realizată de Alina Micu 4 ani în urmă

775

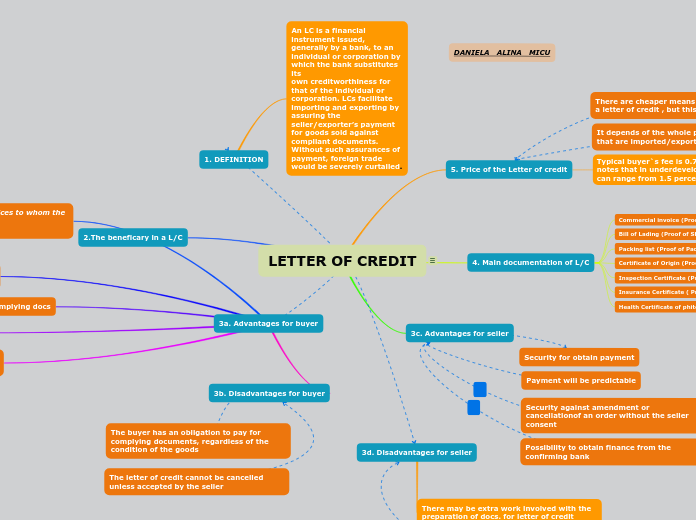

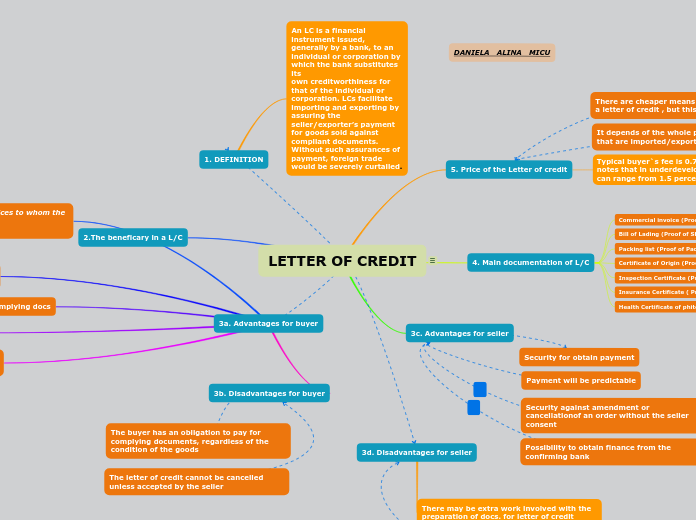

LETTER OF CREDIT

A letter of credit (LC) is a financial instrument typically issued by a bank to facilitate international trade by ensuring that payment will be made once specific documents are presented.

realizată de Alina Micu 4 ani în urmă

775

Mai multe ca aceasta

Letter of credit