realizată de saira mohammed 5 ani în urmă

219

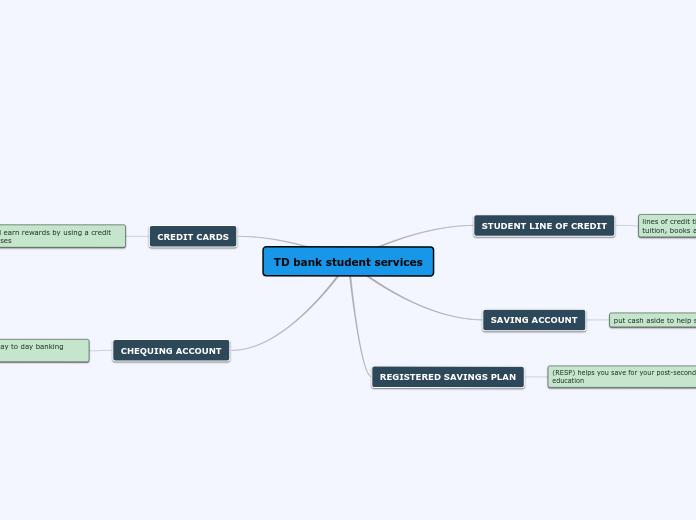

student bankservices

TD Bank offers a variety of financial services tailored specifically for students, designed to ease the financial burden of post-secondary education. Their Student Line of Credit provides a flexible borrowing option to cover tuition, books, and living expenses, transitioning into a manageable student loan post-graduation.