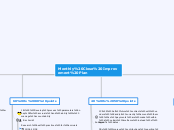

Monthly Close Improvement Plan

100 to 125 points

1A & 4Ai) Close AP within 20 days

Notify LV for consensus

Document new policy

Notify AP staff

Update Floquast with new parameters

AP Close of 20 days complete

3Ai) Develop macro to format data from report download into check register

6Ai) Create Administration Expense Tabulation Macro

1Fiv) Work with YOOZ to create an accrual report

2Ai) Develop program within INTACCT to automate allocation for Hospitality RX LLC.

3Biv) Develop routine and scheduled meetings between CAER and Finance to share issues, best practices, and improvements

Create process of weekly standups with Finance leadership to review FLOQAST and determine status and issues

3Cii) Develop cash management module within INTACCT- Interface between bank and INTACCT

Coordinate with Joe Thomas and Cloudtask

Create file for checks to be produced by USBank

Approve File

Upload file to USBank

60 to 80 points

1Bi) Develop process parameters for accruals and ability to manage accountability

Research best practices for accruals

Document new policy for accruals

Review new policy with Joel and Staff

Run policy by McNell (Auditors)

Finalize policy and send out final document

Accrual Policy Complete

Seyforth Shaw Billing Issues

5Ai) Develop, document, communicate, and enforce clear processes for contributions included end of day balancing.

Document process flows for cash receipts

Review ADS/Vitech reports for appropriateness for balancing

Design the best practice for all cash receipts at the fund including internal controls

1Eii) Turn escalation process back on in YOOZ

Review process with Matthew/ELT

Investigate possibility to add history trail to message for escalation

Update Accounts Payable policy to reflect escalation

Determine effective date and document

Communicate to managers within the fund how the YOOZ escalation process works

1Dii) Educate associates on timeliness of bills and downstream consequences.

1Ei) Educate managers of downstream consequences

6B) Develop process and tools for reporting budget variances (possibly using smartsheets)

40 to 50 points

1Ci) Set future contracts with vendors (and/or currently amend them) so payments are made within a certain timeframe instead of specific dates.

Subtopic

3Bv) Improve contributions reporting from Vitech (PID already submitted)

5Ci) Create report based on posted date to detail any changes made (with original and new transaction numbers) for exception reporting

5Di) Establish cutoff for changes with exceptions only to be approved by director(s)

1Eiii) Include Mgr approvals of invoices into their annual goals

18 to 36 points

1Fii) Improve training and reporting from YOOZ for more appropriate data

1Fiii) Create a dashboard from YOOZ for more appropriate data

3Bii) Develop, document, communicate, and enforce process standardization and documentation for consistency to overcome rework and lack of required feedback from CAER.

3Bii) Develop and rollout metric reporting on errors and rework to overcome rework and lack of required feedback from CAER.

1Fi) Match incoming emails to items in YOOZ to ensure invoices not missing for more appropriate data