 10th was modified by 198 law 1607 of 2012

Article 10

Residence for fiscal purposes

One person is regarded as a Colombian resident when meets any of these conditions:

- Stay during 183 days (A little bit more than 6 months). We must include the entry and exit days. This should happen during 350 calendar days, which means during one year. When the person stays more than one year, this person would be regarded as Colombian resident from the second year.

- Be a diplomatic or work representing the country internationally.

- Be a National Citizen during the fiscal year and:

1. Be married or related to individuals with a fiscal residence in Colombia.

2. Get 50% or more of the revenue from the Colombia.

3. Have 50% or more of the properties in the Colombia.

4. 50% or more of the total assets in the country.*

5. Have a requirement from the fiscal administration.

Being a resident in a territory qualified as a tax haven or paradise

However, If an individual demonstrates that the source of revenue, properties, and assets are located in the country with a residential address in more than 50%, it will not be considered as a fiscal resident

Article 103:

Definition (Income from work and employment)

Are considered labor income when individuals receive a payment as salaries, commissions, remuneration, fees, social security, expenses and any payment for performing services.

Note

This is related to "cooperativas de trabajo and in normal cases would not apply to us.

Article 119

Deductions for interest over loans and mortgages for living homes.

The interest that are generated with the loan got to buy a house, as long as it is garanteed as a morgage and the tax payer is not survailled by the State. The interests can be deducted.

Vocabulary

Unidad de unidad real

Unidad de poder adquisitivo constante

Article 206

Revenue and income exemptions from Labor

All payments or transfers from a legal relation of work and labor are subject of taxation, with the following exceptions:

- Compensations from a work-related accident or illness

- Compensations from maternity protection

- Funeral and other related payments.

- Temporary layoff allowance when the person gets (in average over the last 6 months) less than 350 UVT. In case that the person get in average per month more tha 350 UVTs, this will be the non-taxable base percentage.

350 UVT to 410 UVT 90%

410 UVT to 470 UVT 80%

470 UVT to 530 UVT 60%

530 UVT yo 590 UVT 40%

590 UVT to 650 UVT 20%

650 UVT or more 0%

- Payments no higher than 1000 UVT of the monthly contribution to the retirement account.

- Death insurance and compensation for military and police officers.

- Additional payments for military and police officers

- Representation expenses for University principals and teachers that it can not exceed 50% of the salary. To ask:

9. Los gastos de representación de los rectores y profesores de universidades públicas, los cuales no podrán exceder del cincuenta (50%) de su salario.

****-Modificado- 10. El veinticinco por ciento (25%) del valor total de los pagos laborales, limitada mensualmente a doscientas cuarenta (240) UVT.

El cálculo de esta renta exenta se efectuará una vez se detraiga del valor total de los pagos laborales recibidos por el trabajador, los ingresos no constitutivos de renta, las deducciones y las demás rentas exentas diferentes a la establecida en el presente numeral

PAR 1. La exención prevista en los numerales 1, 2, 3, 4, y 6 de este artículo, opera únicamente sobre los valores que correspondan al mínimo legal de que tratan las normas laborales; el excedente no está exento del impuesto de renta y complementarios.

PAR 2. La exención prevista en el numeral 10o. no se otorgará sobre las cesantías, sobre la porción de los ingresos excluida o exonerada del impuesto de renta por otras disposiciones, ni sobre la parte gravable de las pensiones. La exención del factor prestacional a que se refiere el artículo 18 de la Ley 50 de 1990 queda sustituida por lo previsto en este numeral.

PAR 3. Para tener derecho a la exención consagrada en el numeral 5 de este artículo, el contribuyente debe cumplir los requisitos necesarios para acceder a la pensión, de acuerdo con la Ley 100 de 1993.

-Adicionado- PAR 4. Las rentas exentas establecidas en los numerales 6, 8 Y 9 de este artículo, no estarán sujetas a las limitantes previstas en el numeral 3 del artículo 336 de este Estatuto.

-Adicionado- PAR 5. La exención prevista en el numeral 10 también procede en relación con los honorarios percibidos por personas naturales que presten servicios y que contraten o vinculen por un término inferior a noventa (90) días continuos o discontinuos menos de dos (2) trabajadores o contratistas asociados a la actividad.

Note

The UVT for 2019 costs $34.270

240 UVTs = 8.224.800

1000 UVTs = 34.270.000

Article 241

Tariff for Individuals with fiscal residence, assignations and modal donations

0 UVT to 1,090 UVT / 0% / (0)

>1,090 UVT to 1,700 UVT / 19% / (Income tax base - 1,090 UVT)*19%

>1,700 UVT to 4,100 UVT / 28% / (Income tax base - 1,700 UVT)*28% + 116 UVT

>4,100 UVT to 8670 UVT / 33% / (Income tax base - 4,100 UVT)*33% + 788 UVT

>8,670 UVT to 18,970 UVT / 35% / (Income tax base - 8,670 UVT)*35% + 2,296 UVT

>18,970 UVT to 31,000 UVT / 37% / (Income tax base - 18,970 UVT)*37% + 5,901 UVT

>31,000 UVT / 39% / (Income tax base - 31,000 UVT)*39% + 10,352 UVT

Note

1090 UVTs = 37.354.300

1700 UVTs = 58.259.000

4100 UVTs = 140.507.000

Vocabulary

Asignacion modal: It is a inheritance given with an specific purpose.

