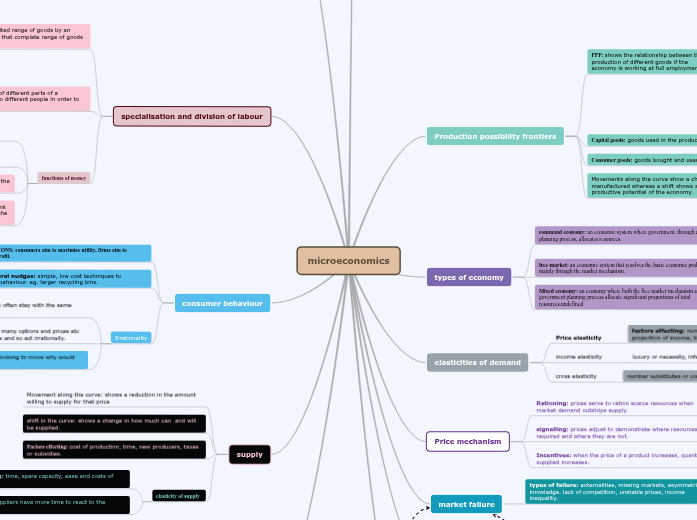

microeconomics

government failure

happens when a government policy fails to create enough of an incentive to change people's behaviour.

types:

political self interest: influenced by political lobbying

poor value for money: low productivity and high waste makes spending less effective.

policy short terminsim:looking for a quick fix

regulatory capture: when government operates in favour of producers

conflicting objectives: one policy may clash with another.

ß

unintended consequences: policies have unanticipated side effects.

Production possibility frontiers

PPF: shows the relationship between the production of different goods if the economy is working at full employment.

Maximum productive potential: shown by the general curve of the PPF.

Opportunity cost: shown when the point of output on the PPF shifts and the point marked in no longer centred and so the amount of one good produced is lower than original.

economic growth or decline: shown by a shift in the PPF either outwards or inwards.

inefficient allocation: the point will be on the inside of the curve.

unobtainable production: a point outside of ppt curve.

Capital goods: goods used in the production of other goods.

Consumer goods: goods bought and used by consumers

Movements along the curve show a change in goods manufactured whereas a shift shows a change in the productive potential of the economy.

types of economy

command economy: an economic system where government, through a planning process, allocates resources.

Karl Marx: presented a criticism of capitalism, believed the capitalists must end up exploiting workers to achieve this objective. he also believed that competition would cause many firms to go bust.

ADVANTAGES: lower inequality of wealth, lower risk.

free-market: an economic system that resolves the basic economic problems mainly through the market mechanism.

Adam Smith: explains that man's selfish desires are for a positive and useful purpose. when individuals pursue their own private interests the economic sphere will be best served.

ADVANTAGES: larger choice, strong incentives for innovation and quality, higher efficiency, better economic growth, greater political freedom.

Mixed economy: an economy where both the free market mechanism and the government planning process allocate significant proportions of total resources.undefined

Friedrich Hayek: believed the resource allocation brought by individuals would be far superior to any state planning system. thought that government should provide food and shelter.

elasticities of demand

Price elasticity

factors effecting: number of substitutes, luxury or necessity, proportion of income, time.

income elasticity

luxury or necessity, inferior or normal good.

cross elasticity

number substitutes or complements, price of substitutes

Price mechanism

Rationing: prices serve to ration scarce resources when market demand outstrips supply.

signalling: prices adjust to demonstrate where resources are required and where they are not.

Incentives: when the price of a product increases, quantity supplied increases.

market failure

types of failure: externalities, missing markets, asymmetric knowledge. lack of competition, unstable prices, income inequality.

Public goods

a good that is non-excludable and non-rivalrous.

poses the "FREE RIDER PROBLEM" where no one is willing to pay for a good as soon as they produce it everyone else can use it too.

a form of market failure as they often aren't produced.

Information gaps:

moral hazard: when the party with superior information alters their behaviour in a way that benefits themselves while imposing costs on those with inferior information eg. insured consumers are more likely to take risks.

adverse selection: most likely to purchase are the most likely to use it. eg. ill people are most likely to purchase health insurance, producers increase the price and price some people out of the market.

asymmetric: where buyers and sellers have different amounts of information.

Imperfect: where buyers or sellers lack information to make an informed decision.

principal agent problem: occurs when the goals of principals, those standing to gain or lose from a decision, are different from agents, those making decisions on half of the principal.

government intervention

minimum price: sets a price floor to ensure incomes for producers and encourages supply.

exploits consumers.

maximum price: sets a price ceiling to ensure consumers are not exploited and maintain demand.

could create a black market due to the excess demand created.

taxes: discourage the production and consumption of particular goods.

unintended consequences, depends on elasticity, ,just be at the right level, regressive effect on lower income groups.

subsidies: encourage the production of particular goods.

other incentives needed? firms may become dependant, extra burden for the taxpayer.

regulation: used to close information gaps etc. limits on CO2 emissions.

advantages: spurs innovation, effective with inelastic goods, can be gradually toughened.

disadvantages: high costs, unintended consequences, cost of meeting regulation can discourage small business.

trade pollution permits: give an incentive to reduce emissions.

advantages: internalises the externality.

disadvantages: how does the government know the optimum level, creating a market that can fail.

state provision of public goods: destroys the free rider problem.

specialisation and division of labour

Specialisation: production of a limited range of goods by an individual or firm with others so that complete range of goods is produced.

DISADVANTAGE: can be monotonous, less motivated, maybe risky due to the size of the market.

ADVANTAGES: increased productivity, cost effective, increased quality, increased output.

division of labour:the assignment of different parts of a manufacturing process or task to different people in order to improve efficiency.

Adam Smith- ten workers could produce 48,000 pins per day if each of eighteen specialised tasks was assigned to particular workers. Average productivity: 4,800 pins per worker per day. But absent the division of labor, a worker would be lucky to produce even one pin per day

functions of money

medium of exchange: used to buy and sell goods. there is no money in a barter economy.

measure of value: acts as a unit of account. high inflation destroys this ability.

store of value: high inflation destroys this ability as money in the future is worth less than in the present.

method of deferred payment: people lend money when they think that when the money comes back they will be able to buy the same goods.

consumer behaviour

ASSUMPTIONS: consumers aim to maximise utility, firms aim to maximise profit.

Behavioural nudges: simple, low cost techniques to influence behaviour. eg. larger recycling bins.

Irrationality

Habit: creatures of familiarity so often stay with the same brands despite better welfare.

Computational difficulties: so many options and prices etc struggle to calculate the best one and so act irrationally.

other people: if others are not looking to move why would you.

supply

Movement along the curve: shows a reduction in the amount willing to supply for that price

shift in the curve: shows a change in how much can and will be supplied.

Factors effecting: cost of production, time, new producers, taxes or subsidies.

elasticity of supply.

factors effecting: time, spare capacity, ease and costs of mobility.

in the long run suppliers have more time to react to the change in price.

taxes and subsidies

taxes increase cost of production, subsidies decrease cost.

Direct tax: a tax directly paid to the government by the taxpayer

indirect tax: a tax on expenditure

excise duties: unit taxes, varies with the volume of goods purchased. eg sugar tax.

Ad valorem tax: tax increases in proportion to the value of the base. eg VAT.

subsidy: money paid by the gov to producers to encourage production.