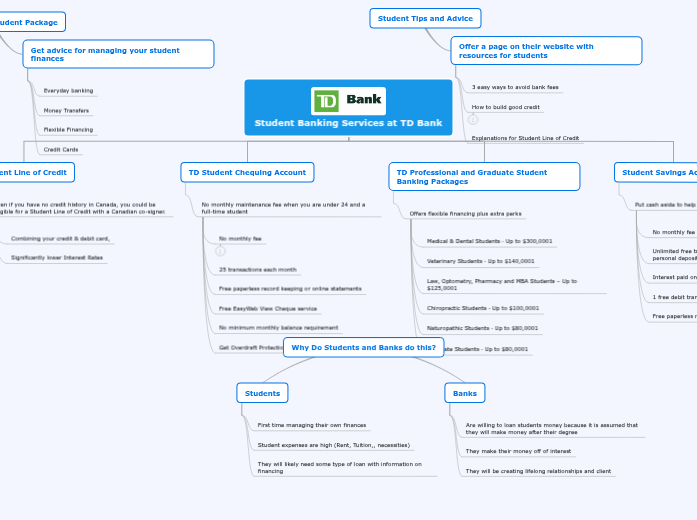

Student Banking Services at TD Bank

Student Line of Credit

Even if you have no credit history in Canada, you could be eligible for a Student Line of Credit with a Canadian co-signer.

Combining your credit & debit card,

Significantly lower Interest Rates

TD Student Chequing Account

No monthly maintenance fee when you are under 24 and a full-time student

No monthly fee

25 transactions each month

Free paperless record keeping or online statements

Free EasyWeb View Cheque service

No minimum monthly balance requirement

Get Overdraft Protection 3 for greater peace of mind

TD Professional and Graduate Student Banking Packages

Offers flexible financing plus extra perks

Medical & Dental Students ‑ Up to $300,0001

Veterinary Students ‑ Up to $140,0001

Law, Optometry, Pharmacy and MBA Students – Up to $125,0001

Chiropractic Students ‑ Up to $100,0001

Naturopathic Students ‑ Up to $80,0001

Graduate Students ‑ Up to $80,0001

Student Savings Accounts

Put cash aside to help save for bigger expenses

No monthly fee

Unlimited free transfers to your other TD Canada Trust personal deposit accounts

Interest paid on every dollar, calculated daily

1 free debit transaction per month

Free paperless record keeping or online statements

International Student Package

Get advice for managing your student finances

Everyday banking

Money Transfers

Flexible Financing

Credit Cards

Student Tips and Advice

Offer a page on their website with resources for students

3 easy ways to avoid bank fees

How to build good credit

Explanations for Student Line of Credit

Why Do Students and Banks do this?

Students

First time managing their own finances

Student expenses are high (Rent, Tuition,, necessities)

They will likely need some type of loan with information on financing

Banks

Are willing to loan students money because it is assumed that they will make money after their degree

They make their money off of interest

They will be creating lifelong relationships and client