Donacion modal: It is a donation given with a specific purpose.

Article 242

Special tariff for earnings and dividends to Individuals with residence

Earnings or dividends from a source that is not considered a subject of income or occasional income, will have an additional tariff for the investor that is a fiscal resident.

0 UVT to 300 UVT / 0% / (0)

>300 UVT / 15% / (earnings or dividends in UVT - 300 UVT)*15%

This tax will be based on withholdings. It will be considered for other similar obligations to reduce the total amount of the withholding.

Article 247

Income Tax Tariff for individuals without a fiscal residence

Considering the aspects of the article 245, individuals without a fiscal residence in Colombia will be subjects of a general tariff of 35%

For foreign teachers and professors that are hired to work on legally recognized colleges and universities for periods of less than 182 days during the fiscal year, it will only apply a general tariff of 7%. It will be withheld when the payment or transaction is issued.

Article 314

For individuals with fiscal residence

General tariff 10%

Article 316

For individuals without fiscal residence

General tariff 10%. It only applies for income gained in the country.

Article 317

Occasional income or revenue from lotteries, bets and similar events

General tariff 20%

TITLE V (it was added by the law 1819 of 2016)

Chapter I :

Determine the Income Tax for Individuals

Article 329:

To determine the income tax for individuals

The income tax for individuals will be established based on the norms and principles of this Title

The norms of this title will consider the principles of Title I.

Article 330

Data based on cells

All the income and revenue that is described on this title has its own classification on cells of information. This information has to be reported independently and based on the rules of Article 26. The result will be Liquid Income.

Any cost, deduction or exemption cannot be applied in more than one cell. It cannot be recognized in two cells at the same time to get a benefit twice.

The classification is based on three major cells

1. Work, labor, capital, and non-working income.

2. Retirement funds and investment

3. Earnings, dividends, and participation

Earnings, dividends, and participation do not permit any related cost or deduction

A loss on a single cell can only be considered for future fiscal periods compensations on the same cell, with the limits and percentages that are established by the norms and regulations.

Article 331

Taxable Liquid Income

To determine the liquid income that is taxable with the tariffs on article 241, the following rules are principles are followed:

The total addition of the liquid income on work, labor, capital, and non-working income cell, and retirement funds cell. The total will be subject of the tariff established in article 241.

A total loss on the cells will no be considered for the addition. In any case, these losses can be used to ask for compensations, according to the article 330 principles.

Paragraph: To the liquid income for earnings, dividends, and participation, the tariff on article 242 will apply

Article 332

Income with exemptions and deductions

Any fiscal benefit or incentive can only be subtracted to the cells with revenue. These benefits or incentives can only be used for a single cell.

Article 333

Presumptive income or revenue

For the principles on article 188 and subsequent articles, the base for the presumptive income is compared with the income on the general cell.

Article 334

Fiscal Control Faculties

To keep control and monitoring of costs and expenses, DIAN will perform control and monitoring programs to verify the fulfillment of all the criteria established on this statute.

Chapter II

Income from work and labor

Article 335

The income of the General Cell

For this title principles the following sources of revenue are considered for the general cell:

From work and labor: As established in article 103.

Income from capital: interests, returns, rentals, royalties, and intellectual property exploitation.

Non-working income: all sources of income that cannot be classified on other cells, except for earnings and occasional income

Article 336

Taxable Liquid Income for the General Cell

To establish the liquid income on the general cell the following rules are followed:

The addition of all concepts of income, except the income from earnings and occasional income.

To the total of the addition, subtract all the revenue that does not constitute income.

To the result, subtract the exemptions and special deductions for each cell. This subtraction cannot exceed 40% or more than 5,040 UVT.

For non-working income and income from capital, it is possible to subtract the costs and expenses that fulfill the general requirements on this statute, and that is directly related to these cells.

Chapter III

Income from Retirement Funds and Savings

Article 337

Income from Retirement Funds

This cell includes all source of income related to a retirement plan. It includes retirement related to the age, disability, survival, risks, compensations, or a return of the retirement savings.

To establish the liquid income, to the total income, subtract the sources of income with exemptions or that are not subject of income. Consider the limitations and principles on this statute, especially the article 206, fifth section.

Chapter VI

Income from Earnings, Dividends and Participations

Article 342

Income from earnings and participation

It is considered for this cell any type of income from earnings, dividends, and participation, and that it can be subject of taxation for the owners, shareholders, and associates, in the case of individuals or inheritances that are fiscal residents. This applies for income from national and foreign entities.

Article 343

Liquid Income

To determine the liquid income, it will be configured by 2 sub-cells:

The first sub-cell will include all the earnings and participation that were distributed based on article 49, third section principles. This sub-cell will be taxable with the first tariff on the article 242 (0%)

The second sub-cell will include all the earnings and participation from the utilities that were estimated according to the second paragraph of article 49. This sub-cell will also include the earnings from foreign entities. This sub-cell will be taxable with the second tariff of the article 242 (15%)