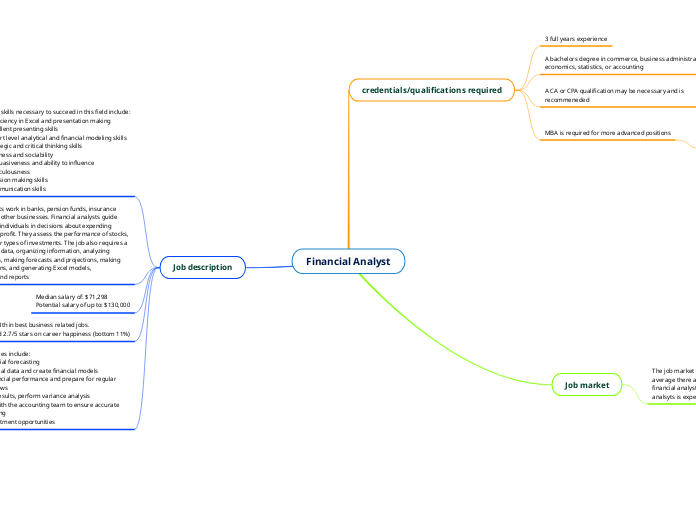

Financial Analyst

credentials/qualifications required

3 full years experience

A bachelors degree in commerce, business administration , economics, statistics, or accounting

Must attend university and succesfully earn 120 credits

A CA or CPA qualification may be necessary and is recommeneded

Must complete a professional training program and have a bachelors degree. Must also complete a series of difficult exams

MBA is required for more advanced positions

Must complete a bachelors degree, and then attend university further to obtain a masters degree. Requires a written detailed thesis, a high GPA, and work experience

Job market

The job market for financial analysts is rather healthy, on average there are about 41,000 new job openings yearly for financial analysts. Furthermore, the job market for financial analsyts is expected to grow 6% from now until 2030

Job description

Some skills necessary to succeed in this field include:

- Proficiency in Excel and presentation making

- Excellent presenting skills

- Expert level analytical and financial modeling skills

- Strategic and critical thinking skills

- Kindness and sociability

- Persuasiveness and ability to influence

- Meticulousness

- Decision making skills

- Communication skills

Financial analysts work in banks, pension funds, insurance companies, and other businesses. Financial analysts guide businesses and individuals in decisions about expending money to attain profit. They assess the performance of stocks, bonds, and other types of investments. The job also requires a lot of gathering data, organizing information, analyzing historical results, making forecasts and projections, making recommendations, and generating Excel models, presentations, and reports

Median salary of: $71,298

Potential salary of up to: $130,000

Ranks 13th in best business related jobs.

Received 2.7/5 stars on career happiness (bottom 11%)

Job responsibilities include:

- Perform financial forecasting

- Analyze financial data and create financial models

- Report on financial performance and prepare for regular leadership reviews

- Analyze past results, perform variance analysis

- Work closely with the accounting team to ensure accurate financial reporting

- Exploring investment opportunities