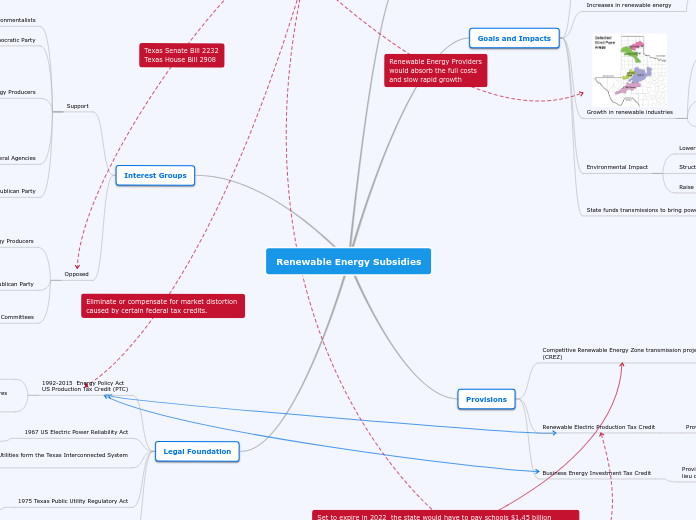

Renewable Energy Subsidies

Goals and Impacts

Increase in energy choices

Market competition

Lower energy bills for customers

Threatens existing energy producers

Loss of Jobs in aging power sources

Creates declining prices for energy

Reduce the incentive to invest in new power plants

Increases in renewable energy

Some renewable energy production is unreliable

Growth in renewable industries

Jobs

Companies involved in installation of generators

Support staff of the energy generators

Construction of transmission line

Income for land owners in the form of leases or royalties

Corporations pay taxes to local economies in the form of property taxes

Environmental Impact

Lower Carbon Dioxide emissions

Structures change the Texas Landscape

Tall structures create "wind shadows"

Raise the surface temperatures of the earth

State funds transmissions to bring power to customers

Provisions

Competitive Renewable Energy Zone transmission project

(CREZ)

1996-2005 3,600 miles of high-voltage transmission lines installed to better connect energy grids

Renewable Electric Production Tax Credit

Provides Tax incentives to Renewable Energy Producers

Chapter 312 abatements exempt all of part of the increase in property value from taxation for as long as a decade

Chapter 313 abatements limit taxes for 10 years for school district maintenance and operations in exchange for property improvements and job creation

Business Energy Investment Tax Credit

Provides businesses with a 30% investment tax credit (ITC) in lieu of the PTC

State Rejects Tax Subsidies for Renewable Energy

Interest Groups

Support

Environmentalists

Sierra Club

Democratic Party

Environmentally minded Legislators

Alternative Energy Producers

Solar

Wind

Hydro

Biomass

Federal Agencies

Environmental Protection Agency

Department of Energy

Republican Party

Rural Legislators

Opposed

Traditional Energy Producers

Oil

Natural Gas

Coal

Republican Party

Fiscally Minded Legislators

Conservative Political Action Committees

Texas Public Policy Foundation

Empower Texans

Legal Foundation

1992-2015 Energy Policy Act

US Production Tax Credit (PTC)

Renewable electricity production tax credit (PTC) is a per-kilowatt-hour (kWh) tax credit

Between 2018 and 2022, under current law, tax expenditures for the renewable electricity PTC are estimated to

be $25.8 billion.

1967 US Electric Power Reliability Act

1968 Creation of North American Energy Reliability Corporation (NERC)

1941 Electric Utilities form the Texas Interconnected System

(TIS)

1970 TIS forms Electric Reliability Council of Texas

(ERCOT) to comply with NERC requirements

2002 ERCOT operates the grid

which connects Texas power producers

1975 Texas Public Utility Regulatory Act

Creation of the Public Utility Commission

(PUC)

1999 PUC oversees competitive retail markets of electricity

2005 Texas Senate Bill 20 PUC in consultation with the ERCOT to designate competitive renewable energy zones (CREZ)

1999 Texas Senate Bill 7

Deregulation of energy market