Cryptocurrency 101 - Day 3

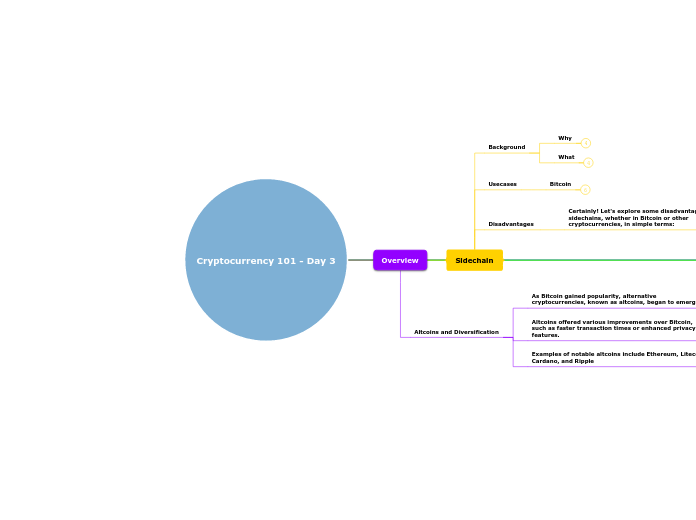

Overview

Altcoins and Diversification

As Bitcoin gained popularity, alternative cryptocurrencies, known as altcoins, began to emerge.

Altcoins offered various improvements over Bitcoin, such as faster transaction times or enhanced privacy features.

Examples of notable altcoins include Ethereum, Litecoin, Cardano, and Ripple

Sidechain

Background

Why

What

Usecases

Bitcoin

Disadvantages

Certainly! Let's explore some disadvantages of using sidechains, whether in Bitcoin or other cryptocurrencies, in simple terms:

Highlight:Layer1, Layer 2, Sidechain

Layer 1

Layer 1: Layer 1 refers to the base layer of a blockchain network, which is the underlying foundation. It is the main blockchain protocol that operates independently and has its own set of rules and features. Bitcoin and Ethereum are examples of Layer 1 blockchain networks.

ex

To understand Layer 1, think of it as the foundation of a building. It provides the main structure and supports all the floors and rooms above it. Similarly, Layer 1 is the foundational layer of a blockchain network that enables basic functionalities like storing and transferring digital assets.

Layer 2

Layer 2: Layer 2 refers to a secondary layer that operates on top of Layer 1. It is designed to enhance and extend the capabilities of the underlying Layer 1 blockchain. Layer 2 solutions aim to address the scalability and speed limitations of Layer 1 networks. They offer additional features and functionalities without directly modifying the base layer.

ex

Sidechain

Sidechains are separate chains that run in parallel to the main Layer 1 blockchain. They operate independently but are still connected to the main blockchain network. Sidechains are designed to offer specific features or use cases that may not be available or efficient on the Layer 1 blockchain.

ex

Summary

In summary, Layer 1 is the foundational blockchain layer, while Layer 2 is an additional layer that extends the capabilities of Layer 1. Sidechains, on the other hand, are separate chains connected to the Layer 1 blockchain, providing specialized features or use cases. It's like having a building with multiple floors (Layer 1), adding extra rooms on those floors (Layer 2), and attaching separate compartments for specific purposes (sidechains) to the building.

Bitcoin: Lightning Network

Usecases

Lightning Network: The Lightning Network is a Layer 2 solution for Bitcoin that enables faster and cheaper transactions. It creates payment channels between participants, allowing them to conduct multiple transactions without the need to record each one on the main Bitcoin blockchain. It's like having a separate "tab" at your favorite café, where you can make multiple purchases without having to pay and record each transaction individually.

Scalability and Throughput: Layer 2 solutions help improve the scalability and throughput of the Bitcoin network. By moving some transactions off-chain and settling them on the Layer 1 blockchain later, Layer 2 solutions can handle a higher volume of transactions. It's like adding extra lanes to a road to accommodate more traffic, relieving congestion and allowing for smoother and faster movement.

Use cases: Bitcoin

Use cases: Ethereum

Decentralized Finance (DeFi): EVM powers various DeFi protocols like decentralized exchanges, lending platforms, and stablecoins, enabling secure and transparent financial transactions.

Non-Fungible Tokens (NFTs): EVM facilitates the creation and trading of NFTs, revolutionizing the digital art, gaming, and collectibles industries.

Supply Chain Management: EVM-based solutions can enhance supply chain transparency, traceability, and efficiency, reducing fraud and improving accountability.

Voting and Governance: EVM allows for the development of decentralized voting and governance systems, enabling fair and transparent decision-making processes.

Identity Management: EVM can be utilized to create self-sovereign identity systems, providing individuals with control over their personal data and eliminating reliance on centralized authorities.

Insurance and Claims: EVM-based smart contracts can automate insurance policies, claims processing, and payouts, increasing transparency and streamlining the insurance industry.

Real Estate Transactions: EVM enables the tokenization of real estate assets, facilitating fractional ownership, transparent transactions, and simplified property management.

Gaming and Virtual Worlds: EVM powers blockchain-based gaming platforms and virtual worlds, enabling ownership and trade of in-game assets, as well as verifiable scarcity.

Decentralized Autonomous Organizations (DAOs): EVM allows the creation of DAOs, where governance and decision-making are decentralized and transparent, enabling community-driven organizations.

Energy Trading: EVM can be utilized for peer-to-peer energy trading, enabling individuals to buy and sell excess energy directly, promoting renewable energy adoption.

Use cases: Ripple

Use cases: Cardano

Use cases: Solana

Use cases: HBAR

CBDC

Overview

Central Bank Digital Currencies, or CBDCs, are digital representations of a country's fiat currency.

Several central banks worldwide are exploring the concept of CBDCs to leverage the benefits of blockchain technology.

CBDCs aim to provide a secure and efficient medium of exchange with enhanced transparency and traceability.

Why CBDC

Pros & Cons

CBDC Roadmap

CBDC Progress