realizată de harris sudirman 1 an în urmă

264

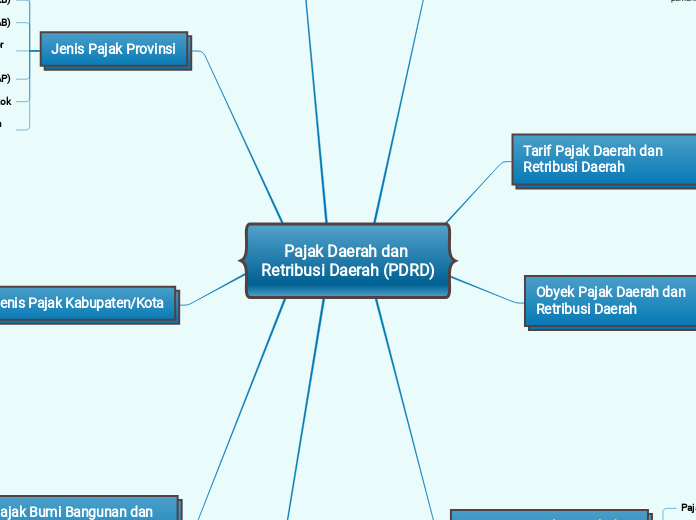

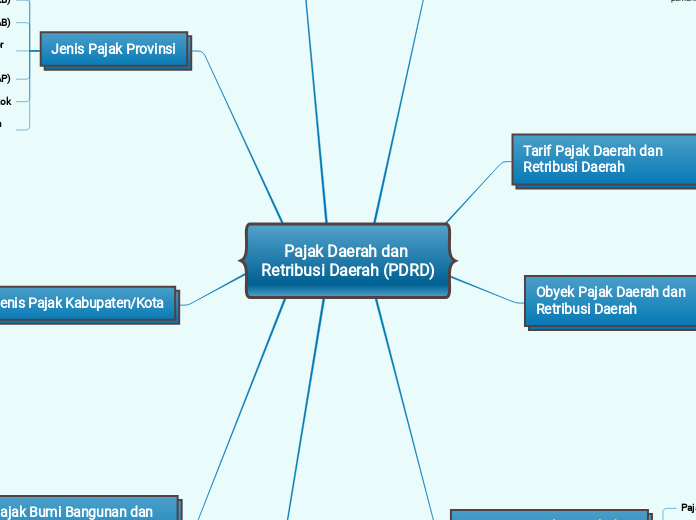

Pajak Daerah dan Retribusi Daerah (PDRD)

realizată de harris sudirman 1 an în urmă

264

Mai multe ca acesta

The part of speech is a category to which a word is assigned according to its syntactic functions. In English the main parts of speech are noun, pronoun, adjective, determiner, verb, adverb, preposition, conjunction, and interjection.

A conjunction is a word like 'if' 'but' or 'and' which is used to connect sentences or clauses together.

Subordinating conjunctions are conjunctions that are used at the beginning of subordinate clauses. Some examples of these conjunctions are: although, after, before, because, how, if, once, since, so that, until, unless, when etc.

Coordinating conjunctions always connect phrases, words, and clauses. They are: for, and, nor, but, or, yet, so.

J

A preposition is one of the most exciting parts of grammar. A preposition is used to describe the location of something in relation to something else.

A group of words used with the force of a single preposition is called phrase preposition.

Participle preposition consists of words that end in “ing”.

An interjection is used to express emotion in a sentence.

Think of other interjections!

An adverb is used to describe a verb, but it can also describe an adjective or another adverb.

Adverbs normally help paint a fuller picture by describing how something happens.

The intensifiers strengthen adverbs adjectives and adverbs and down- toners make them weaker.

A numeral is a word or phrase that describes a numerical quantity.

Some theories of grammar use the word 'numeral' to refer to cardinal numbers that act as a determiner to specify the quantity of a noun, for example the 'two' in 'two hats'.

An article is a word used to modify a noun, which is a person, place, object, or idea. Technically, an article is an adjective, which is any word that modifies a noun.

Indefinite articles are the words 'a' and 'an.' Each of these articles is used to refer to a noun, but the noun being referred to is not a specific person, place, object, or idea. It can be any noun from a group of nouns.

It refers directly to a specific noun or groups of nouns.

A pronoun is a word that can be used in place of a noun, typically after the noun itself has already been stated.

Demonstrative pronouns are used to demonstrate (or indicate). This, that, these, and those are all demonstrative pronouns.

Possessive pronouns are used to show possession. The possessive pronouns are mine, yours, his, hers, ours, and theirs.

A noun is defined as a person, place, thing or idea. Proper nouns always begin with a capital letter. Common nouns, which are general words, such as 'cars,' are not capitalized.

Compound nouns are words where two nouns have been stuck together to make a new noun. Compound nouns should be written as one word, without a hyphen.

A verb is an action word or 'doing' word that signifies movement in some way.

An auxiliary verb helps the main (full) verb and is also called a 'helping verb.' With auxiliary verbs, you can write sentences in different tenses, moods, or voices.

A modal is a type of auxiliary (helping) verb that is used to express: ability, possibility, permission or obligation. The main modal verbs in the English language are: can, could, may, might, must, shall, should, will, would.