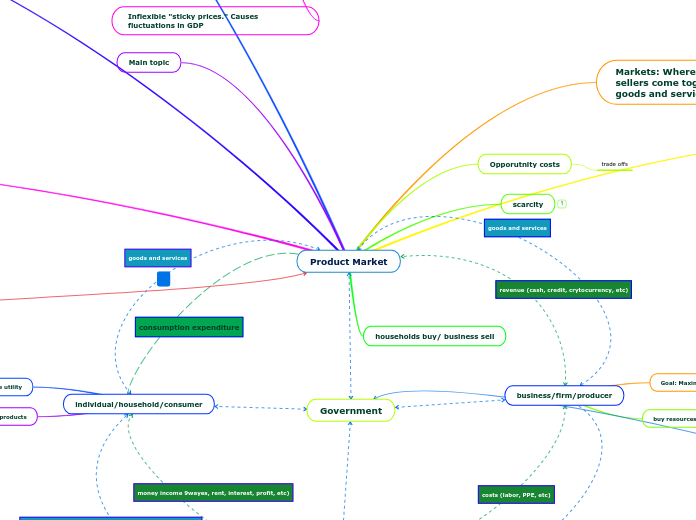

Product Market

Markets: Where buyers and sellers come together to exchange goods and services

Supply and Demand

Opporutnity costs

trade offs

scarcity

households buy/ business sell

The Business Cycle

Aggregate Demand

Main topic

Aggregate Supply

individual/household/consumer

Goal: Maximize utility

sell resources, buy products

business/firm/producer

Goal: Maximize profit

buy resources, sell products

Resource Market

Unemployment

consumption expenditure

revenue (cash, credit, crytocurrency, etc)

goods and services

resources

costs (labor, PPE, etc)

resources- factors of production (land, labor, capital, entrepreneurial)

money income 9wayes, rent, interest, profit, etc)

goods and services

Supply: amount producers are able/willing to sell at given price

Demand: amount consumers are able/willing to buy at given price

Law of Demand

as price rises, quantity demanded falls

As price falls, quantity demanded rises

Determinates

change in consumer expectations

change in income

change in price of related goods

change in consumer tastes

change in # of consumers

Consumer surplus

what consumers are willing to pay vs what they actually pay

Demand Failure

Law of Supply

As price rises, quantity supplied rises

As price falls, quantity supplied falls

Producer Surplus

what producers are willing to get paid vs what they actually get paid

Supply failures

Determinates

change in producer expectations

Change in number of sellers

change in taxes

change in price of other goods

change in resource costs

change in technology

Equilibrium- Where supply and demand intersect. Where the price is right

Types of Markets

Command: Government determines how things are made/sold

Mixed: Mix of Command and Market

Market: Consumers choose what they buy (invisible hand)

Traditional: Relies on customs, religion, etc.

Real GDP

GDP (Gross Domestic Product)

Adjusts for inflation

Nominal GDP/ price index

Inflexible "sticky prices." Causes fluctuations in GDP

Nominal GDP

In Current U.S. $'s

Calculating GDP

Income Approach

Expenditures approach. COGS

Economic Growth

determinates of growth

efficiency factors

demand factors

supply factors

economic scale

increasing returns

increase GDP over time

modern economic growth

approx # of years to double real GDP

GDP per capita= GDP/population

Multiplier effect= change in GDP/ initial change in spending

Phillip's Curve

inverse relationship between unemployment and inflation

Types of Unemployment

Structural: difficult to find new jobs without retrain, relocate, etc

Frictional: Those looking for a new job

Cyclical: Unemployed because of less spending

=Unemployed/Work Force

Work Force= 16+, not in jail, not in active service, not retired, actively searching for a job

Phases

peak

Recession

Trough

Expansion

Demand- side shocks (taxes, unemployment, financial instability)

Supply- side shocks (changes in resource prices, political events, natural disasters, new technology)

Downward sloping because:

real balance effect

interest rate effect

foreign purchases effect

Factors that shift the AD curve

government spending

consumer spending

investment spending

net export spending

expected returns

borrowing

expectations

consumer wealth

personal taxes

Factors that shift the AS curve

input prices

productivity

Legal- Institutional environment

price of imported goods

time horizons

immediate short run

input and output prices are fixed

long run

input and output are variable

short run

input is fixed and output may vary

Government

Government

Public Goods

externality

"Free Rider Problem"

nonexcludability

nonrivalry

Quasai- Public Goods

Fiscal Policy

tax systems

progressive: avg rate= tax revenue/ GDP

Proportional: rate stays the same as GDP rises

Regressive: rate falls as GDP falls

built in stabilizers

Budget Deficit

increased government spedning

less taxes

Budget Surplus

less government spending

increased taxes

Expansionary FP

when recession occurs

raise real gdp

+ gov't spending, - taxes

Contractionary FP

when demand-pull inflation occurs

decrease aggregate demand

- gov't spending, + taxes

Problems with Fiscal Policy

Future policies/ reversals

Timing

recognition lag 9seeing what's happening)

administrative lag (getting policy)

operational lag (seeing effects)

offsetting local/state finances

political consideration (using policies to boost votes)

Money

Money M1

currency + all checkable deposits

Financial Services industry

commercial banks

insurance companies

thrifts

security funds

mutual fund companies

investment banks

Fed Functions

issuing currency

setting reserve requirements

proving for check collections

lending to financial solutions

supervising banks

acting as a fiscal agent

controlling the money supply

Federal Reserve Banks

Assets

securities

loans to commercial banks

Liabilities

reserves to commercial banks

treasury deposits

federal reserve notes outstanding

Money M2

M1 + savings deposits, including MMDA + small denominated time deposits +MMF held by individuals

Purchasing power

$V- 1/P

interest

interest yield

bond/interest rate

Money Creation

Monetary multiplier

tools of monetary supply

open market operations

Selling securities

bank transactions to create money

1. create a bank

2. acquiring property and equipment

3. accepting deoposits

4. depositing reserves in a Fed Reserve bank

5. clearing a check drawn against the bank

6. granting a loan

7. buying government security

monetary policy

Asset Demand for Money

transactions demand for money

fractional reserve system

required reserve

reserve ratio (>20%)

excess reserve 9actual reserve - required reserve)