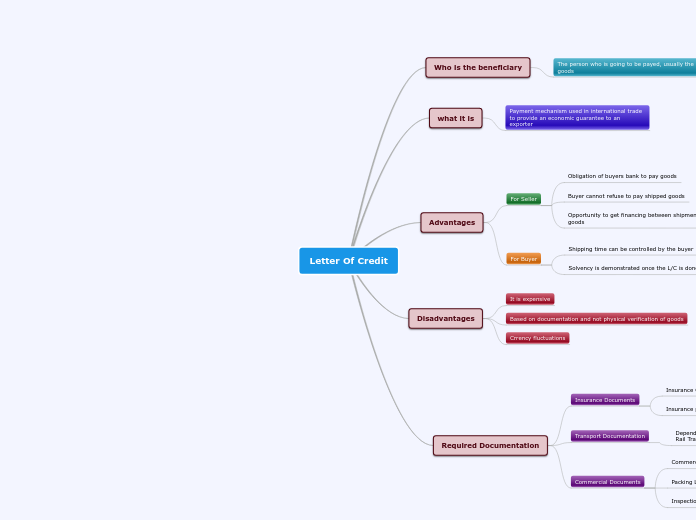

Letter Of Credit

Who is the beneficiary

The person who is going to be payed, usually the seller of goods

what it is

Payment mechanism used in international trade

to provide an economic guarantee to an exporter

Advantages

For Seller

Obligation of buyers bank to pay goods

Buyer cannot refuse to pay shipped goods

Opportunity to get financing between shipment and pyment of goods

For Buyer

Shipping time can be controlled by the buyer

Solvency is demonstrated once the L/C is done

Disadvantages

It is expensive

Based on documentation and not physical verification of goods

Crrency fluctuations

Required Documentation

Insurance Documents

Insurance Certificate

Insurance policy

Transport Documentation

Depending on mean of transport ( Air Waybill, Road Transport, Rail Transport...)

Commercial Documents

Commercial Invoice

Packing List

Inspection Certificate